Tax Specialist Resume Examples and Templates

This page provides you with Tax Specialist resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Tax Specialist resume.

What do Hiring Managers look for in a Tax Specialist Resume

- Tax Knowledge: Strong knowledge of tax laws, regulations, and compliance requirements.

- Analytical Skills: Proficiency in analyzing financial documents and tax records to ensure accurate tax reporting.

- Attention to Detail: Meticulousness in preparing and reviewing tax returns and documentation for accuracy.

- Communication Skills: Effective communication with clients and colleagues to provide tax advice and guidance.

- Problem-Solving Abilities: Capability to address complex tax issues, identify tax-saving opportunities, and resolve tax-related challenges.

How to Write a Tax Specialist Resume?

To write a professional Tax Specialist resume, follow these steps:

- Select the right Tax Specialist resume template.

- Write a professional summary at the top explaining your Tax Specialist’s experience and achievements.

- Follow the STAR method while writing your Tax Specialist resume’s work experience. Show what you were responsible for and what you achieved as a Tax Specialist.

- List your top Tax Specialist skills in a separate skills section.

How to Write Your Tax Specialist Resume Header?

Write the perfect Tax Specialist resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Tax Specialist position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Tax Specialist resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Tax Specialist Resume Example - Header Section

Joey 7600 W. Bay Meadows Avenue Rochester, NY 14606 Marital Status: Married, email: cooldude2022@gmail.com

Good Tax Specialist Resume Example - Header Section

Joey Campos, Rochester, NY, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Tax Specialist email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Tax Specialist Resume Summary?

Use this template to write the best Tax Specialist resume summary: Tax Specialist with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Tax Specialist Resume Experience Section?

Here’s how you can write a job winning Tax Specialist resume experience section:

- Write your Tax Specialist work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Tax Specialist work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Tax Specialist).

- Use action verbs in your bullet points.

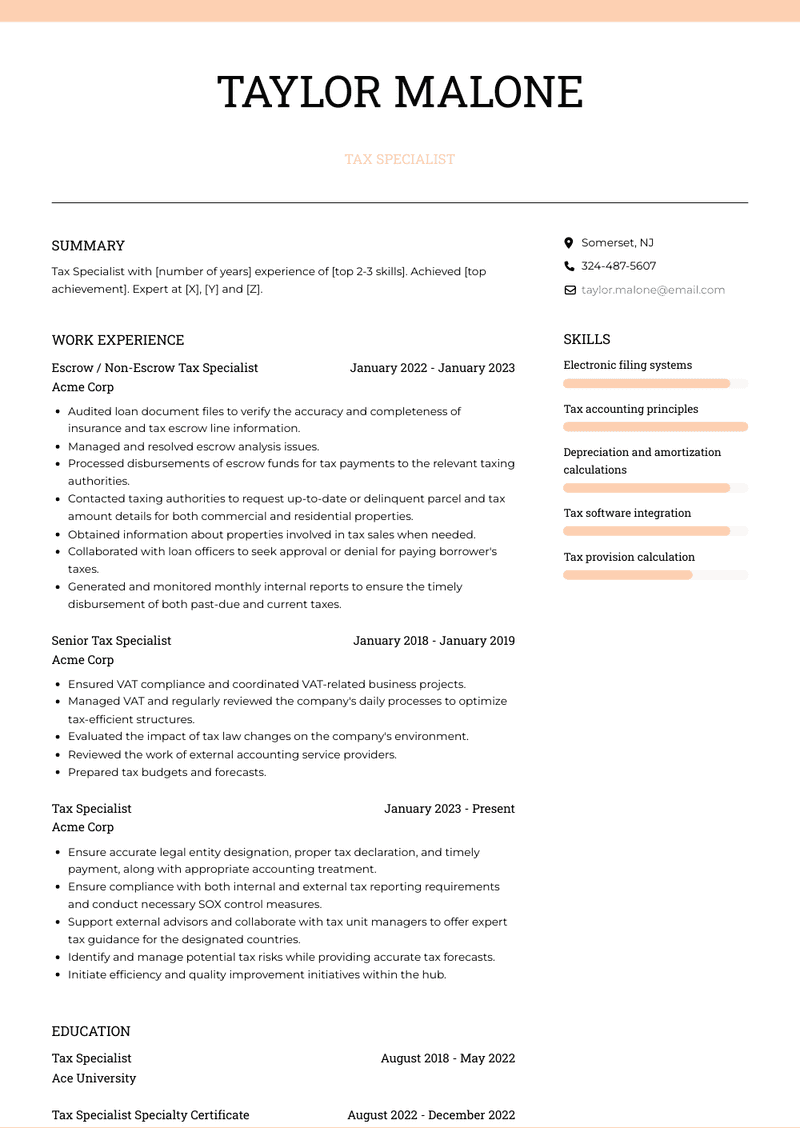

Tax Specialist Resume Example

Tax Specialist

- Ensure accurate legal entity designation, proper tax declaration, and timely payment, along with appropriate accounting treatment.

- Ensure compliance with both internal and external tax reporting requirements and conduct necessary SOX control measures.

- Support external advisors and collaborate with tax unit managers to offer expert tax guidance for the designated countries.

- Identify and manage potential tax risks while providing accurate tax forecasts.

- Initiate efficiency and quality improvement initiatives within the hub.

Escrow / Non-Escrow Tax Specialist Resume Example

Escrow / Non-Escrow Tax Specialist

- Audited loan document files to verify the accuracy and completeness of insurance and tax escrow line information.

- Managed and resolved escrow analysis issues.

- Processed disbursements of escrow funds for tax payments to the relevant taxing authorities.

- Contacted taxing authorities to request up-to-date or delinquent parcel and tax amount details for both commercial and residential properties.

- Obtained information about properties involved in tax sales when needed.

- Collaborated with loan officers to seek approval or denial for paying borrower's taxes.

- Generated and monitored monthly internal reports to ensure the timely disbursement of both past-due and current taxes.

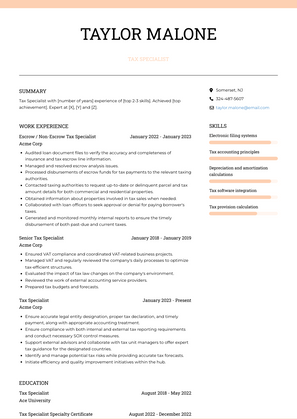

Tax Specialist Resume Example

Tax Specialist

- Assisted in monitoring federal, state, and municipal inspections related to tax compliance.

- Provided support to the Legal department in matters related to tax processes.

- Assisted in external and internal audits related to indirect taxes.

- Reviewed taxes and tax declarations to ensure compliance and avoid penalties and fines.

- Conducted daily monitoring of legal changes and interpreted legislation to mitigate potential risks and their impact on the business.

- Participated in projects and provided analysis and support for fiscal operations related to indirect taxes.

Tax Specialist Resume Example

Tax Specialist

- Successfully built a new client portfolio, meeting company expectations and goals.

- Prepared federal and state forms while maintaining strict confidentiality.

- Utilized interview techniques to recommend products and services tailored to each client's needs.

- Provided clients with clear explanations and updated information on new tax laws.

- Assisted clients in navigating IRS-related audits.

- Conducted cash balance, ATH processing, and credit card transactions.

Tax Specialist Resume Example

Tax Specialist

- Enhanced 99% of refunds and reduced payments for clients during tax return preparation.

- Accurately prepared federal and state tax returns for clients, ensuring compliance with Treasury Department laws.

- Electronically processed client forms and maintained secure documentation filing protocols.

- Provided guidance to clients on available options based on their income and deductions, aiming to maximize their benefits.

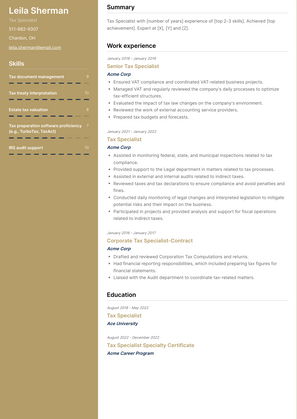

Senior Tax Specialist Resume Example

Senior Tax Specialist

- Ensured VAT compliance and coordinated VAT-related business projects.

- Managed VAT and regularly reviewed the company's daily processes to optimize tax-efficient structures.

- Evaluated the impact of tax law changes on the company's environment.

- Reviewed the work of external accounting service providers.

- Prepared tax budgets and forecasts.

Accountant and Tax Specialist Resume Example

Accountant and Tax Specialist

- Prepared the annual balance sheet and the CPC.

- Monitored the processing of customer and supplier invoices.

- Generated a monthly statement of the company's accounting situation, often referred to as a dashboard.

- Prepared staff pay slips and handled tax and social declarations.

- Created annual reports by analyzing actual and budgeted costs.

Corporate Tax Specialist-Contract Resume Example

Corporate Tax Specialist-Contract

- Drafted and reviewed Corporation Tax Computations and returns.

- Had financial reporting responsibilities, which included preparing tax figures for financial statements.

- Liaised with the Audit department to coordinate tax-related matters.

Top Tax Specialist Resume Skills for 2023

- Tax preparation software proficiency (e.g., TurboTax, TaxAct)

- Income tax return preparation

- Tax planning and analysis

- Knowledge of tax codes and regulations

- IRS audit support

- Tax compliance and reporting

- State and local tax expertise

- Tax research and analysis

- Tax accounting principles

- Tax deductions and credits

- Tax document management

- Estate and gift tax planning

- International tax laws and treaties

- Tax software integration

- Electronic filing systems

- Financial statement analysis

- Tax exemption applications

- Payroll tax processing

- Tax dispute resolution

- Business tax planning

- Tax strategy development

- Sales and use tax analysis

- Tax liability estimation

- Tax provision calculation

- Tax forecasting

- Tax compliance audits

- Knowledge of tax forms (e.g., 1040, 1065, 1120)

- Multi-state taxation

- Tax research databases (e.g., RIA Checkpoint, CCH)

- Taxation of investments

- Transfer pricing analysis

- Tax-efficient investment strategies

- IRS e-services usage

- Tax reporting automation

- Tax return review and quality assurance

- Tax treaty interpretation

- Tax software customization

- Depreciation and amortization calculations

- Estate tax valuation

- Tax risk assessment

- Tax credits and incentives analysis

- Tax compliance software management

- Tax compliance calendars

- Cost segregation analysis

- Tax-related financial modeling

- Non-profit tax expertise

- Trust and estate tax planning

- Tax implications of mergers and acquisitions

- Tax strategy optimization

- Tax due diligence for transactions

How Long Should my Tax Specialist Resume be?

Your Tax Specialist resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Tax Specialist, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2024 Workstory Inc.