Tax Associate Resume Examples and Templates

This page provides you with Tax Associate resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Tax Associate resume.

What Do Hiring Managers Look for in a Tax Associate Resume

- Proficient in assisting with tax preparation and compliance for individuals or businesses.

- Strong knowledge of tax laws, regulations, and filing requirements.

- Skilled in preparing tax returns, calculating tax liabilities, and identifying potential deductions.

- Ability to conduct tax research, address client inquiries, and resolve tax-related issues.

- Proficiency in staying updated on changes in tax laws and applying them appropriately to tax situations.

How to Write a Tax Associate Resume?

To write a professional Tax Associate resume, follow these steps:

- Select the right Tax Associate resume template.

- Write a professional summary at the top explaining your Tax Associate’s experience and achievements.

- Follow the STAR method while writing your Tax Associate resume’s work experience. Show what you were responsible for and what you achieved as a Tax Associate.

- List your top Tax Associate skills in a separate skills section.

How to Write Your Tax Associate Resume Header?

Write the perfect Tax Associate resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Tax Associate to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Tax Associate resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Tax Associate Resume Example - Header Section

Eve 7598 Old Manor St. Saugus, MA 01906 Marital Status: Married, email: cooldude2022@gmail.com

Good Tax Associate Resume Example - Header Section

Eve Beltran, Saugus, MA, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Tax Associate email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Tax Associate Resume Summary?

Use this template to write the best Tax Associate resume summary: Tax Associate with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Tax Associate Resume Experience Section?

Here’s how you can write a job winning Tax Associate resume experience section:

- Write your Tax Associate work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Tax Associate work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Tax Associate).

- Use action verbs in your bullet points.

Tax Associate Resume Example

Tax Associate

- Obtain National Tax Number (NTN) for various clients.

- Prepare and submit Income Tax Returns for Individuals and Corporate clients.

- Prepare Income tax and Sales tax challans for tax payments.

- Prepare and submit Sales tax returns with the Federal Board of Revenue (FBR).

- Prepare provincial Sales tax returns for services, such as with the Punjab Revenue Authority (PRA).

- Prepare Income tax Withholding returns under section 165 and submit them to FBR.

- Obtain exemptions under section 2(36) & 100c of total tax credit for Non-Profit Organizations (NPO).

- Obtain withholding tax exemptions under section 150 & 151 for NPOs.

- Prepare replies against notices under section 177 (Audit) of the Income Tax Ordinance, 2001.

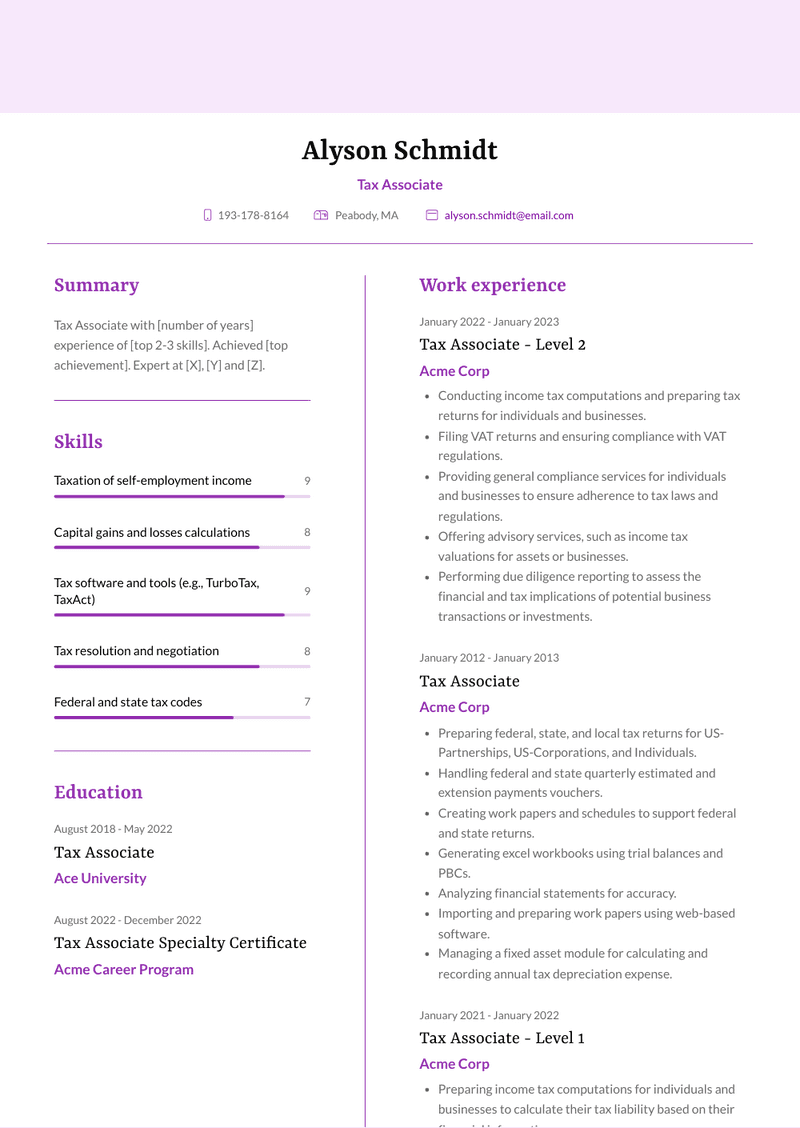

Tax Associate - Level 2 Resume Example

Tax Associate - Level 2

- Conducting income tax computations and preparing tax returns for individuals and businesses.

- Filing VAT returns and ensuring compliance with VAT regulations.

- Providing general compliance services for individuals and businesses to ensure adherence to tax laws and regulations.

- Offering advisory services, such as income tax valuations for assets or businesses.

- Performing due diligence reporting to assess the financial and tax implications of potential business transactions or investments.

Tax Associate - Level 1 Resume Example

Tax Associate - Level 1

- Preparing income tax computations for individuals and businesses to calculate their tax liability based on their financial information.

- Preparing and filing income tax returns for individuals and businesses to report their taxable income and claim deductions and credits.

- Managing risk by ensuring compliance with tax laws and regulations, identifying potential risks, and implementing appropriate controls to mitigate them.

- Assisting in the development of internal tools using Excel to streamline processes and improve efficiency in tax-related tasks. These tools may include templates for tax calculations, data analysis, or reporting.

Tax Associate Resume Example

Tax Associate

- Managed disputed tax assessment cases of assigned clients, representing them in discussions with tax authorities and preparing necessary documentation for resolution.

- Handled tax filing and compliance tasks for assigned clients, ensuring timely and accurate submission of tax returns and other required documents.

- Conducted research on tax rulings and other related issues to provide accurate and up-to-date information to clients.

- Assisted clients with Securities and Exchange Commission (SEC) business registration, ensuring compliance with registration requirements.

- Prepared various reports as assigned by the Supervisor, which may include financial reports, tax analysis, or other relevant documents.

Senior Tax Associate Resume Example

Senior Tax Associate

- Conduct reviews and monitor the work of less experienced associates (work buddies) to minimize careless mistakes in tax return preparation.

- Review and ensure the accuracy and appropriateness of tax returns, computations, and attachments before submitting them to managers for further review.

- Advise and explain tax concepts to clients, providing guidance on tax minimization strategies through valid deductions and exemptions.

- Assist in e-filing tax returns and ensure compliance with tax deadlines and regulations.

- Prepare individual tax returns and tax equalization calculations, which will be reviewed and approved by managers.

- Demonstrate a sense of urgency in completing work efficiently and effectively.

- Monitor tax deadlines and ensure compliance with regulatory bodies.

- Analyze and review source documents related to stock options granted, evaluate tax implications, compute tax liabilities, and file necessary documents.

Senior Tax Associate Resume Example

Senior Tax Associate

- Oversee tax information and reporting for a portfolio of 100+ domestic and international clients.

- Handle complex transactions, such as multi-million dollar asset sales, partnership interest sales, mergers & acquisitions, and preparation of client tax information for initial public offerings.

- Act as the primary point of contact for clients regarding all tax-related matters, including tax notices, federal and state tax credits, and ensuring timely resolution of issues and client needs.

- Review financial statements for various business entities to ensure compliance with generally accepted accounting principles and tax basis accounting.

- Manage, develop, and mentor staff and interns on projects, providing regular feedback on their performance. Assist team members in meeting goals and deadlines set by management.

- Conduct interviews for intern candidates through on-campus hiring and networking events. Lead summer intern training and development programs.

Tax Associate Resume Example

Tax Associate

- Draft letter to Inland Revenue Department

- Prepare Tax Return including individual and corporation tax

- Assist in providing tax planning and advisory service to clients

- Provide an efficient and pro-active service to clients and their internal management to ensure that their needs are fully met

- Understand Financial figures in Annual report

Senior Tax Associate Resume Example

Senior Tax Associate

- Managed tax notice process, avoiding penalties and interest for Clients.

- Reconciled General Ledgers (GL) related to taxes for Clients, ensuring accuracy.

- Responded to notices from various State Internal Revenue Services on behalf of Clients.

- Assisted with Objection letters and other correspondences to the Federal Inland Revenue Service (FIRS) for Clients.

- Filed Annual PAYE tax returns with relevant State Internal Revenue Service (SIRS) for clients.

- Filed Companies Income Tax returns for clients before the due date.

- Prepared and filed notices of objection to tax authorities within specified time frames as per tax law.

- Represented Clients at Tax Audit Reconciliation Committee (TARC) meetings with Relevant Tax Authority.

- Prepared Clients for tax audit activities and supervised tax audits for Clients.

- Provided advisory services on Tax matters, keeping up with tax legislative changes.

Tax associate Resume Example

Tax associate

- Supervisor of tax prepares.

- Input tax information for individuals and business tax returns, following tax office policies.

- Preparing complex multi-state business and fiduciary tax returns.

- Researching and developing tax planning strategies in order to improve accuracy and upload to software.

Senior Tax Associate Resume Example

Senior Tax Associate

- Supported Fortune 500 client through providing conceptual funding strategies to efficiently utilize foreign cash of U.S. multinational target as part of an acquisition

- Articulated potential international restructuring opportunities for Fortune 100 client through PowerPoint by identifying steps in addition to relevant U.S. and foreign tax consequences

- Executed quarterly asset and income tests while analyzing impact of tax differences on effective tax rate in order to assist client in successfully transitioning to a real estate investment trust (REIT)

- Aided in the preparation of various tax returns and forms for financial services clients at Federal and State levels

US Tax Associate Resume Example

US Tax Associate

- Analyzing federal and state returns for Partnerships and S corporations.

- Preparing complex federal and state tax returns for US-Partnerships, US-S Corporations, and US-Corporations.

- Reviewing and preparing workpapers and forms for credits, depreciation, amortization, and other supporting worksheets.

- Conducting research and analysis on partnership and corporate workpapers and returns using tax software.

- Collaborating with the tax team to prepare and review tax returns.

Tax Associate Resume Example

Tax Associate

- Preparing federal, state, and local tax returns for US-Partnerships, US-Corporations, and Individuals.

- Handling federal and state quarterly estimated and extension payments vouchers.

- Creating work papers and schedules to support federal and state returns.

- Generating excel workbooks using trial balances and PBCs.

- Analyzing financial statements for accuracy.

- Importing and preparing work papers using web-based software.

- Managing a fixed asset module for calculating and recording annual tax depreciation expense.

Top Tax Associate Resume Skills for 2023

- Tax law and regulations

- Income tax preparation

- Tax planning and strategies

- IRS guidelines and requirements

- Tax compliance and reporting

- Tax deductions and credits

- Tax software and tools (e.g., TurboTax, TaxAct)

- Tax research and analysis

- Federal and state tax codes

- Filing individual and business tax returns

- Tax audit assistance and representation

- Tax forms and schedules (e.g., 1040, Schedule C)

- Estimated tax payments

- Taxation for different types of entities (e.g., corporations, partnerships)

- Tax-exempt organizations and filings

- Sales tax and use tax knowledge

- Tax implications of investment decisions

- Tax planning for retirement contributions

- International tax considerations

- Tax accounting principles

- Tax credits for renewable energy and green initiatives

- Capital gains and losses calculations

- Taxation of real estate transactions

- Tax implications of business expenses

- Taxation of employee benefits

- Taxation of stock options and equity compensation

- Tax strategies for estate planning

- Taxation of charitable contributions

- Tax implications of healthcare coverage

- Taxation of rental income and expenses

- Taxation of self-employment income

- Taxation of foreign income and foreign tax credits

- Electronic filing and e-filing procedures

- Tax fraud prevention and detection

- Amending tax returns and corrections

- Communication and client interaction

- Tax season preparation and organization

- Tax return review and accuracy checks

- Tax-related financial analysis and forecasting

- Knowledge of tax treaties and international tax issues

- Keeping up-to-date with tax law changes

- Tax withholding and estimated tax calculations

- Communication with tax authorities on behalf of clients

- Tax consultation and advising clients on tax matters

- IRS correspondence and responses

- Tax resolution and negotiation

- Tax dispute resolution and appeals

How Long Should my Tax Associate Resume be?

Your Tax Associate resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Tax Associate, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

How can I highlight my tax preparation experience on a Tax Associate resume?

To highlight your tax preparation experience, focus on your ability to prepare and file tax returns for individuals and businesses, ensure compliance with tax regulations, and identify potential tax savings. Include specific examples of the types of tax returns you’ve handled, such as individual, corporate, or partnership returns. Mention your familiarity with various tax software programs and your experience in analyzing financial data to ensure accuracy.

What are the key skills to feature on a Tax Associate resume?

Key skills to feature include tax preparation, knowledge of federal and state tax laws, financial analysis, and proficiency with tax software such as TurboTax, Lacerte, or ProSeries. Additionally, highlight your attention to detail, problem-solving abilities, and your capacity to manage multiple client accounts during peak tax season. Emphasize your ability to communicate complex tax concepts to clients in an understandable way.

How do I demonstrate my ability to ensure compliance on a Tax Associate resume?

Demonstrate your ability to ensure compliance by providing examples of how you’ve interpreted and applied tax laws to prepare accurate tax returns. Mention any experience you have in staying updated with changes in tax regulations and how you’ve advised clients or your team on compliance issues. Highlight your role in minimizing audit risks by ensuring all filings are accurate and submitted on time.

Should I include metrics on my Tax Associate resume? If so, what kind?

Including metrics can help quantify your impact as a Tax Associate. For example, you could mention the number of tax returns you prepared each season, the amount of tax savings you identified for clients, or the percentage of returns filed without errors. Metrics provide tangible evidence of your efficiency and effectiveness in tax preparation.

How can I showcase my experience with tax software on my resume?

You can showcase your experience with tax software by listing the specific programs you’ve used and detailing how you’ve utilized them to prepare, review, and file tax returns. Mention any experience you have in troubleshooting software issues, customizing tax software to meet specific client needs, or training others in the use of these tools. Highlight your proficiency in maximizing the efficiency of tax preparation processes through the use of these technologies.

What kind of achievements should I highlight as a Tax Associate?

Highlight achievements such as identifying significant tax savings for clients, successfully managing a high volume of tax returns during peak season, or receiving positive feedback from clients for your service. You could also mention any recognition you received from supervisors or clients, such as awards, bonuses, or commendations for accuracy and efficiency. Achievements that demonstrate your expertise and your ability to deliver value to clients are particularly valuable.

How do I address a lack of experience on a Tax Associate resume?

If you lack experience, focus on transferable skills such as financial analysis, attention to detail, and problem-solving. Mention any relevant coursework, internships, or volunteer work where you gained experience in tax preparation or financial management. Emphasize your eagerness to learn, your familiarity with tax concepts, and any certifications or training you’ve completed to prepare for a career in tax.

How important is attention to detail for a Tax Associate?

Attention to detail is crucial for a Tax Associate, as even minor errors can lead to significant issues, such as penalties or audits. Highlight your meticulous approach to reviewing tax documents, ensuring all calculations are correct, and double-checking information before filing. Mention any procedures you follow to maintain accuracy, such as checklists or peer reviews.

How do I demonstrate my ability to work under pressure on my resume?

Demonstrate your ability to work under pressure by describing how you’ve managed tight deadlines, handled a high volume of tax returns during busy seasons, or resolved complex tax issues under time constraints. Mention your approach to prioritizing tasks, staying organized, and maintaining a high level of accuracy even when working quickly. Highlight any experience you have in managing multiple clients or projects simultaneously.

Should I include certifications on my Tax Associate resume?

Yes, including certifications can enhance your resume by demonstrating your qualifications and commitment to professional development. Certifications such as Enrolled Agent (EA), Certified Public Accountant (CPA), or Chartered Tax Professional (CTP) can add significant value to your resume and make you stand out to potential employers.

-

How can I highlight my tax preparation experience on a Tax Associate resume?

-

What are the key skills to feature on a Tax Associate resume?

-

How do I demonstrate my ability to ensure compliance on a Tax Associate resume?

-

Should I include metrics on my Tax Associate resume? If so, what kind?

-

How can I showcase my experience with tax software on my resume?

-

What kind of achievements should I highlight as a Tax Associate?

-

How do I address a lack of experience on a Tax Associate resume?

-

How do I demonstrate my ability to work under pressure on my resume?

Copyright ©2024 Workstory Inc.