Tax Manager Resume Examples and Templates

This page provides you with Tax Manager resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Tax Manager resume.

What do Hiring Managers look for in a Tax Manager Resume

- Taxation Expertise: Proficiency in tax laws, regulations, and tax planning strategies.

- Analytical Skills: Ability to analyze financial data and tax documents accurately.

- Leadership: Strong leadership skills to manage tax teams and projects effectively.

- Communication: Effective communication skills for interacting with clients, stakeholders, and tax authorities.

- Problem-Solving: Capability to address complex tax issues and provide strategic solutions.

How to Write a Tax Manager Resume?

To write a professional Tax Manager resume, follow these steps:

- Select the right Tax Manager resume template.

- Write a professional summary at the top explaining your Tax Manager’s experience and achievements.

- Follow the STAR method while writing your Tax Manager resume’s work experience. Show what you were responsible for and what you achieved as a Tax Manager.

- List your top Tax Manager skills in a separate skills section.

How to Write Your Tax Manager Resume Header?

Write the perfect Tax Manager resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Tax Management position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Tax Manager resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Tax Manager Resume Example - Header Section

Lorelai 696 Rock Maple St. South Lyon, MI 48178 Marital Status: Married, email: cooldude2022@gmail.com

Good Tax Manager Resume Example - Header Section

Lorelai Frye, Lyon, MI, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Tax Manager email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Tax Manager Resume Summary?

Use this template to write the best Tax Manager resume summary: Tax Manager with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Tax Manager Resume Experience Section?

Here’s how you can write a job winning Tax Manager resume experience section:

- Write your Tax Manager work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Tax Manager work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Tax Manager).

- Use action verbs in your bullet points.

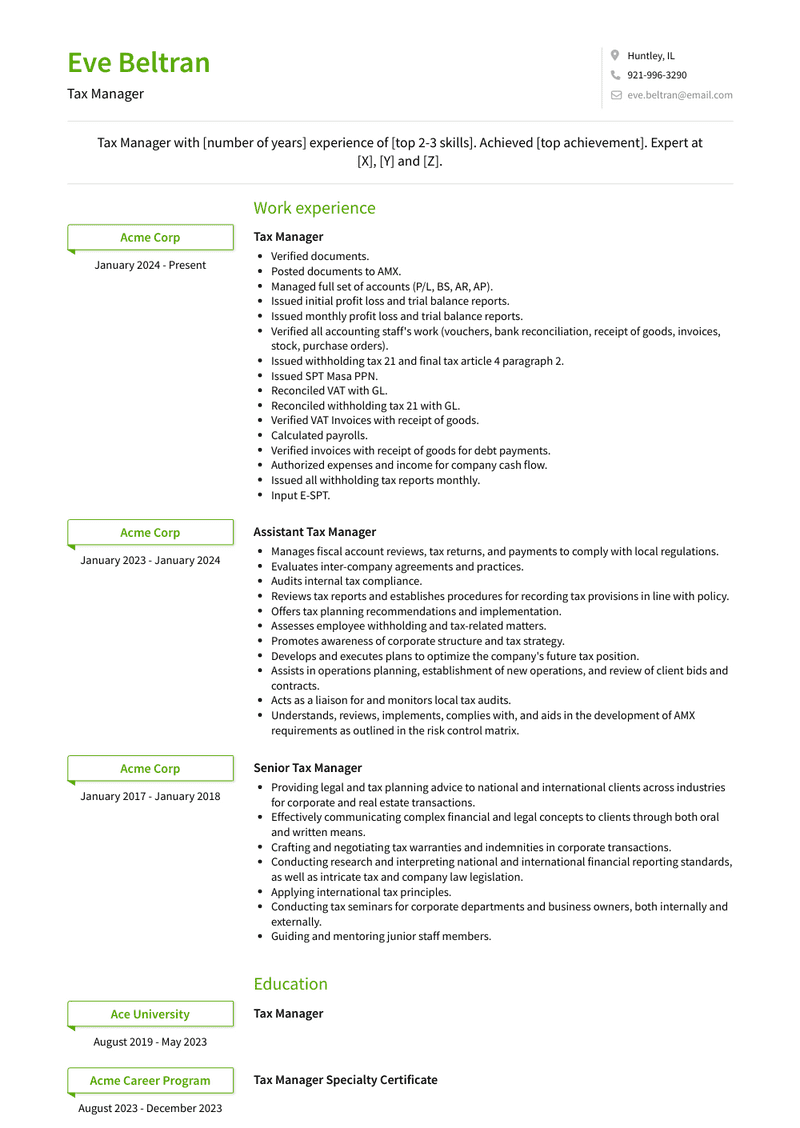

Tax Manager Resume Example

Tax Manager

- Verified documents.

- Posted documents to AMX.

- Managed full set of accounts (P/L, BS, AR, AP).

- Issued initial profit loss and trial balance reports.

- Issued monthly profit loss and trial balance reports.

- Verified all accounting staff's work (vouchers, bank reconciliation, receipt of goods, invoices, stock, purchase orders).

- Issued withholding tax 21 and final tax article 4 paragraph 2.

- Issued SPT Masa PPN.

- Reconciled VAT with GL.

- Reconciled withholding tax 21 with GL.

- Verified VAT Invoices with receipt of goods.

- Calculated payrolls.

- Verified invoices with receipt of goods for debt payments.

- Authorized expenses and income for company cash flow.

- Issued all withholding tax reports monthly.

- Input E-SPT.

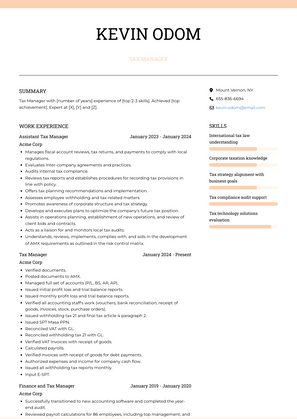

Assistant Tax Manager Resume Example

Assistant Tax Manager

- Manages fiscal account reviews, tax returns, and payments to comply with local regulations.

- Evaluates inter-company agreements and practices.

- Audits internal tax compliance.

- Reviews tax reports and establishes procedures for recording tax provisions in line with policy.

- Offers tax planning recommendations and implementation.

- Assesses employee withholding and tax-related matters.

- Promotes awareness of corporate structure and tax strategy.

- Develops and executes plans to optimize the company's future tax position.

- Assists in operations planning, establishment of new operations, and review of client bids and contracts.

- Acts as a liaison for and monitors local tax audits.

- Understands, reviews, implements, complies with, and aids in the development of AMX requirements as outlined in the risk control matrix.

Group Tax Manager Resume Example

Group tax manager

- Expertise in international tax, transfer pricing, and thin capitalization.

- Specialization in tax and business structuring.

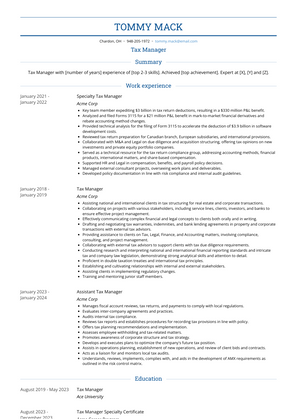

Specialty Tax Manager Resume Example

Specialty Tax Manager

- Key team member expediting $3 billion in tax return deductions, resulting in a $330 million P&L benefit.

- Analyzed and filed Forms 3115 for a $21 million P&L benefit in mark-to-market financial derivatives and rebate accounting method changes.

- Provided technical analysis for the filing of Form 3115 to accelerate the deduction of $3.9 billion in software development costs.

- Reviewed tax return preparation for Canadian branch, European subsidiaries, and international provisions.

- Collaborated with M&A and Legal on due diligence and acquisition structuring, offering tax opinions on new investments and private equity portfolio companies.

- Served as a technical resource for the tax return compliance group, addressing accounting methods, financial products, international matters, and share-based compensation.

- Supported HR and Legal in compensation, benefits, and payroll policy decisions.

- Managed external consultant projects, overseeing work plans and deliverables.

- Developed policy documentation in line with risk compliance and internal audit guidelines.

Group Direct Tax Manager Resume Example

Group Direct Tax Manager

- Prepared and reviewed income tax returns in compliance with relevant tax laws.

- Prepared tax-related disclosures for statutory or GAAP financial statements and various state and local tax filings.

- Assisted in overseeing income tax audits and filings.

- Conducted research and analysis of tax developments and their application to specific business scenarios.

- Managed routine closings, maintained accurate records, and monitored transaction updates throughout each quarter.

- Facilitated communication between the company and tax authorities, including preparing written responses or tax return amendments to address tax notices.

- Streamlined the integration of modern tax software with accounting software.

Finance and Tax Manager Resume Example

Finance and Tax Manager

- Successfully transitioned to new accounting software and completed the year-end audit.

- Reviewed payroll calculations for 86 employees, including top management, and assisted in preparing and submitting TD1, TD59, TD63, and TD7 declarations.

- Orchestrated, managed, and reported on the outcomes of obtaining IP rulings under the new IP box regime.

- Formulated international tax planning strategies for the international group of companies.

- Coordinated and managed individual and group VAT applications for the Cyprus group of companies, along with quarterly VAT reporting.

- Ensured timely compliance with the latest tax regulations, calculated, submitted, and paid relevant tax forms, including temporary Corporate Tax, while minimizing penalties for delays.

Tax Manager Resume Example

Tax Manager

- Assisting national and international clients in tax structuring for real estate and corporate transactions.

- Collaborating on projects with various stakeholders, including service lines, clients, investors, and banks to ensure effective project management.

- Effectively communicating complex financial and legal concepts to clients both orally and in writing.

- Drafting and negotiating tax warranties, indemnities, and bank lending agreements in property and corporate transactions with external tax advisors.

- Providing assistance to clients on Tax, Legal, Finance, and Accounting matters, involving compliance, consulting, and project management.

- Collaborating with external tax advisors to support clients with tax due diligence requirements.

- Conducting research and interpreting national and international financial reporting standards and intricate tax and company law legislation, demonstrating strong analytical skills and attention to detail.

- Proficient in double taxation treaties and international tax principles.

- Establishing and cultivating relationships with internal and external stakeholders.

- Assisting clients in implementing regulatory changes.

- Training and mentoring junior staff members.

Senior Tax Manager Resume Example

Senior Tax Manager

- Providing legal and tax planning advice to national and international clients across industries for corporate and real estate transactions.

- Effectively communicating complex financial and legal concepts to clients through both oral and written means.

- Crafting and negotiating tax warranties and indemnities in corporate transactions.

- Conducting research and interpreting national and international financial reporting standards, as well as intricate tax and company law legislation.

- Applying international tax principles.

- Conducting tax seminars for corporate departments and business owners, both internally and externally.

- Guiding and mentoring junior staff members.

Top Tax Manager Resume Skills for 2023

- Tax planning and strategy development

- Corporate taxation knowledge

- Individual taxation knowledge

- Tax compliance and reporting

- Tax code and regulations expertise

- International tax law understanding

- State and local tax (SALT) knowledge

- Transfer pricing analysis

- Tax accounting methods

- Tax software proficiency (e.g., TurboTax, TaxACT)

- Tax return preparation and review

- Tax audit management

- Tax credits and deductions identification

- Tax accounting standards (e.g., ASC 740)

- Tax risk assessment and mitigation

- Tax dispute resolution

- Tax research and analysis

- Tax compliance software utilization

- Tax exemption and incentive programs

- Tax strategy alignment with business goals

- Tax planning for mergers and acquisitions

- Tax-efficient investment strategies

- Tax compliance auditing

- Tax return e-filing processes

- Tax compliance deadline management

- Tax depreciation and amortization analysis

- Tax provision calculation and reporting

- Tax compliance documentation

- Tax compliance audit support

- Tax software customization and integration

- Tax compliance process improvement

- Tax software security and data protection

- Tax compliance training and coaching

- Tax policy development and implementation

- Tax compliance risk assessment

- Tax planning for real estate transactions

- Tax planning for international expansion

- Tax planning for employee benefits

- Tax compliance data analytics

- Tax return accuracy and quality control

- Tax compliance reporting tools (e.g., Excel)

- Tax compliance automation and optimization

- Tax technology solutions evaluation

- Tax compliance workflow management

- Tax compliance audits and assessments

- Tax return amendment processes

- Tax compliance documentation storage

- Tax compliance process audits

- Tax compliance process documentation

How Long Should my Tax Manager Resume be?

Your Tax Manager resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Tax Manager, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2025 Workstory Inc.