3+ Payroll Administrator Resume Examples and Templates

This page provides you with Payroll Administrator resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Payroll Administrator resume.

What Do Hiring Managers Look for in a Payroll Administrator Resume

- Proficient in managing payroll processes, including calculating employee wages, deductions, and taxes.

- Strong knowledge of payroll systems, employment laws, and regulatory compliance.

- Skilled in processing payroll accurately and in a timely manner.

- Ability to generate and distribute payroll reports, pay stubs, and tax forms.

- Proficiency in resolving payroll discrepancies, addressing employee inquiries, and maintaining payroll records.

How to Write a Payroll Administrator Resume?

To write a professional Payroll Administrator resume, follow these steps:

- Select the right Payroll Administrator resume template.

- Write a professional summary at the top explaining your Payroll Administrator’s experience and achievements.

- Follow the STAR method while writing your Payroll Administrator resume’s work experience. Show what you were responsible for and what you achieved as a Payroll Administrator.

- List your top Payroll Administrator skills in a separate skills section.

How to Write Your Payroll Administrator Resume Header?

Write the perfect Payroll Administrator resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Payroll Administration position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Payroll Administrator resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Payroll Administrator Resume Example - Header Section

Belinda 308 E. Homewood Lane Westford, MA 01886 Marital Status: Married, email: cooldude2022@gmail.com

Good Payroll Administrator Resume Example - Header Section

Belinda Thompson, Westford, MA, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Payroll Administrator email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Payroll Administrator Resume Summary?

Use this template to write the best Payroll Administrator resume summary: Payroll Administrator with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Payroll Administrator Resume Experience Section?

Here’s how you can write a job winning Payroll Administrator resume experience section:

- Write your Payroll Administrator work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Payroll Administrator work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Payroll Administrator).

- Use action verbs in your bullet points.

Payroll Administrator Resume Example

Payroll Administrator

- Ensured all documents submitted to time and attendance were signed by supervisors and department heads.

- Addressed employee queries and ensured compliance with statutory laws and company policies regarding overtimes.

- Prepared monthly journals accurately for posting into the Sun system from the VIP Payroll system.

- Reviewed shift cycles with time and attendance clerks to ensure proper shift differentials and Sunday bonuses were uploaded into the payroll system.

- Conducted follow-ups with department heads, supervisors, and HR regarding absences, excessive overtime, and policy adherence.

- Supervised the work of time and attendance clerks, overseeing the capturing of overtimes and configuring new employees in the Jarrison Time Software (Timesheets system).

- Managed access control for employees and visitors to the plant using Gallagher Software (clocking system).

- Created shift cycles, filed leave forms, and captured overtimes using Jarrison Time Software.

- Prepared payroll reports from the clocking system, including overtime calculations for employees working 12-hour shifts, backshift overtime for employees on 10.5-hour shifts, and AWOP (Absent Without Official Permission) reports.

Payroll Administrator Resume Example

Payroll Administrator

- Resolved contractor enquiries via telephone and email, providing prompt and accurate responses.

- Assessed and processed Statutory Sick Pay (SSP), Statutory Maternity Pay (SMP), and Statutory Paternity Pay (SPP), issuing SSP1 forms when applicable.

- Generated and submitted BACS (Bankers' Automated Clearing Services) and FPS (Full Payment Submission) payments.

- Reconciled incoming payments against invoices to ensure accuracy and consistency.

- Processed company benefits, such as bonuses, annual leave, business mileage, and reimbursed expenses.

- Created employment letters and job references for contractors as needed.

- Calculated and deducted Attachment of Earnings Orders (AEO), Deductions from Earnings Orders (DEA), and child maintenance payments.

- Handled P45 and P60 processing and issued statement of earnings for CIS workers in compliance with regulatory requirements.

HR and Payroll Administrator Resume Example

HR and Payroll Administrator

- Developed and implemented Blue-Collar and White-Collar Development Programs on SuccessFactors LMS, utilizing blended learning approaches.

- Designed and launched a Mental Health at Work platform, including posters, leaflets, how-to guides for managers, and top tips for working from home, to support employees and management.

- Involved in absence management and employee relations activities, tracking ER cases, completing Occupational Health referrals, assisting with absence reviews, preparing outcome letters, and participating in disciplinary and grievance meetings. Also experienced in minute-taking for these meetings.

- Provided comprehensive support to employees and management, whether face-to-face, virtual, over the phone, or via email, on HR policies and procedures.

- Extensive experience managing blue and white-collar employees across multiple sites, including agency workers and trade union involvement.

- Led HR digital transformation as the SAP SuccessFactors Lead in the UK and served as a global key user.

- Successfully project managed the migration of eRecruiter to SAP SuccessFactors Recruiting for the UK and Italy.

- Implemented SAP SuccessFactors LMS (Learning Management System) in the UK, including system creation and maintenance.

Staff Accountant/Payroll Administrator Resume Example

Staff Accountant/Payroll Administrator

- Conducted daily bank reconciliations, ensuring accuracy and identifying any discrepancies between bank statements and merchant account statements for American Express and MasterCard/Visa transactions.

- Handled the processing of patient and insurance refunds, ensuring timely and accurate refund transactions.

- Assisted with accounts payable (A/P) invoice coding and check printing, maintaining organized records of payment transactions.

- Managed timesheet adjustments and maintained accurate records of salaried employees' paid time off (PTO) balances.

- Acted as a co-administrator for the company's 401K retirement plan, assisting with employee enrollments, contributions, and related administrative tasks.

Payroll Administrator Resume Example

Payroll Administrator

- Managing electronic timekeeping systems or collecting and reviewing manual timesheets to accurately track employees' worked hours.

- Providing information and addressing employee inquiries regarding payroll-related matters, such as pay rates, deductions, and benefits.

- Calculating payable hours, commissions, bonuses, tax withholdings, and deductions based on company policies and applicable laws.

- Preparing and distributing earnings statements to employees, detailing their earnings, deductions, and net pay.

- Issuing paychecks or managing direct deposit processes to ensure timely and accurate payment to employees.

- Maintaining accurate and up-to-date employee records, including personal information, tax forms, and payroll-related documents.

- Providing administrative support to the accounting department, including data entry, record-keeping, and generating reports.

- Collaborating with the HR department to ensure accurate and consistent employee data, such as salary changes, new hires, and terminations, for payroll processing.

Payroll Administrator Resume Example

Payroll Administrator

- Preparing tax-related documentation for clients, ensuring accuracy and compliance with relevant regulations.

- Filing documents and maintaining organized records for easy retrieval and reference.

- Compiling and preparing monthly payroll documentation to be submitted to the Finance Department for processing.

- Conducting quality checks on payroll data and related documentation to identify and resolve any discrepancies or errors.

- Implemented Standard Operating Procedures to streamline the payroll process, improving efficiency and reducing errors.

- Verifying records and attendance of students to ensure accuracy in attendance tracking and reporting.

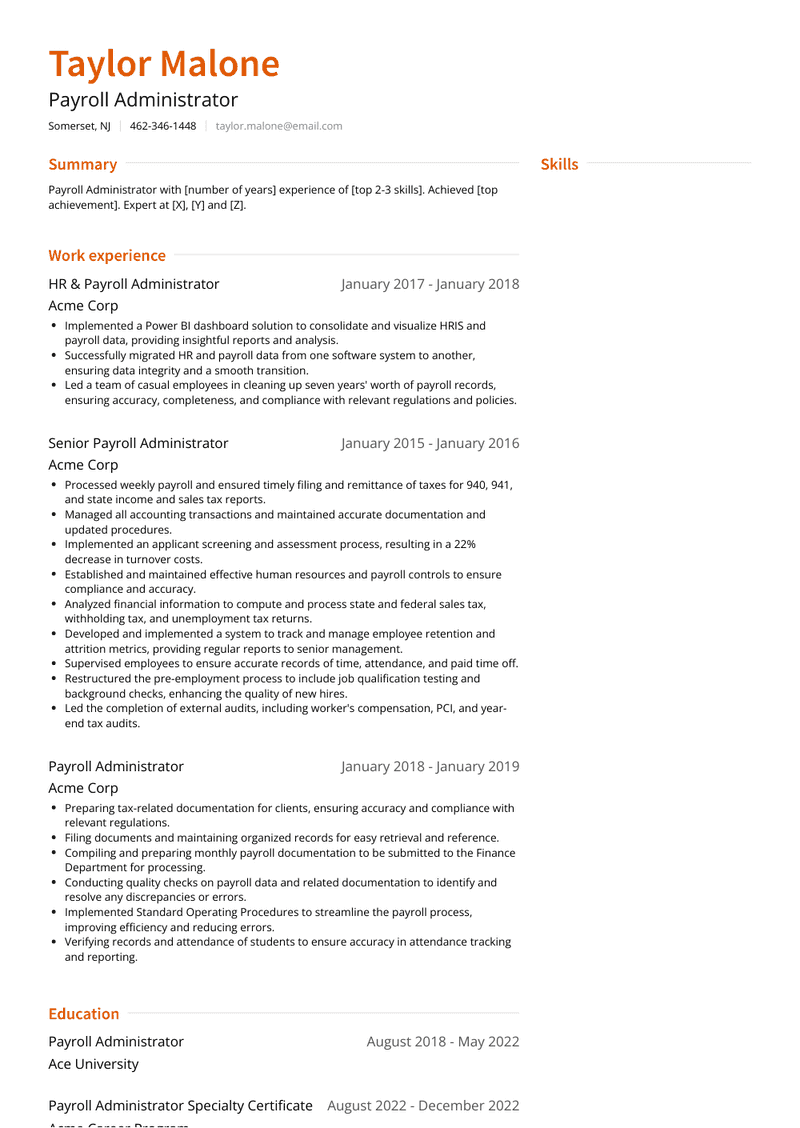

HR & Payroll Administrator Resume Example

HR & Payroll Administrator

- Implemented a Power BI dashboard solution to consolidate and visualize HRIS and payroll data, providing insightful reports and analysis.

- Successfully migrated HR and payroll data from one software system to another, ensuring data integrity and a smooth transition.

- Led a team of casual employees in cleaning up seven years' worth of payroll records, ensuring accuracy, completeness, and compliance with relevant regulations and policies.

HR/Payroll administrator Resume Example

HR/Payroll administrator

- Resolving payroll discrepancies and addressing any issues or concerns raised by employees.

- Maintaining accurate and up-to-date employee records, including personal information, tax withholding forms, and direct deposit details.

- Coordinating with the HR department to ensure correct employee data is used for payroll processing.

- Providing administrative assistance to the accounting department, such as reconciling payroll accounts and assisting with financial reporting.

- Fostering communication and compliance between various departments of the company as it pertains to payroll administration.

- Creating and updating company and employee records in accordance with federal, state, and local guidelines.

- Ensuring all payroll transactions are processed efficiently and accurately, including timely submission of payroll taxes and filings.

- Managing electronic timekeeping systems or manually collecting and reviewing timesheets to accurately record employee work hours.

- Calculating payable hours, commissions, and deductions based on employee timesheets and company policies.

- Preparing and issuing earnings statements to employees, providing a breakdown of their earnings and deductions.

Senior Payroll Administrator Resume Example

Senior Payroll Administrator

- Processed weekly payroll and ensured timely filing and remittance of taxes for 940, 941, and state income and sales tax reports.

- Managed all accounting transactions and maintained accurate documentation and updated procedures.

- Implemented an applicant screening and assessment process, resulting in a 22% decrease in turnover costs.

- Established and maintained effective human resources and payroll controls to ensure compliance and accuracy.

- Analyzed financial information to compute and process state and federal sales tax, withholding tax, and unemployment tax returns.

- Developed and implemented a system to track and manage employee retention and attrition metrics, providing regular reports to senior management.

- Supervised employees to ensure accurate records of time, attendance, and paid time off.

- Restructured the pre-employment process to include job qualification testing and background checks, enhancing the quality of new hires.

- Led the completion of external audits, including worker's compensation, PCI, and year-end tax audits.

Payroll Administrator Resume Example

Payroll Administrator

- Complete and submit verification of employments.

- Facilitate onboarding and terminations.

- Process unemployment claims.

- Perform weekly payroll for multiple stores.

- Benefit and 401k administration.

Top Payroll Administrator Resume Skills for 2023

- Knowledge of payroll processes and regulations

- Understanding of payroll software and systems

- Calculation and processing of employee wages and salaries

- Knowledge of payroll tax laws and compliance

- Familiarity with payroll deductions and withholdings

- Ability to maintain accurate employee records and payroll data

- Preparation and distribution of paychecks or direct deposits

- Understanding of wage and hour laws and regulations

- Calculation and processing of payroll adjustments (e.g., overtime, bonuses)

- Knowledge of payroll reporting and record-keeping requirements

- Familiarity with payroll benefits administration (e.g., health insurance, retirement plans)

- Ability to handle payroll inquiries and resolve employee issues

- Understanding of payroll auditing and reconciliation processes

- Compliance with payroll confidentiality and data protection regulations

- Knowledge of multi-state payroll processing and taxation

- Familiarity with payroll garnishments and deductions (e.g., child support, tax levies)

- Ability to stay updated on payroll legislation and regulatory changes

- Understanding of payroll accruals and liabilities

- Calculation and reporting of payroll taxes (e.g., federal, state, local)

- Knowledge of payroll year-end processes and reporting (e.g., W-2, 1099)

- Familiarity with electronic payroll processing and timekeeping systems

- Ability to handle payroll disputes and resolve discrepancies

- Understanding of payroll cost allocation and distribution

- Calculation and processing of payroll adjustments (e.g., retroactive pay, wage increases)

- Knowledge of payroll auditing and internal controls

- Familiarity with payroll budgeting and forecasting

- Ability to generate payroll reports and analytics

- Understanding of payroll reconciliation and general ledger entries

- Compliance with payroll tax deposit and filing deadlines

- Knowledge of payroll garnishment orders and compliance

- Familiarity with payroll accrual accounting principles

- Ability to handle payroll-related inquiries from government agencies (e.g., IRS, DOL)

- Understanding of payroll best practices and industry trends

- Calculation and processing of payroll for hourly, salaried, and commissioned employees

- Knowledge of payroll integration with other HR systems (e.g., time and attendance)

- Familiarity with payroll for different employment classifications (e.g., full-time, part-time, contractors)

- Ability to generate payroll-related reports for management and auditing purposes

- Understanding of payroll reconciliation and variance analysis

- Compliance with payroll-related internal and external audits

- Knowledge of payroll budget forecasting and variance analysis

How Long Should my Payroll Administrator Resume be?

Your Payroll Administrator resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Payroll Administrator, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Frequently Asked Questions (FAQs) for Payroll Administrator Resume

-

What does a Payroll Administrator do?

- A Payroll Administrator is responsible for processing payroll for employees, ensuring accurate calculation of wages, deductions, and taxes, and managing payroll-related records and documentation. They also handle inquiries from employees regarding payroll matters.

-

What qualifications are important for a Payroll Administrator position?

- Qualifications typically include a bachelor's degree in accounting, finance, business administration, or a related field. Professional certifications such as Certified Payroll Professional (CPP) or Fundamental Payroll Certification (FPC) may be preferred. Strong attention to detail and knowledge of payroll software are essential.

-

What kind of experience should a Payroll Administrator highlight on their resume?

- Experience in payroll processing, including calculating wages, withholding taxes, and issuing paychecks or direct deposits, is crucial for a Payroll Administrator. Highlighting proficiency in payroll software, resolving payroll discrepancies, and ensuring compliance with relevant laws and regulations is important.

-

How important is it for a Payroll Administrator to demonstrate attention to detail on their resume?

- Attention to detail is critical for a Payroll Administrator as they are responsible for accurately processing payroll data and ensuring compliance with legal and regulatory requirements. Highlighting experience in identifying errors, reconciling discrepancies, and maintaining precise records is essential.

-

Should a Payroll Administrator include their experience with payroll tax filings on their resume?

- Yes, mentioning experience with payroll tax filings, including preparing and submitting payroll tax returns, W-2 forms, and other tax-related documentation, can demonstrate the Administrator's understanding of tax compliance and reporting requirements.

-

What soft skills are important for a Payroll Administrator to highlight on their resume?

- Soft skills such as communication, organization, time management, problem-solving, and confidentiality are crucial for a Payroll Administrator. These skills contribute to effectively managing payroll processes, resolving employee inquiries, and maintaining confidentiality of sensitive information.

-

Is it necessary for a Payroll Administrator to mention their experience with benefits administration on their resume?

- Yes, mentioning experience with benefits administration, including managing employee benefits deductions, enrollments, and changes, can demonstrate the Administrator's understanding of the interconnectedness between payroll and employee benefits.

-

How should a Payroll Administrator tailor their resume for different industries?

- A Payroll Administrator should highlight experience and skills relevant to the specific industry they are applying to, whether it's healthcare, manufacturing, retail, or hospitality. Emphasizing familiarity with industry-specific payroll regulations and practices can be beneficial.

-

Should a Payroll Administrator include their educational background on their resume?

- Yes, including educational background such as degrees, certifications, or relevant coursework in accounting, finance, or payroll administration is important. This provides credibility and demonstrates the foundational knowledge necessary for the role.

-

How can a Payroll Administrator make their resume visually appealing and easy to read?

- Utilizing clear headings, bullet points to highlight key skills and experiences, and a professional layout are important aspects of resume formatting. Additionally, including specific examples of successful payroll projects or process improvements can enhance the overall presentation of the resume.

Copyright ©2024 Workstory Inc.