Tax Preparer Resume Examples and Templates

This page provides you with Tax Preparer resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Tax Preparer resume.

What do Hiring Managers look for in a Tax Preparer Resume

- Tax law knowledge (federal, state, and local)

- Understanding of tax codes and regulations

- Tax preparation software proficiency (e.g., TurboTax, TaxAct, H&R Block)

- Income tax return preparation

- Individual tax return preparation

- Business tax return preparation

- Partnership tax return preparation

- Corporate tax return preparation

- Estate and trust tax return preparation

- Nonprofit tax return preparation

- Tax form completion (e.g., Form 1040, Schedule C, Form 1065)

- Tax deduction identification

- Tax credit identification

- Tax planning strategies

- Tax refund calculation

- Tax liability calculation

- Tax filing deadline management

- Estimated tax payment calculation

- Tax document organization

- Tax document review

- Tax document scanning and digitization

- Tax audit support

- Tax dispute resolution assistance

- Tax research skills

- Knowledge of tax incentives and credits

- Tax compliance review

- Taxpayer representation before tax authorities

- Knowledge of tax treaties (for international tax preparation)

- Tax compliance for individuals and businesses

- State and local tax compliance

- Payroll tax preparation

- Sales tax preparation

- Property tax preparation

- Tax filing extensions preparation

- Tax planning for retirement accounts

- Tax planning for education expenses

- Tax planning for investments

- Tax implications of real estate transactions

- Tax implications of inheritance and gifts

- Tax implications of divorce and alimony

- Tax implications of business transactions (e.g., mergers, acquisitions)

- Tax implications of employee benefits

- Knowledge of tax deductions for small businesses

- Knowledge of tax credits for small businesses

- Knowledge of tax deductions for self-employed individuals

- Knowledge of tax credits for self-employed individuals

- Continuous learning and professional development in tax laws and regulations

- Strong analytical skills

- Attention to detail

- Ethical conduct in tax preparation practices

How to Write a Tax Preparer Resume?

To write a professional Tax Preparer resume, follow these steps:

- Select the right Tax Preparer resume template.

- Write a professional summary at the top explaining your Tax Preparer’s experience and achievements.

- Follow the STAR method while writing your Tax Preparer resume’s work experience. Show what you were responsible for and what you achieved as a Tax Preparer.

- List your top Tax Preparer skills in a separate skills section.

How to Write Your Tax Preparer Resume Header?

Write the perfect Tax Preparer resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Tax Preparer position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Tax Preparer resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Tax Preparer Resume Example - Header Section

Alyson 9507 Morris Street Somerset, NJ 08873 Marital Status: Married, email: cooldude2022@gmail.com

Good Tax Preparer Resume Example - Header Section

Alyson Schmidt, Somerset, NJ, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Tax Preparer email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Tax Preparer Resume Summary?

Use this template to write the best Tax Preparer resume summary: Tax Preparer with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Tax Preparer Resume Experience Section?

Here’s how you can write a job winning Tax Preparer resume experience section:

- Write your Tax Preparer work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Tax Preparer work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Tax Preparer).

- Use action verbs in your bullet points.

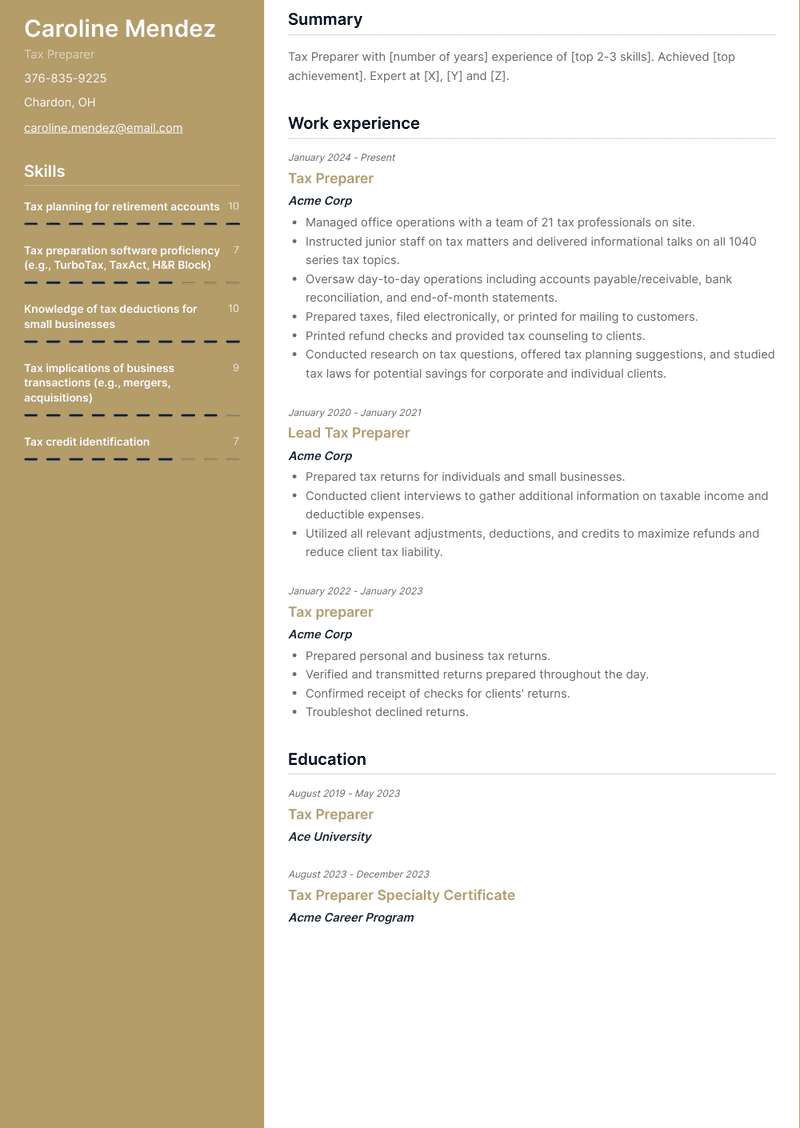

Tax Preparer Resume Example

Tax Preparer

- Managed office operations with a team of 21 tax professionals on site.

- Instructed junior staff on tax matters and delivered informational talks on all 1040 series tax topics.

- Oversaw day-to-day operations including accounts payable/receivable, bank reconciliation, and end-of-month statements.

- Prepared taxes, filed electronically, or printed for mailing to customers.

- Printed refund checks and provided tax counseling to clients.

- Conducted research on tax questions, offered tax planning suggestions, and studied tax laws for potential savings for corporate and individual clients.

Tax Preparer Resume Example

Tax Preparer

- Prepared income tax return forms for individuals.

- Reviewed financial records and income statements to identify necessary forms for tax preparation.

- Conducted client interviews to gather information on taxable income, deductible expenses, and allowances.

- Consulted tax law handbooks to address unusual tax return scenarios.

- Determined form preparation fee based on return complexity and preparation time.

- Ensured accuracy and compliance of documents.

- Maintained student education records and prepared arrival schedules for new students.

- Generated daily morning reports.

Tax preparer Resume Example

Tax preparer

- Prepared personal and business tax returns.

- Verified and transmitted returns prepared throughout the day.

- Confirmed receipt of checks for clients' returns.

- Troubleshot declined returns.

Tax preparer Resume Example

Tax preparer

- Managed and administered annual income tax paperwork filing to the Internal Revenue Service (IRS).

- Accurately calculated taxpayers' tax returns and prepared all income tax forms for client signatures.

- Provided assistance to taxpayers via phone or in-person regarding their rights and responsibilities in filing taxes.

- Ensured customer satisfaction by answering questions on filing rules, dates, and procedures.

- Handled incoming telephone calls from clients and maintained up-to-date taxpayer personal information.

- Liaised with bank specialists regarding taxpayers' tax returns.

Lead Tax Preparer Resume Example

Lead Tax Preparer

- Prepared tax returns for individuals and small businesses.

- Conducted client interviews to gather additional information on taxable income and deductible expenses.

- Utilized all relevant adjustments, deductions, and credits to maximize refunds and reduce client tax liability.

Tax preparer Resume Example

Tax preparer

- Utilized profiler to prepare 1040 forms with impeccable accuracy.

- Prepared over 200 tax returns per season for both business and individual customers.

- Coordinated company's tax returns for paperless submission to state and federal authorities.

Tax preparer Resume Example

Tax preparer

- Coordinated company's tax returns for paperless submission to state and federal authorities.

- Reviewed clients' W-2s, supplementary income, and expense documentation to prepare accurate tax returns with minimal liability.

- Prepared over 100 tax returns per season for both business and individual customers.

- Utilized profiler to prepare 1040 forms with impeccable accuracy.

Tax Preparer Resume Example

Tax Preparer

- Prepared tax returns, extensions, and write-ups for individuals.

- Prepared US and multistate tax returns for business clients.

- Provided clients with recommendations to minimize tax liabilities.

- Reviewed clients' tax filing documents thoroughly to assess eligibility for additional tax credits or deductions.

- Conducted reviews of internal tax documentation, reducing errors related to missed tax benefits.

- Facilitated communication between clients and tax authorities.

Tax Preparer Resume Example

Tax Preparer

- Prepared individual income tax returns.

- Provided assistance through the Income Tax Assistance Program.

- Advised on potential tax liabilities.

- Reviewed financial records such as income statements.

- Utilized electronic software to prepare tax returns.

- Reported progress by sending weekly reports to the team.

- Audited all tax forms for completeness and accuracy.

Tax Preparer Resume Example

Tax Preparer

- Acquired Preparer Tax Identification Number (PTIN).

- Conducted comprehensive in-person interviews with potential clients.

- Reviewed financial records to ascertain necessary information for tax return preparation.

- Completed all relevant tax forms adhering to legislative and regulatory requirements.

- Addressed client inquiries and offered future tax planning advice.

- Engaged in marketing activities.

Top Tax Preparer Resume Skills for 2023

- Tax law knowledge (federal, state, and local)

- Understanding of tax codes and regulations

- Tax preparation software proficiency (e.g., TurboTax, TaxAct, H&R Block)

- Income tax return preparation

- Individual tax return preparation

- Business tax return preparation

- Partnership tax return preparation

- Corporate tax return preparation

- Estate and trust tax return preparation

- Nonprofit tax return preparation

- Tax form completion (e.g., Form 1040, Schedule C, Form 1065)

- Tax deduction identification

- Tax credit identification

- Tax planning strategies

- Tax refund calculation

- Tax liability calculation

- Tax filing deadline management

- Estimated tax payment calculation

- Tax document organization

- Tax document review

- Tax document scanning and digitization

- Tax audit support

- Tax dispute resolution assistance

- Tax research skills

- Knowledge of tax incentives and credits

- Tax compliance review

- Taxpayer representation before tax authorities

- Knowledge of tax treaties (for international tax preparation)

- Tax compliance for individuals and businesses

- State and local tax compliance

- Payroll tax preparation

- Sales tax preparation

- Property tax preparation

- Tax filing extensions preparation

- Tax planning for retirement accounts

- Tax planning for education expenses

- Tax planning for investments

- Tax implications of real estate transactions

- Tax implications of inheritance and gifts

- Tax implications of divorce and alimony

- Tax implications of business transactions (e.g., mergers, acquisitions)

- Tax implications of employee benefits

- Knowledge of tax deductions for small businesses

- Knowledge of tax credits for small businesses

- Knowledge of tax deductions for self-employed individuals

- Knowledge of tax credits for self-employed individuals

- Strong analytical skills

- Attention to detail

How Long Should my Tax Preparer Resume be?

Your Tax Preparer resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Tax Preparer, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2024 Workstory Inc.