Senior Tax Accountant Resume Examples and Templates

This page provides you with Senior Tax Accountant resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Senior Tax Accountant resume.

What Do Hiring Managers Look for in a Senior Tax Accountant Resume

- Proficient in preparing and reviewing complex tax returns for individuals or businesses.

- Strong knowledge of tax laws, regulations, and accounting principles.

- Skilled in providing tax planning and consulting services to clients.

- Ability to research tax issues, identify opportunities for tax savings, and provide tax-related advice.

- Proficiency in staying updated on changes in tax laws and regulations to ensure compliance and maximize tax benefits.

How to Write a Senior Tax Accountant Resume?

To write a professional Senior Tax Accountant resume, follow these steps:

- Select the right Senior Tax Accountant resume template.

- Write a professional summary at the top explaining your Senior Tax Accountant’s experience and achievements.

- Follow the STAR method while writing your Senior Tax Accountant resume’s work experience. Show what you were responsible for and what you achieved as a Senior Tax Accountant.

- List your top Senior Tax Accountant skills in a separate skills section.

How to Write Your Senior Tax Accountant Resume Header?

Write the perfect Senior Tax Accountant resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Tax Accountant position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Senior Tax Accountant resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Senior Tax Accountant Resume Example - Header Section

Leila 7598 Old Manor St. Saugus, MA 01906 Marital Status: Married, email: cooldude2022@gmail.com

Good Senior Tax Accountant Resume Example - Header Section

Leila Sherman, Saugus, MA, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Senior Tax Accountant email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Senior Tax Accountant Resume Summary?

Use this template to write the best Senior Tax Accountant resume summary: Senior Tax Accountant with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Senior Tax Accountant Resume Experience Section?

Here’s how you can write a job winning Senior Tax Accountant resume experience section:

- Write your Senior Tax Accountant work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Senior Tax Accountant work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Senior Tax Accountant).

- Use action verbs in your bullet points.

Senior Tax Accountant Resume Example

Senior Tax Accountant

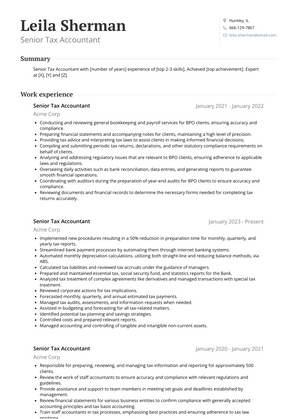

- Implemented new procedures resulting in a 50% reduction in preparation time for monthly, quarterly, and yearly tax reports.

- Streamlined bank payment processes by automating them through internet banking systems.

- Automated monthly depreciation calculations, utilizing both straight-line and reducing balance methods, via ABS.

- Calculated tax liabilities and reviewed tax accruals under the guidance of managers.

- Prepared and maintained essential tax, social security fund, and statistics reports for the Bank.

- Analyzed tax treatment of complex agreements like derivatives and managed transactions with special tax treatment.

- Reviewed corporate actions for tax implications.

- Forecasted monthly, quarterly, and annual estimated tax payments.

- Managed tax audits, assessments, and information requests when needed.

- Assisted in budgeting and forecasting for all tax-related matters.

- Identified potential tax planning and savings strategies.

- Controlled costs and prepared relevant reports.

- Managed accounting and controlling of tangible and intangible non-current assets.

Senior Tax Accountant Resume Example

Senior Tax Accountant

- Thoroughly review and prepare federal and state tax compliance for corporate and individual clients.

- Develop tax plans and projections for clients, ensuring optimal tax strategies are in place.

- Conduct in-depth research on complex taxation issues and present findings to firm leadership and clients for informed decision-making.

- Oversee and direct the workflow, while supervising and evaluating staff assigned to in-charge engagements.

- Provide financial statement audit, compilation, and review services for non-audit clients.

- Skillfully manage multiple clients and engagements, delivering high-quality value-added services within designated timelines and budgets.

- Foster strong client relationships, ensuring their needs are met and exceeding their expectations.

- Stay updated with the latest tax laws and regulations to offer expert guidance and advice to clients.

Senior Tax Accountant Resume Example

Senior Tax Accountant

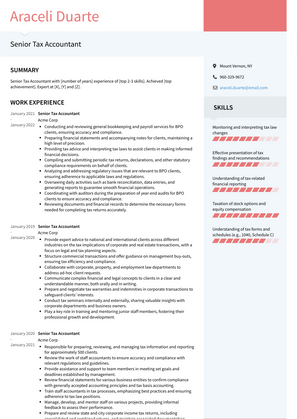

- Conducting and reviewing general bookkeeping and payroll services for BPO clients, ensuring accuracy and compliance.

- Preparing financial statements and accompanying notes for clients, maintaining a high level of precision.

- Providing tax advice and interpreting tax laws to assist clients in making informed financial decisions.

- Compiling and submitting periodic tax returns, declarations, and other statutory compliance requirements on behalf of clients.

- Analyzing and addressing regulatory issues that are relevant to BPO clients, ensuring adherence to applicable laws and regulations.

- Overseeing daily activities such as bank reconciliation, data entries, and generating reports to guarantee smooth financial operations.

- Coordinating with auditors during the preparation of year-end audits for BPO clients to ensure accuracy and compliance.

- Reviewing documents and financial records to determine the necessary forms needed for completing tax returns accurately.

Senior Tax Accountant Resume Example

Senior Tax Accountant

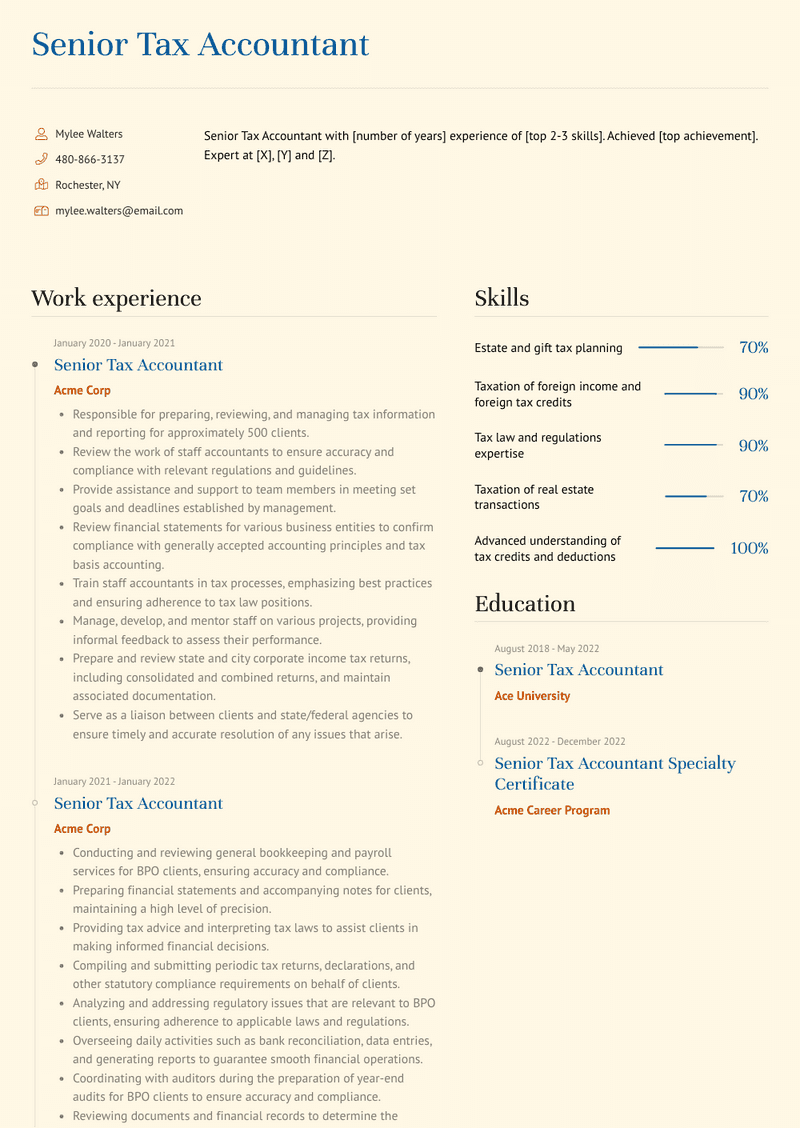

- Responsible for preparing, reviewing, and managing tax information and reporting for approximately 500 clients.

- Review the work of staff accountants to ensure accuracy and compliance with relevant regulations and guidelines.

- Provide assistance and support to team members in meeting set goals and deadlines established by management.

- Review financial statements for various business entities to confirm compliance with generally accepted accounting principles and tax basis accounting.

- Train staff accountants in tax processes, emphasizing best practices and ensuring adherence to tax law positions.

- Manage, develop, and mentor staff on various projects, providing informal feedback to assess their performance.

- Prepare and review state and city corporate income tax returns, including consolidated and combined returns, and maintain associated documentation.

- Serve as a liaison between clients and state/federal agencies to ensure timely and accurate resolution of any issues that arise.

Senior Tax Accountant Resume Example

Senior Tax Accountant

- Provide expert advice to national and international clients across different industries on the tax implications of corporate and real estate transactions, with a focus on legal and tax planning aspects.

- Structure commercial transactions and offer guidance on management buy-outs, ensuring tax efficiency and compliance.

- Collaborate with corporate, property, and employment law departments to address ad-hoc client requests.

- Communicate complex financial and legal concepts to clients in a clear and understandable manner, both orally and in writing.

- Prepare and negotiate tax warranties and indemnities in corporate transactions to safeguard clients' interests.

- Conduct tax seminars internally and externally, sharing valuable insights with corporate departments and business owners.

- Play a key role in training and mentoring junior staff members, fostering their professional growth and development.

Top Senior Tax Accountant Resume Skills for 2023

- Tax law and regulations expertise

- Income tax preparation for individuals and businesses

- Tax planning and strategies

- Tax compliance and reporting

- Knowledge of federal, state, and local tax codes

- Advanced understanding of tax credits and deductions

- Tax research and analysis

- Taxation of investments and capital gains

- Knowledge of tax accounting principles

- Taxation for different types of entities (e.g., corporations, partnerships)

- Handling complex tax returns

- Multi-state and international tax knowledge

- Tax implications of mergers and acquisitions

- Corporate tax provision and ASC 740 compliance

- Tax audit assistance and representation

- IRS guidelines and requirements

- Tax-exempt organizations and filings

- Transfer pricing and intercompany transactions

- Estate and gift tax planning

- Taxation of employee benefits

- Taxation of real estate transactions

- Taxation of foreign income and foreign tax credits

- Tax implications of retirement planning

- Taxation of stock options and equity compensation

- Research and development tax credits

- Compliance with tax deadlines and extensions

- Tax return review and accuracy checks

- Knowledge of tax software (e.g., TurboTax, TaxAct)

- Understanding of tax forms and schedules (e.g., 1040, Schedule C)

- Handling amended tax returns and corrections

- Tax implications of business expenses and deductions

- Adapting to changes in tax laws and regulations

- Familiarity with international tax treaties

- Tax analysis for financial planning and forecasting

- Monitoring and interpreting tax law changes

- Experience with tax preparation software and systems

- Understanding of tax-related financial reporting

- Communication and collaboration with clients and stakeholders

- Effective presentation of tax findings and recommendations

- Working with tax authorities on behalf of clients

- Tax strategy development and implementation

- Analyzing and interpreting tax-related data

- Managing tax documentation and records

- Identifying tax planning opportunities

- Applying tax research to specific client situations

- Providing tax advice and guidance to clients

- Coordinating with other accounting and finance teams

- Managing and mentoring junior tax accountants

How Long Should my Senior Tax Accountant Resume be?

Your Senior Tax Accountant resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Senior Tax Accountant, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2025 Workstory Inc.