Loan Closer Resume Examples and Templates

This page provides you with Loan Closer resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Loan Closer resume.

What do Hiring Managers look for in a Loan Closer Resume

- Attention to Detail: Precision in reviewing loan documents, ensuring accuracy and completeness in all paperwork and transactions.

- Organizational Skills: Ability to manage multiple loan files simultaneously, prioritize tasks, and meet closing deadlines.

- Knowledge of Loan Procedures: Understanding of loan closing processes, including compliance requirements, title searches, and escrow procedures.

- Communication Skills: Clear and effective communication with borrowers, lenders, and other parties involved in the loan closing process to convey information and address inquiries.

- Problem-Solving Abilities: Aptitude to identify and resolve issues that may arise during the closing process, such as discrepancies in documentation or unexpected delays.

How to Write a Loan Closer Resume?

To write a professional Loan Closer resume, follow these steps:

- Select the right Loan Closer resume template.

- Write a professional summary at the top explaining your Loan Closer’s experience and achievements.

- Follow the STAR method while writing your Loan Closer resume’s work experience. Show what you were responsible for and what you achieved as a Loan Closer.

- List your top Loan Closer skills in a separate skills section.

How to Write Your Loan Closer Resume Header?

Write the perfect Loan Closer resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Loan Closer position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Loan Closer resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Loan Closer Resume Example - Header Section

Joey 7600 W. Bay Meadows Avenue Rochester, NY 14606 Marital Status: Married, email: cooldude2022@gmail.com

Good Loan Closer Resume Example - Header Section

Joey Campos, Rochester, NY, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Loan Closer email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Loan Closer Resume Summary?

Use this template to write the best Loan Closer resume summary: Loan Closer with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Loan Closer Resume Experience Section?

Here’s how you can write a job winning Loan Closer resume experience section:

- Write your Loan Closer work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Loan Closer work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Loan Closer).

- Use action verbs in your bullet points.

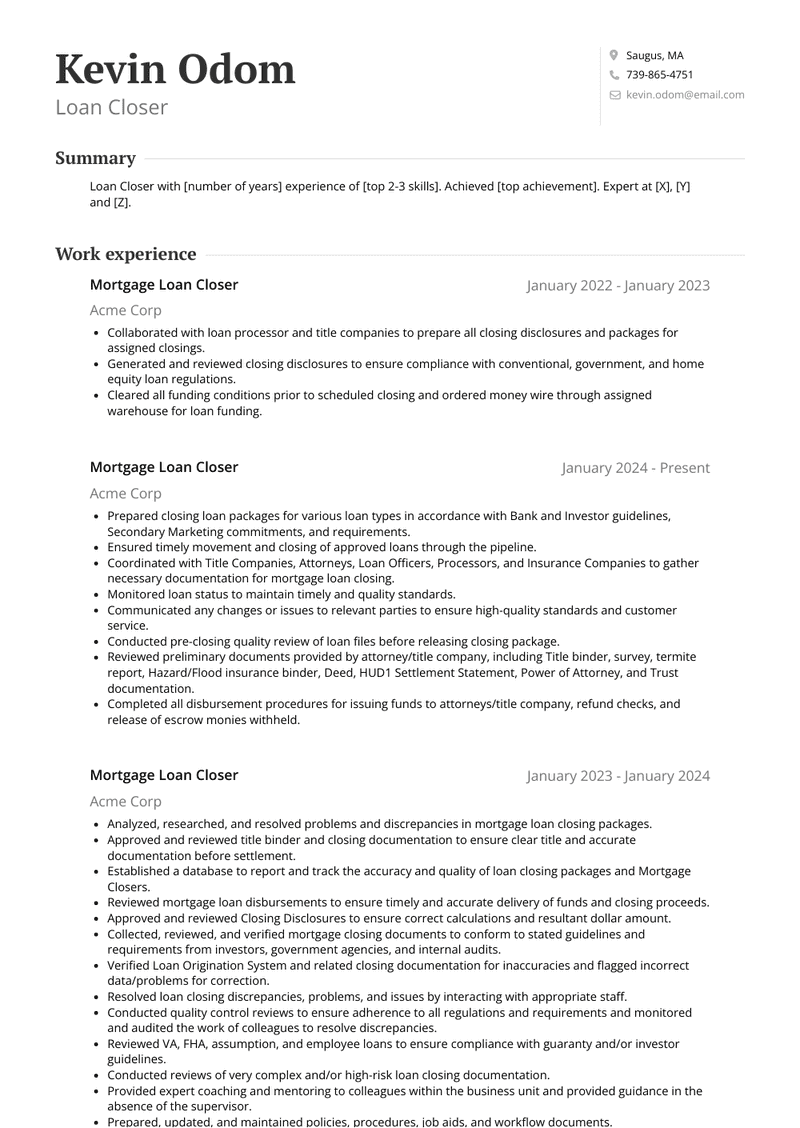

Mortgage Loan Closer Resume Example

Mortgage Loan Closer

- Prepared closing loan packages for various loan types in accordance with Bank and Investor guidelines, Secondary Marketing commitments, and requirements.

- Ensured timely movement and closing of approved loans through the pipeline.

- Coordinated with Title Companies, Attorneys, Loan Officers, Processors, and Insurance Companies to gather necessary documentation for mortgage loan closing.

- Monitored loan status to maintain timely and quality standards.

- Communicated any changes or issues to relevant parties to ensure high-quality standards and customer service.

- Conducted pre-closing quality review of loan files before releasing closing package.

- Reviewed preliminary documents provided by attorney/title company, including Title binder, survey, termite report, Hazard/Flood insurance binder, Deed, HUD1 Settlement Statement, Power of Attorney, and Trust documentation.

- Completed all disbursement procedures for issuing funds to attorneys/title company, refund checks, and release of escrow monies withheld.

Mortgage Loan Closer Resume Example

Mortgage Loan Closer

- Analyzed, researched, and resolved problems and discrepancies in mortgage loan closing packages.

- Approved and reviewed title binder and closing documentation to ensure clear title and accurate documentation before settlement.

- Established a database to report and track the accuracy and quality of loan closing packages and Mortgage Closers.

- Reviewed mortgage loan disbursements to ensure timely and accurate delivery of funds and closing proceeds.

- Approved and reviewed Closing Disclosures to ensure correct calculations and resultant dollar amount.

- Collected, reviewed, and verified mortgage closing documents to conform to stated guidelines and requirements from investors, government agencies, and internal audits.

- Verified Loan Origination System and related closing documentation for inaccuracies and flagged incorrect data/problems for correction.

- Resolved loan closing discrepancies, problems, and issues by interacting with appropriate staff.

- Conducted quality control reviews to ensure adherence to all regulations and requirements and monitored and audited the work of colleagues to resolve discrepancies.

- Reviewed VA, FHA, assumption, and employee loans to ensure compliance with guaranty and/or investor guidelines.

- Conducted reviews of very complex and/or high-risk loan closing documentation.

- Provided expert coaching and mentoring to colleagues within the business unit and provided guidance in the absence of the supervisor.

- Prepared, updated, and maintained policies, procedures, job aids, and workflow documents.

- Researched, clarified, and resolved escalated problems related to mortgage closing documents.

- Contributed to the department achieving monthly/yearly AFP.

- Acted as supervisor/manager in the incumbent's absence.

- Performed other duties as assigned.

Mortgage Loan Closer Resume Example

Mortgage Loan Closer

- Collaborated with loan processor and title companies to prepare all closing disclosures and packages for assigned closings.

- Generated and reviewed closing disclosures to ensure compliance with conventional, government, and home equity loan regulations.

- Cleared all funding conditions prior to scheduled closing and ordered money wire through assigned warehouse for loan funding.

Top Loan Closer Resume Skills for 2023

- Loan closing procedures

- Mortgage loan documentation review

- Verification of loan applicant information

- Compliance with loan regulations and guidelines

- Understanding of loan products (e.g., conventional, FHA, VA)

- Closing disclosure preparation

- Loan estimate preparation

- Title review and verification

- Property appraisal review

- Insurance verification (e.g., homeowners insurance)

- Escrow account setup and management

- Truth in Lending Act (TILA) compliance

- Real Estate Settlement Procedures Act (RESPA) compliance

- Closing document preparation (e.g., promissory notes, deeds)

- Coordination with underwriters and loan officers

- Communication with borrowers and third-party vendors

- Confirmation of loan terms and conditions

- Coordination of loan funding

- Wire transfer processing for loan funds

- Payoff statement verification

- UCC (Uniform Commercial Code) lien search

- Review of closing costs and fees

- Preparation of closing documents package

- Execution of loan documents with borrowers

- Notarization of loan documents (if applicable)

- Recording of mortgage and deed documents

- Post-closing document delivery to appropriate parties

- Quality control review of loan files

- Audit trail documentation maintenance

- Compliance audit support

- Technology proficiency for loan closing software

- Data entry accuracy in loan management systems

- File organization and management

- Record retention compliance

- Communication skills with internal teams and external parties

- Attention to detail in document review and verification

- Time management for meeting closing deadlines

- Problem-solving skills for addressing issues during the closing process

- Adaptability to changing loan guidelines and regulations

- Collaboration with legal counsel for document review (if applicable)

- Continuous learning and professional development in loan closing procedures

- Vendor management for title companies and settlement agents

- Customer service skills for borrower inquiries

- Conflict resolution skills for resolving closing-related disputes

- Risk assessment and mitigation during the closing process

- Coordination of closing logistics (e.g., scheduling, location)

- Cash management for loan funds disbursement

- Disbursement of escrow funds

- Compliance with anti-fraud measures

How Long Should my Loan Closer Resume be?

Your Loan Closer resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Loan Closer, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2025 Workstory Inc.