Introducing: 'My Workstory' Career Series

On this International Women’s Day, VisualCV is proud to begin a new series about women and their work stories. We’ll be profiling women from different backgrounds, industries, and environments, sharing exactly how they got to where they are today. Despite their variety of experiences, all of the women you’ll learn about throughout this series have one thing in common: they’re high-earners who’ve put in the work to climb the ranks and want to share advice for getting there too.

In the US, women make up less than 20% of six-figure earners. We’ll be speaking to several people who fall into that category over the course of this series, and sharing plenty of interview, resume, and career advice from both our subjects and our resume experts.

Quick Facts:

Name: Lori Age: 32 Location: NYC Job Title: Product Analytics Manager Salary: $188,250 (plus $10,000 in side income)

Living in New York City on a Six-Figure Income

New York City is, infamously, one of the most expensive places in the world to live. We’ve all seen plenty of hot takes about how much is really enough to live – and live well – in NYC. Recently, debate about whether even a six-figure salary can provide individuals or families with a comfortable life. “I’d agree that this is definitely the case in a very high cost of living city like NYC,” Lori says. “Especially as the cost for base living essentials (rent and food) are so high here compared to other areas. I think a part of it is the overall culture, especially for younger people, to constantly go out and spend money - you think everyone else is doing it, so you should be too.”

But does Lori herself feel financially comfortable at her current salary? “At the moment I feel financially comfortable, especially as I own my property outright (I bought my condo in 2015 and paid off the mortgage in 2019) and don't have many large expenses outside of my essentials. I'd say I started feeling more comfortable when my income hit the six-figure level, and I was able to max out my retirement contributions and still increase my after-tax savings.”

Even with her current salary of $188,250 per year, Lori, a 32-year-old Product Analytics Manager at a healthcare technology firm, supplements her income through various side-gigs. After moving to New York in 2012, she found she enjoyed taking photos of her food with a DSLR camera. After some nudging from friends, Lori started a food Instagram account in 2015. In just a few months, she began receiving invites from restaurant owners. While the majority of the “income” from this stream is paid in free food, she’s also earned, on average, several thousand dollars each year doing paid campaigns on Instagram. “The vast benefit of this is the ‘bonus’ of trying food at different restaurants in NYC,” Lori explains.

Additionally, in the summer of 2022 Lori began dog walking. “I was getting a little sick of working from home and not leaving my apartment. My parents had a dog when I was in high school and I’ve always enjoyed spending time with them, but knew I wasn’t able to solely care for a dog. I signed up to be a walker and began taking ad hoc walks for the exercise, the dog time, and for a little side income.” All in all, this side income amounts to roughly $10,000 extra per year; not anything to sneeze at, when most of it is either passive income or money for activities Lori would be doing anyway. A recent study claimed that 45% of Americans work at some kind of side hustle in 2023, spending an average of 13 hours per week on this additional income stream.

Does that attitude – finding ways to monetize your daily walk, for example – separate Lori from others, who may not be earning as much or who may not be seeking to build wealth in the same way?

“I think as a whole, my attitude towards money hasn't changed that much over time,” Lori says. “As first generation immigrants, my parents and I always had a scarcity mindset when it came to money - unless we absolutely needed to buy something, it was better saved. It's beneficial in that I've done my best to live below my means and make sure that my finances go towards my longer term goals, whether that's for retirement assets, owning property, etc. and I'm now able to consider things like retiring early or working part-time later down the line.”

While that super-saver mindset has served Lori well, it can also come with unexpected costs – no pun intended. “I sometimes don't allow myself or feel bad about buying things that are ‘nice to have’ or would improve the quality of my life, but aren't essentials,” she explains. “It can be anything from buying clothing that's not on sale, investing in a good – albeit more expensive – hair dryer or pillow, or even something as ridiculous as spending 10 minutes in the store debating a 10-cent difference in duster cloths between the in-store product that I can have ASAP or waiting a week if I were to order it online. I am trying to be better about not hounding myself over every last dollar that I spend though, especially now that I have a lot more wiggle room in my finances, and stop thinking about money as the end goal - it's just a means to get there.”

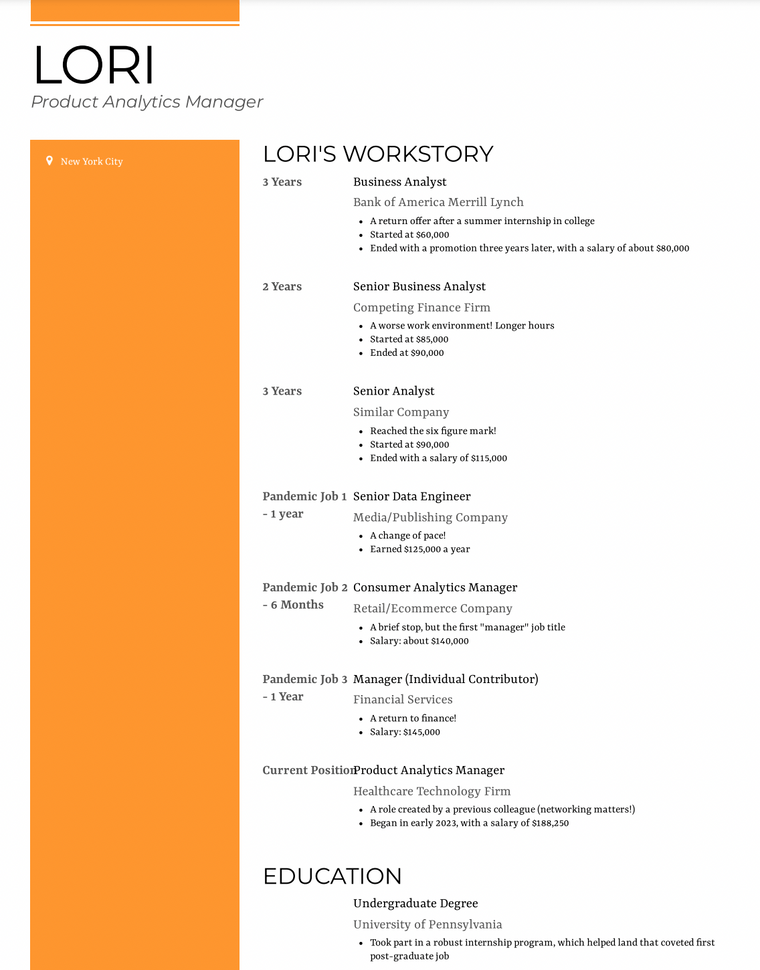

Lori's Workstory

Everyone’s workstory looks a little bit different. Often, people set out towards a career they’re positive they’re meant to have, only to find themselves in a completely different place ten years later. But that’s not always the case! While attending University of Pennsylvania’s business school for her undergraduate degree, Lori’s career plans were already beginning to take shape.

“My college [had] a pretty active on campus recruiting system that set many of my classmates on a path in financial services/banking,” Lori says. She decided to follow that path herself, and secured a summer internship at Merrill Lynch that resulted in her first full-time job offer post graduation. As a Business Analyst at Bank of America Merrill Lynch, her starting salary was around $60,000; $20-$30,000 more than the average starting salary in New York City.

While her plan to enter the business world was off to a stellar start, there are always surprises that come with any new job. Lori’s biggest career regret is not building out her technical skillset when she was younger, but it’s never too late to upskill!

“My two main pieces of advice would be, one, keep learning: learn about the industry as a whole, competitors and their advantages, and about your company in depth as much as possible. Keep as up-to-date as you can with different technologies, coding languages, software, etc. And two, finesse not only your hard skills, but your soft skills as well. Learning to work with and communicate with different people will become especially important the longer you work.”

Those soft skills have served Lori well over the course of her career. In fact, her proudest career achievement is the relationships she’s formed with colleagues and peers. “I still keep in touch with many of them even though we no longer work together!”

Lori was able to leverage her degree into her first full-time career opportunity that set her on a path towards being a high earner, but is she currently working at her dream job? “Honestly, I don’t know if I’ve ever had a ‘dream job’ in mind, aside from one that would allow me to support myself and maintain an overall good work-life balance,” she says, adding that her current job “certainly” fits that description. As the workforce continues to feel the aftereffects of the pandemic, work-life balance has become a major factor in why people start – and leave – jobs. Half of respondents to a Gartner survey say the pandemic changed their expectations toward their employer and made them rethink the place that work should have in their lives. For Lori, the pandemic brought her to a new industry; healthcare.

Lori’s Career Progression

“In a nutshell, I’ve been working full time for 10 years, mostly in a data analytics role within various industries.”

-

My first full time job after college was a return offer from my summer internship to Bank of America Merrill Lynch as a Business Analyst. I worked there for about 3 years, starting off with a salary of about $60,000 and ending with a promotion and an ending salary of about $80,000

-

I left that job to take on a Senior Business Analyst Role at a competing finance firm starting at about $85,000, where I worked for 2 years. The work environment was much worse with much longer hours and I voluntarily left that role with an ending salary of $90,000.

-

My next job was in a similar company and industry, where I worked for about 3 years. I got promoted once to a Senior Analyst role, starting with a salary of about $90,000 and ending with a salary of $115,000.

-

The next few years involve a number of different companies and industries, all centered around the analytics and data engineering realm of work. For the sake of simplicity, I will call these my "pandemic jobs,” as they were during the COVID-19 pandemic and involved 3 different companies and jobs during this timeframe. The first of these was a voluntary change to a Media/Publishing company as a Senior Data Engineer that I was at for 1 year with a salary of $125,000. The second of these was a brief 6 month stint in a Retail/Ecommerce company where I became a manager for the first time; my title was Consumer Analytics Manager and my salary was about $140,000. The third of these was a year back in financial services; I had a Manager title but was an individual contributor and my salary was $145,000.

-

My current role is as Product Analytics Manager at a healthcare technology firm. I actually was recruited by my director; we previously had worked together at Job 3 and had a great working relationship and kept in touch over the years. She was able to make this role for me and brought me onboard at the start of 2023.

Our Questions, Her Answers

*Did you receive a post-secondary education? If so, where? *

“Yes - I attended the University of Pennsylvania for my undergraduate degree.”

Did you take out student loans?

“No - My college costs were fully covered by a mix of parental support (529 account), scholarships, and work-study”

What do you believe is the biggest thing that’s held you back throughout your career?

“Being afraid to ask questions or ask for help. Especially as an Asian American woman, it isn't something that I was encouraged to do for fear of standing out or looking stupid, but it really held me back in some of my earlier roles.”

What do you believe is the biggest thing that’s propelled you forward in your career?

“Wanting to do my best work, regardless of who may or may not see it or realize it. At the end of the day, it means a lot to be proud of what you do and to find meaning in it.”

What is one interesting fact, good or bad, that surprised you about your job or your industry?

“In finance, I was always impressed with how much revenue cash brought in just by sitting in people's accounts! Net interest revenue is a big component of a lot of bank's income statements.”

How many jobs in your field have you had so far?

“This is technically the first job in the healthcare industry that I've had. However, my work experience in broader realm of data analytics is much longer and at the 10 year mark. I've had 7 different jobs since 2012, which is when I began working full time.”

Written By

Maggie Horne

Content Manager & Resume Expert

Maggie is the Content Manager at VisualCV, with years of experience creating easy-to-understand resume guides, blogs, and career marketing content. Now, she loves helping people learn how to leverage their skills to start their dream jobs.

The best tips for writing a great resume for applying to a start-up

July 21, 2020

Read Post

Content Marketer

Many people have several different jobs at the same company over the course of their career. Here's how to display that information on your resume.

December 17, 2022

Read Post

Community Success Manager & CV Writing Expert

The top hiring and human resource statistics for 2025, including data on AI resumes, job interviews, remote work, and recruiting.

January 1, 2025

Read Post

Community Success Manager & CV Writing Expert

Copyright ©2025 Workstory Inc.