Underwriter Resume Examples and Templates

This page provides you with Underwriter resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Underwriter resume.

What Do Hiring Managers Look for in a Underwriter Resume

- Proficient in evaluating and assessing insurance or financial risk for potential clients.

- Strong knowledge of underwriting guidelines, industry regulations, and risk assessment techniques.

- Skilled in reviewing applications, financial documents, and medical records to determine coverage eligibility.

- Ability to calculate risk factors, premiums, and terms for insurance policies.

- Proficiency in making informed decisions to manage risk and ensure profitability for the insurance company.

How to Write a Underwriter Resume?

To write a professional Underwriter resume, follow these steps:

- Select the right Underwriter resume template.

- Write a professional summary at the top explaining your Underwriter’s experience and achievements.

- Follow the STAR method while writing your Underwriter resume’s work experience. Show what you were responsible for and what you achieved as an Underwriter.

- List your top Underwriter skills in a separate skills section.

How to Write Your Underwriter Resume Header?

Write the perfect Underwriter resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Underwriter position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Underwriter resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Underwriter Resume Example - Header Section

Rose 682 Fifth St. South Plainfield, NJ 07080 Marital Status: Married, email: cooldude2022@gmail.com

Good Underwriter Resume Example - Header Section

Rose Hudson, Plainfield, NJ, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Underwriter email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Underwriter Resume Summary?

Use this template to write the best Underwriter resume summary: Underwriter with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Underwriter Resume Experience Section?

Here’s how you can write a job winning Underwriter resume experience section:

- Write your Underwriter work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Underwriter work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Underwriter).

- Use action verbs in your bullet points.

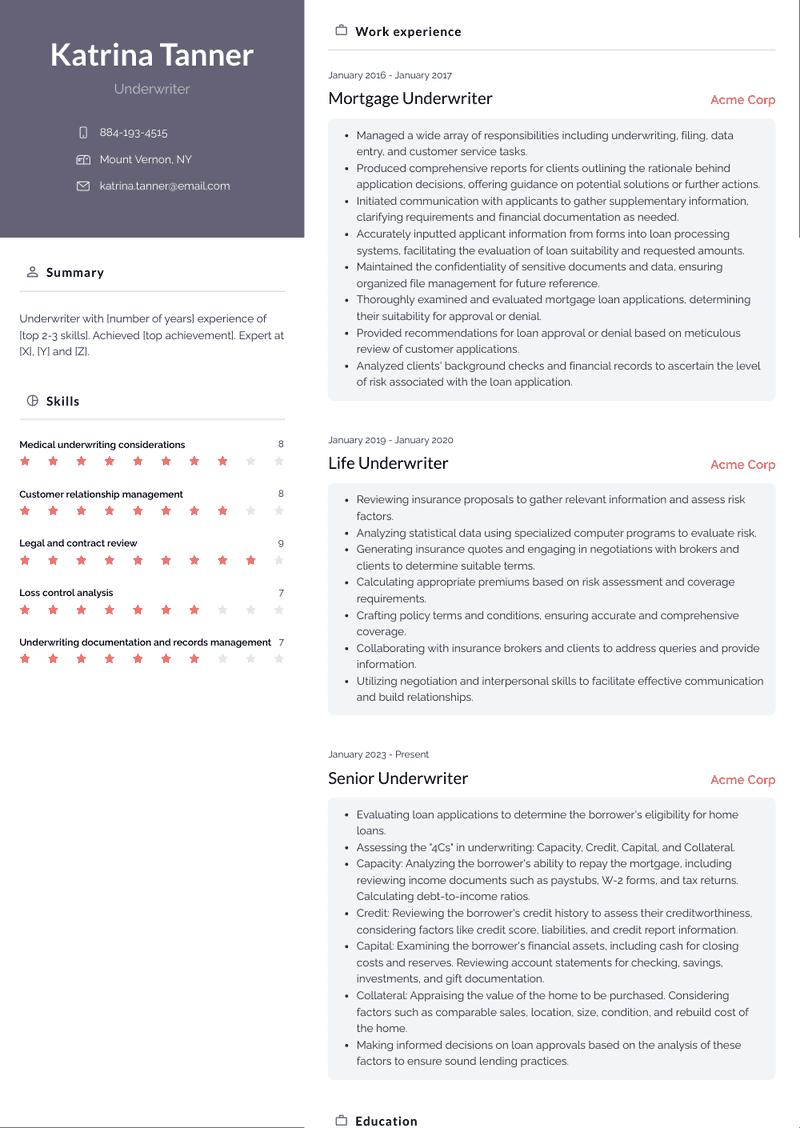

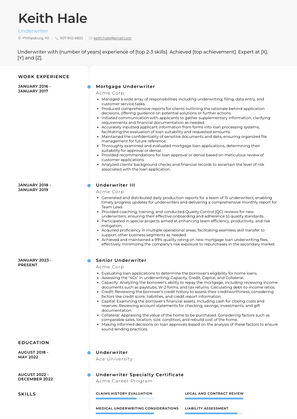

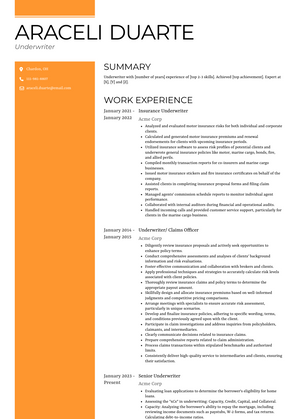

Senior Underwriter Resume Example

Senior Underwriter

- Evaluating loan applications to determine the borrower's eligibility for home loans.

- Assessing the "4Cs" in underwriting: Capacity, Credit, Capital, and Collateral.

- Capacity: Analyzing the borrower's ability to repay the mortgage, including reviewing income documents such as paystubs, W-2 forms, and tax returns. Calculating debt-to-income ratios.

- Credit: Reviewing the borrower's credit history to assess their creditworthiness, considering factors like credit score, liabilities, and credit report information.

- Capital: Examining the borrower's financial assets, including cash for closing costs and reserves. Reviewing account statements for checking, savings, investments, and gift documentation.

- Collateral: Appraising the value of the home to be purchased. Considering factors such as comparable sales, location, size, condition, and rebuild cost of the home.

- Making informed decisions on loan approvals based on the analysis of these factors to ensure sound lending practices.

Insurance Underwriter (Internship) Resume Example

Insurance Underwriter (Internship)

- Conducted underwriting assessments for various types of general insurance applications.

- Generated insurance quotes and engaged in negotiations with brokers and clients to determine suitable terms and conditions.

- Managed a diverse range of tasks to address the daily operational requirements of the business.

Insurance Underwriter Resume Example

Insurance Underwriter

- Analyzed and evaluated motor insurance risks for both individual and corporate clients.

- Calculated and generated motor insurance premiums and renewal endorsements for clients with upcoming insurance periods.

- Utilized insurance software to assess risk profiles of potential clients and underwrote general insurance policies like motor, marine cargo, bonds, fire, and allied perils.

- Compiled monthly transaction reports for co-insurers and marine cargo businesses.

- Issued motor insurance stickers and fire insurance certificates on behalf of the company.

- Assisted clients in completing insurance proposal forms and filing claim reports.

- Managed agents' commission schedule reports to monitor individual agent performance.

- Collaborated with internal auditors during financial and operational audits.

- Handled incoming calls and provided customer service support, particularly for clients in the marine cargo business.

Life Underwriter Resume Example

Life Underwriter

- Receive and monitor proposals submitted by Zonal Sales Managers (ZSMs).

- Review and validate the accuracy of the proposal details; approve or reject proposals by communicating decisions to ZSMs.

- Input information from proposals and related documents into the core application to ensure accurate data entry.

- Assess and evaluate the risk associated with providing life assurance coverage to clients, determining whether to accept, decline, or defer.

- Generate or verify quotations for Protection policies using the actuarial or reinsurance rate guide.

- Calculate appropriate premiums and coverage amounts for life insurance policies.

- Compile weekly, monthly, and quarterly performance reports, and any additional reports as needed.

- Manage medical underwriting processes, including requesting medical examination tests for proposals exceeding the non-medical limit, coordinating with medical examiners.

- Undertake special projects as assigned by management.

Life Underwriter Resume Example

Life Underwriter

- Reviewing insurance proposals to gather relevant information and assess risk factors.

- Analyzing statistical data using specialized computer programs to evaluate risk.

- Generating insurance quotes and engaging in negotiations with brokers and clients to determine suitable terms.

- Calculating appropriate premiums based on risk assessment and coverage requirements.

- Crafting policy terms and conditions, ensuring accurate and comprehensive coverage.

- Collaborating with insurance brokers and clients to address queries and provide information.

- Utilizing negotiation and interpersonal skills to facilitate effective communication and build relationships.

Underwriter III Resume Example

Underwriter III

- Generated and distributed daily production reports for a team of 15 underwriters, enabling timely progress updates for underwriters and delivering a comprehensive monthly report for Team Lead.

- Provided coaching, training, and conducted Quality Control (QC) reviews for new underwriters, ensuring their effective onboarding and adherence to quality standards.

- Participated in special projects aimed at enhancing team efficiency, productivity, and risk mitigation.

- Acquired proficiency in multiple operational areas, facilitating seamless skill transfer to support other business segments as needed.

- Achieved and maintained a 99% quality rating on new mortgage loan underwriting files, effectively minimizing the company's risk exposure to repurchases in the secondary market.

Insurance underwriter Resume Example

Insurance underwriter

- Conducted thorough analysis and evaluation of the risk profiles of prospective clients, underwriting various general insurance policies including motor, marine cargo, bonds, fire, and allied perils insurance.

- Managed the preparation of monthly transaction reports for co-insurers, ensuring accurate and timely reporting of key financial data.

- Oversaw the process of renewal endorsements, ensuring seamless continuation of insurance coverage for clients.

- Collaborated closely with internal auditors during financial and operational audits to ensure compliance with established standards and practices.

Mortgage Underwriter Resume Example

Mortgage Underwriter

- Managed a wide array of responsibilities including underwriting, filing, data entry, and customer service tasks.

- Produced comprehensive reports for clients outlining the rationale behind application decisions, offering guidance on potential solutions or further actions.

- Initiated communication with applicants to gather supplementary information, clarifying requirements and financial documentation as needed.

- Accurately inputted applicant information from forms into loan processing systems, facilitating the evaluation of loan suitability and requested amounts.

- Maintained the confidentiality of sensitive documents and data, ensuring organized file management for future reference.

- Thoroughly examined and evaluated mortgage loan applications, determining their suitability for approval or denial.

- Provided recommendations for loan approval or denial based on meticulous review of customer applications.

- Analyzed clients' background checks and financial records to ascertain the level of risk associated with the loan application.

Credit Underwriter Resume Example

Credit Underwriter

- Engaged in consistent follow-ups with clients to gather necessary loan documentation.

- Meticulously indexed all loan-related documents in the appropriate sequence with accurate labels.

- Maintained a daily Management Information System (MIS) report for multiple clients.

- Ensured meticulous document organization both before and after loan closings, guaranteeing adherence to investor guidelines.

- Played a vital role in training new team members on the company's underwriting procedures, with a particular focus on financial aspects.

- Assumed responsibility for the comprehensive analysis of financial statements, pinpointing credit strengths and weaknesses, and delivering well-documented assessments of creditworthiness.

- Proficient in financial modeling with a strong grasp of Microsoft Office tools, especially Excel (including macros), Word, and PowerPoint.

- Demonstrated adept analytical and problem-solving capabilities.

- Displayed effective time management skills and a quick learning aptitude.

Underwriter/ Claims Officer Resume Example

Underwriter/ Claims Officer

- Diligently review insurance proposals and actively seek opportunities to enhance policy terms.

- Conduct comprehensive assessments and analyses of clients' background information and risk evaluations.

- Foster effective communication and collaboration with brokers and clients.

- Apply professional techniques and strategies to accurately calculate risk levels associated with client policies.

- Thoroughly review insurance claims and policy terms to determine the appropriate payout amount.

- Skillfully design and allocate insurance premiums based on well-informed judgments and competitive pricing comparisons.

- Arrange meetings with specialists to ensure accurate risk assessment, particularly in unique scenarios.

- Develop and finalize insurance policies, adhering to specific wording, terms, and conditions previously agreed upon with the client.

- Participate in claim investigations and address inquiries from policyholders, claimants, and intermediaries.

- Clearly communicate decisions related to insurance claims.

- Prepare comprehensive reports related to claim administration.

- Process claims transactions within stipulated benchmarks and authorized limits.

- Consistently deliver high-quality service to intermediaries and clients, ensuring their satisfaction.

Top Underwriter Resume Skills for 2023

- Risk assessment and analysis

- Insurance policy evaluation

- Financial statement analysis

- Underwriting guidelines interpretation

- Risk selection and classification

- Underwriting software proficiency

- Data analysis and interpretation

- Policy terms and conditions review

- Market and industry research

- Pricing determination and analysis

- Fraud detection and prevention

- Claims history evaluation

- Regulatory compliance assessment

- Underwriting decision-making

- Loss ratio analysis

- Customer risk profile analysis

- Insurance product knowledge

- Risk mitigation strategies

- Customer relationship management

- Negotiation and communication skills

- Reinsurance considerations

- Policy issuance procedures

- Liability assessment

- Commercial insurance underwriting

- Personal insurance underwriting

- Workers' compensation assessment

- Legal and contract review

- Policy coverage determination

- Actuarial concepts understanding

- Loss control analysis

- Underwriting audit and review

- Risk appetite assessment

- Premium calculation and analysis

- Claims frequency analysis

- Regulatory compliance in underwriting

- Medical underwriting considerations

- Environmental risk assessment

- Market trends analysis

- Catastrophe risk assessment

- Cyber risk assessment

- Policy endorsement evaluation

- Risk rating methodologies

- Financial solvency assessment

- Underwriting authority management

- Underwriting documentation and records management

- Portfolio analysis and management

- Predictive modeling understanding

- Customer interaction and communication

- Professional ethics and integrity

- Continuous learning in underwriting

How Long Should my Underwriter Resume be?

Your Underwriter resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Underwriter, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2025 Workstory Inc.