Tax Analyst Resume Examples and Templates

This page provides you with Tax Analyst resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Tax Analyst resume.

What do Hiring Managers look for in a Tax Analyst Resume

- Tax Knowledge: Proficiency in tax laws, regulations, and compliance requirements relevant to the organization's jurisdiction.

- Analytical Skills: Strong ability to analyze financial data, documents, and transactions to ensure accurate tax reporting.

- Attention to Detail: A keen eye for detail to prevent errors and discrepancies in tax filings and financial records.

- Research Skills: Capability to research and stay updated on changing tax laws and regulations to ensure compliance.

- Communication: Effective communication skills to convey tax-related information internally and externally and collaborate with other departments or external tax authorities when necessary.

How to Write a Tax Analyst Resume?

To write a professional Tax Analyst resume, follow these steps:

- Select the right Tax Analyst resume template.

- Write a professional summary at the top explaining your Tax Analyst’s experience and achievements.

- Follow the STAR method while writing your Tax Analyst resume’s work experience. Show what you were responsible for and what you achieved as a Tax Analyst.

- List your top Tax Analyst skills in a separate skills section.

How to Write Your Tax Analyst Resume Header?

Write the perfect Tax Analyst resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Tax Analyst position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Tax Analyst resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Tax Analyst Resume Example - Header Section

Deandre 9507 Morris Street Somerset, NJ 08873 Marital Status: Married, email: cooldude2022@gmail.com

Good Tax Analyst Resume Example - Header Section

Deandre Huff, Somerset, NJ, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Tax Analyst email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Tax Analyst Resume Summary?

Use this template to write the best Tax Analyst resume summary: Tax Analyst with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Tax Analyst Resume Experience Section?

Here’s how you can write a job winning Tax Analyst resume experience section:

- Write your Tax Analyst work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Tax Analyst work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Tax Analyst).

- Use action verbs in your bullet points.

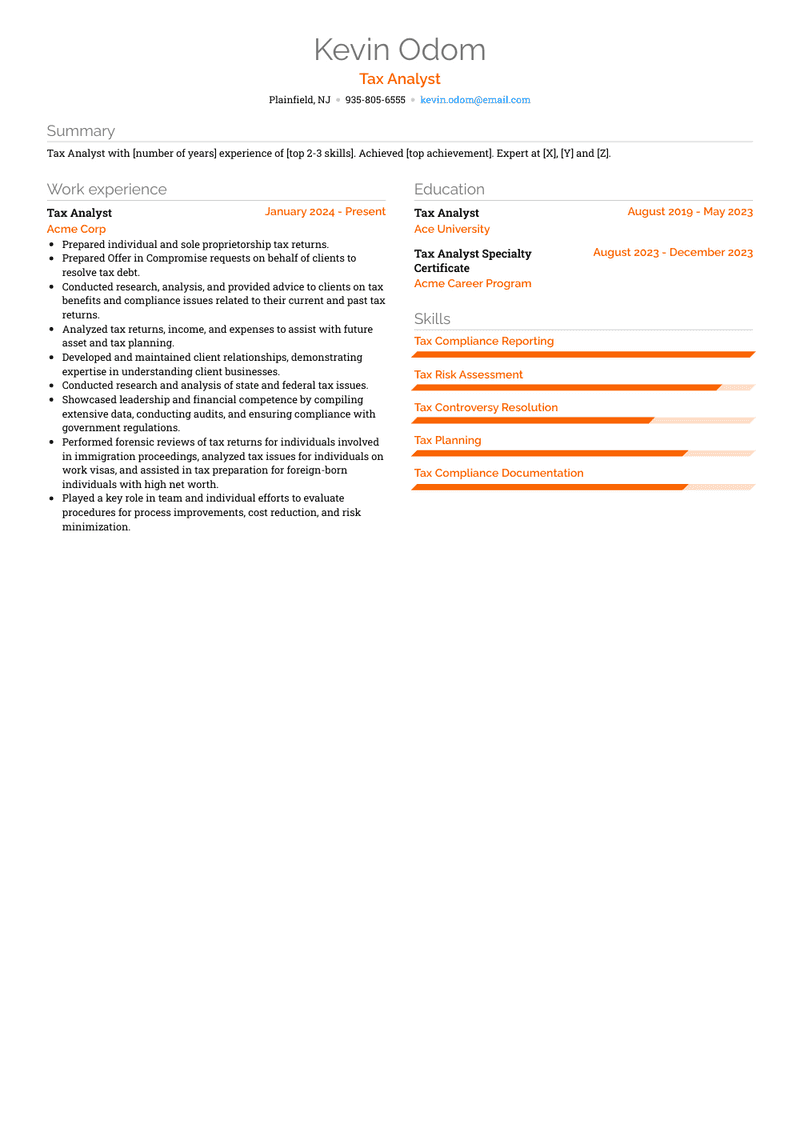

Tax Analyst Resume Example

Tax Analyst

- Prepared individual and sole proprietorship tax returns.

- Prepared Offer in Compromise requests on behalf of clients to resolve tax debt.

- Conducted research, analysis, and provided advice to clients on tax benefits and compliance issues related to their current and past tax returns.

- Analyzed tax returns, income, and expenses to assist with future asset and tax planning.

- Developed and maintained client relationships, demonstrating expertise in understanding client businesses.

- Conducted research and analysis of state and federal tax issues.

- Showcased leadership and financial competence by compiling extensive data, conducting audits, and ensuring compliance with government regulations.

- Performed forensic reviews of tax returns for individuals involved in immigration proceedings, analyzed tax issues for individuals on work visas, and assisted in tax preparation for foreign-born individuals with high net worth.

- Played a key role in team and individual efforts to evaluate procedures for process improvements, cost reduction, and risk minimization.

Top Tax Analyst Resume Skills for 2023

- Tax Preparation Software (e.g., TurboTax, H&R Block)

- Tax Planning

- Tax Compliance

- Tax Research

- Tax Code Interpretation

- Income Tax Return Preparation

- State and Local Taxation

- Federal Taxation

- Tax Regulations Knowledge (e.g., IRS guidelines)

- Tax Deduction Analysis

- Tax Credits

- Tax Accounting

- Tax Reporting

- International Taxation

- Transfer Pricing

- Tax Law Changes Tracking

- Tax Auditing

- Tax Exemptions

- Tax Compliance Audits

- Tax Analysis Software (e.g., Intuit ProConnect)

- Tax Data Analysis

- Tax Accounting Software (e.g., QuickBooks)

- Payroll Taxation

- Estate Tax Planning

- Tax Accounting Standards (e.g., GAAP)

- Tax Treaty Interpretation

- Tax Forecasting

- Tax Return Review

- Tax Documentation Management

- Tax Filings

- Sales Tax Calculation and Reporting

- Excise Tax Analysis

- Trust Taxation

- Tax Deferred Investments

- Taxation of Investments (e.g., Capital Gains)

- Tax Compliance Testing

- Tax Compliance Reporting

- Tax Liability Assessment

- Tax Risk Assessment

- Tax Compliance Documentation

- Tax Compliance Software

- Tax Policy Analysis

- Tax Impact Assessment (Mergers, Acquisitions)

- Tax Controversy Resolution

- Tax Incentive Programs

- Tax Compliance Process Improvement

- Tax Compliance Auditing Tools

- Tax Compliance Training

- Tax Compliance Automation

- Tax Compliance Best Practices

How Long Should my Tax Analyst Resume be?

Your Tax Analyst resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Tax Analyst, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2024 Workstory Inc.