Property Claims Adjuster Resume Examples and Templates

This page provides you with Property Claims Adjuster resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Property Claims Adjuster resume.

What do Hiring Managers look for in a Property Claims Adjuster Resume

- Insurance Knowledge: Strong understanding of insurance policies, coverage, and claims processes.

- Analytical Skills: The ability to assess property damage, evaluate claims, and determine coverage eligibility.

- Communication Skills: Effective communication, both written and verbal, to interact with policyholders, contractors, and other stakeholders.

- Negotiation Skills: Proficiency in negotiating claim settlements and handling disputes with policyholders.

- Attention to Detail: Meticulousness in documenting and reviewing claims information, ensuring accuracy in assessments and settlements.

How to Write a Property Claims Adjuster Resume?

To write a professional Property Claims Adjuster resume, follow these steps:

- Select the right Property Claims Adjuster resume template.

- Write a professional summary at the top explaining your Property Claims Adjuster’s experience and achievements.

- Follow the STAR method while writing your Property Claims Adjuster resume’s work experience. Show what you were responsible for and what you achieved as a Property Claims Adjuster.

- List your top Property Claims Adjuster skills in a separate skills section.

How to Write Your Property Claims Adjuster Resume Header?

Write the perfect Property Claims Adjuster resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Property Claims Adjuster job title to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Property Claims Adjuster resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Property Claims Adjuster Resume Example - Header Section

Leila 7704 Clay St. Huntley, IL 60142 Marital Status: Married, email: cooldude2022@gmail.com

Good Property Claims Adjuster Resume Example - Header Section

Leila Sherman, Huntley, IL, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Property Claims Adjuster email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Property Claims Adjuster Resume Summary?

Use this template to write the best Property Claims Adjuster resume summary: Property Claims Adjuster with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Property Claims Adjuster Resume Experience Section?

Here’s how you can write a job winning Property Claims Adjuster resume experience section:

- Write your Property Claims Adjuster work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Property Claims Adjuster work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Property Claims Adjuster).

- Use action verbs in your bullet points.

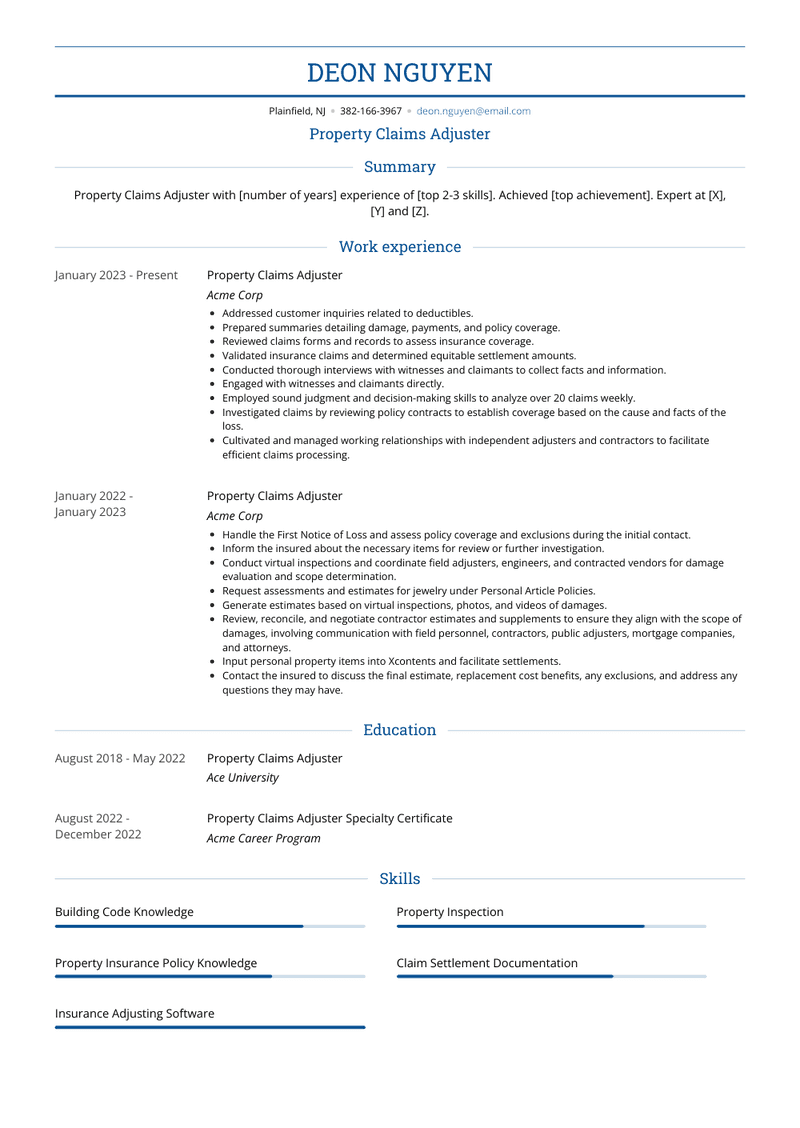

Property Claims Adjuster Resume Example

Property Claims Adjuster

- Addressed customer inquiries related to deductibles.

- Prepared summaries detailing damage, payments, and policy coverage.

- Reviewed claims forms and records to assess insurance coverage.

- Validated insurance claims and determined equitable settlement amounts.

- Conducted thorough interviews with witnesses and claimants to collect facts and information.

- Engaged with witnesses and claimants directly.

- Employed sound judgment and decision-making skills to analyze over 20 claims weekly.

- Investigated claims by reviewing policy contracts to establish coverage based on the cause and facts of the loss.

- Cultivated and managed working relationships with independent adjusters and contractors to facilitate efficient claims processing.

Property Claims Adjuster Resume Example

Property Claims Adjuster

- Handle the First Notice of Loss and assess policy coverage and exclusions during the initial contact.

- Inform the insured about the necessary items for review or further investigation.

- Conduct virtual inspections and coordinate field adjusters, engineers, and contracted vendors for damage evaluation and scope determination.

- Request assessments and estimates for jewelry under Personal Article Policies.

- Generate estimates based on virtual inspections, photos, and videos of damages.

- Review, reconcile, and negotiate contractor estimates and supplements to ensure they align with the scope of damages, involving communication with field personnel, contractors, public adjusters, mortgage companies, and attorneys.

- Input personal property items into Xcontents and facilitate settlements.

- Contact the insured to discuss the final estimate, replacement cost benefits, any exclusions, and address any questions they may have.

Top Property Claims Adjuster Resume Skills for 2023

- Property Insurance Policy Knowledge

- Claims Assessment

- Property Damage Evaluation

- Claims Investigation

- Policy Interpretation

- Risk Assessment

- Loss Estimation

- Insurance Adjusting Software

- Damage Documentation

- Claims Coding

- Claims Report Writing

- Claims Settlement Negotiation

- Damage Appraisal

- Claims Fraud Detection

- Claims Documentation Management

- Subrogation

- Liability Assessment

- Coverage Determination

- Claims Handling Best Practices

- Claims Adjustment Guidelines

- Customer Service

- Claims Process Optimization

- Claims Dispute Resolution

- Catastrophe Claims

- Claims Data Analysis

- Property Claims Software (e.g., Xactimate)

- Building Code Knowledge

- Insurance Regulations

- Claims Reporting

- Claims Metrics Analysis

- Claims Quality Assurance

- Claims Workflow Management

- Claims Adjuster Communication

- Settlement Calculation

- Insurance Law and Regulations

- Property Inspection

- Weather and Natural Disaster Assessment

- Claims Payment Processing

- Claims Adjuster Ethics

- Damage Assessment Tools

- Claims Recordkeeping

- Claims Fraud Prevention

- Claim Settlement Documentation

- Claims Arbitration

- Emergency Response Coordination

- Claims Negotiation

- Property Claims Review

- Property Claims Audit Procedures

- Property Claims Data Privacy and Security

- Property Claims Documentation Audit

How Long Should my Property Claims Adjuster Resume be?

Your Property Claims Adjuster resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Property Claims Adjuster, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2024 Workstory Inc.