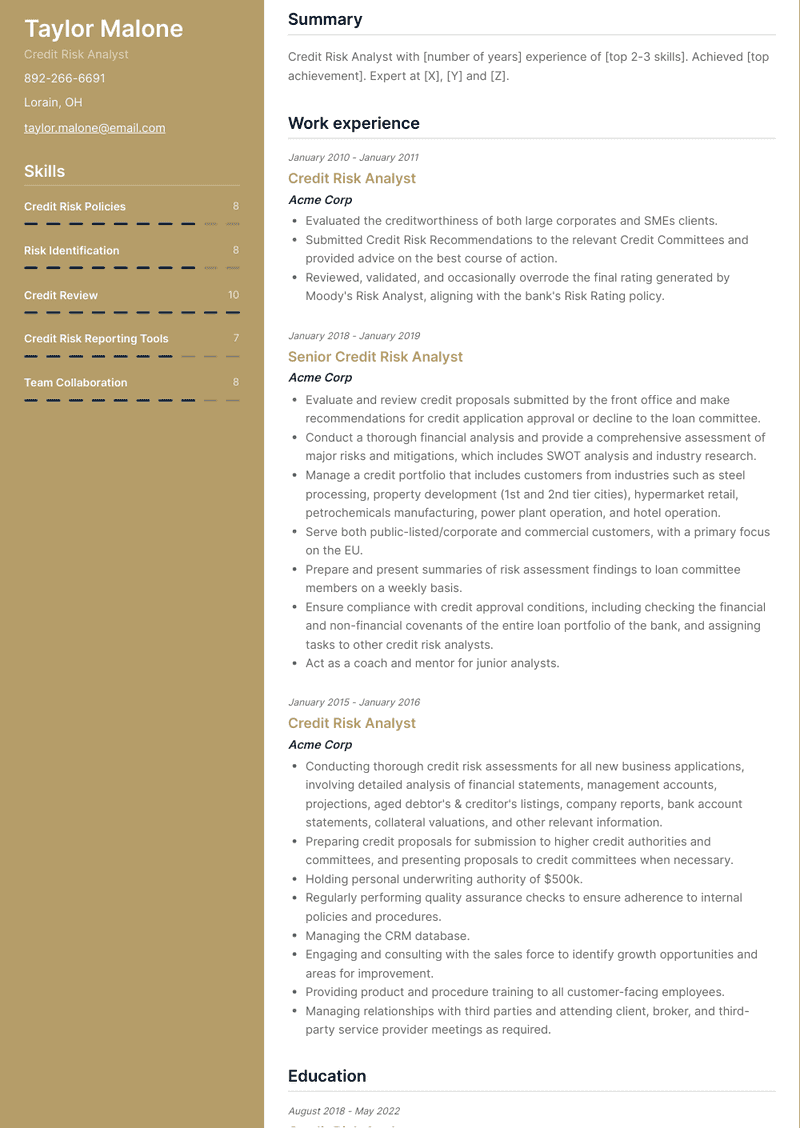

Credit Risk Analyst Resume Examples and Templates

This page provides you with Credit Risk Analyst resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Credit Risk Analyst resume.

What do Hiring Managers look for in a Credit Risk Analyst Resume

- Analytical Skills: Strong analytical abilities to assess credit risk by analyzing financial data and credit reports.

- Risk Assessment: Proficiency in evaluating the creditworthiness of individuals or businesses and making informed lending decisions.

- Financial Knowledge: A deep understanding of financial principles and lending practices.

- Attention to Detail: Meticulousness in reviewing and verifying financial documents and credit histories.

- Communication Skills: Effective communication, both written and verbal, to convey credit risk assessments to colleagues and stakeholders.

How to Write a Credit Risk Analyst Resume?

To write a professional Credit Risk Analyst resume, follow these steps:

- Select the right Credit Risk Analyst resume template.

- Write a professional summary at the top explaining your Credit Risk Analyst’s experience and achievements.

- Follow the STAR method while writing your Credit Risk Analyst resume’s work experience. Show what you were responsible for and what you achieved as a Credit Risk Analyst.

- List your top Credit Risk Analyst skills in a separate skills section.

How to Write Your Credit Risk Analyst Resume Header?

Write the perfect Credit Risk Analyst resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Credit Risk Analyst position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Credit Risk Analyst resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Credit Risk Analyst Resume Example - Header Section

Taylor 7704 Clay St. Huntley, IL 60142 Marital Status: Married, email: cooldude2022@gmail.com

Good Credit Risk Analyst Resume Example - Header Section

Taylor Malone, Huntley, IL, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Credit Risk Analyst email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Credit Risk Analyst Resume Summary?

Use this template to write the best Credit Risk Analyst resume summary: Credit Risk Analyst with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Credit Risk Analyst Resume Experience Section?

Here’s how you can write a job winning Credit Risk Analyst resume experience section:

- Write your Credit Risk Analyst work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Credit Risk Analyst work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Credit Risk Analyst).

- Use action verbs in your bullet points.

Senior Commercial Credit Risk Analyst Resume Example

Senior Commercial Credit Risk Analyst

- Offer PMO support for Programme Management.

- Provide support for AMX SteerCo.

- Coordinate Dashboard Reporting for AMX.

- Generate management reports for AMX and finance-related projects.

- Provide support for Wholesale Projects.

- Maintain the Departmental Instruction Manual (DIM).

- Take responsibility for Good Governance Initiatives for the team.

Commercial Credit Risk Analyst II Resume Example

Commercial Credit Risk Analyst II

- Performed diverse administrative duties, aiding both management and colleagues with various tasks.

- Maintained responsibility for tracking all Audit findings within Wholesale & Market Risk.

- Maintained strong interaction with Audit and CRRI.

- Reviewed various audit reports and reported findings to Senior Management.

- Regularly interacted with Senior Management.

- Assisted in employee engagement initiatives for Wholesale & Market Risk.

- Contributed to the coordination of town hall events hosted by our CCO.

- Participated in various projects.

- Coordinated dashboard reporting for Wholesale Risk.

- Reviewed monthly FTP reports for monthly certification.

- Provided support for various team members in handling access requests.

Credit Risk Analyst Resume Example

Credit Risk Analyst

- Evaluated the creditworthiness of Medium & Corporate clients through in-depth analysis of Financial Statements, the creation of Cash Flow models, and examination of qualitative factors.

- Presented a Credit Risk Recommendation to the appropriate Credit Committees and provided advice on the most suitable course of action.

Credit Risk Analyst Resume Example

Credit Risk Analyst

- Managed production follow-up from printing to pattern creation.

- Organized the clothing for fashion shows.

- Developed a concept for the new collection.

- Conducted quality control on sample production.

Credit Risk Analyst Resume Example

Credit Risk Analyst

- Evaluate and review credit proposals submitted by the front office.

- Provide recommendations for approving or declining credit applications to the loan committee.

- Conduct a detailed financial analysis and comprehensive assessment of major risks and mitigations, including SWOT analysis and industry research.

- Manage a credit portfolio consisting of customers from industries such as agricultural commodities trading, real estate development, energy, and petrochemicals trading.

- Serve both public-listed/corporate and commercial customers, with a primary focus on South East Asia.

Senior Credit Risk Analyst Resume Example

Senior Credit Risk Analyst

- Evaluate and review credit proposals submitted by the front office and make recommendations for credit application approval or decline to the loan committee.

- Conduct a thorough financial analysis and provide a comprehensive assessment of major risks and mitigations, which includes SWOT analysis and industry research.

- Manage a credit portfolio that includes customers from industries such as steel processing, property development (1st and 2nd tier cities), hypermarket retail, petrochemicals manufacturing, power plant operation, and hotel operation.

- Serve both public-listed/corporate and commercial customers, with a primary focus on the EU.

- Prepare and present summaries of risk assessment findings to loan committee members on a weekly basis.

- Ensure compliance with credit approval conditions, including checking the financial and non-financial covenants of the entire loan portfolio of the bank, and assigning tasks to other credit risk analysts.

- Act as a coach and mentor for junior analysts.

Credit Risk Analyst Resume Example

Credit Risk Analyst

- Splitting time evenly between Retail Financing Credit Risk and Property Credit Risk.

- Overseeing and enhancing the monitoring of consumer lending at Castle Trust, specifically focusing on credit risk to ensure alignment with the agreed risk appetite.

- Integrating our new Scorecard into our decision platform, updating SAS code to incorporate the new score and risk grades. Creating a dashboard to track its implementation and compare it with our previous risk grades.

- Developing meaningful Management Information (MI) using PowerBI, ensuring the provision of insightful, relevant, and accurate information along with commentary.

- Advancing credit and retailer risk strategy and policy through advanced analytics and modeling, ensuring compliance with regulations and achieving the desired outcomes for both customers and the business. For instance, writing a report proposing changes to prudent risk grade cut-offs for lending.

- Generating ad-hoc analyses and reports, with a focus on delivering insightful, relevant, and accurate information along with commentary.

- Supporting the business in its analysis of credit lifecycle value and risk.

Senior Credit Risk Analyst Resume Example

Senior Credit Risk Analyst

- Validating MIS data.

- Developing and automating new reports.

- Designing automated reports for monitoring collection management and its efficiency.

- Establishing collection objectives.

- Monitoring delinquency indicators.

- Ensuring traffic quality control and compliance with risk appetite.

- Calibrating product conditions.

- Implementing fraud prevention policies, including PEP and AML measures.

Credit Risk Analyst Resume Example

Credit Risk Analyst

- Conducting thorough credit risk assessments for all new business applications, involving detailed analysis of financial statements, management accounts, projections, aged debtor's & creditor's listings, company reports, bank account statements, collateral valuations, and other relevant information.

- Preparing credit proposals for submission to higher credit authorities and committees, and presenting proposals to credit committees when necessary.

- Holding personal underwriting authority of $500k.

- Regularly performing quality assurance checks to ensure adherence to internal policies and procedures.

- Managing the CRM database.

- Engaging and consulting with the sales force to identify growth opportunities and areas for improvement.

- Providing product and procedure training to all customer-facing employees.

- Managing relationships with third parties and attending client, broker, and third-party service provider meetings as required.

Senior Credit Risk Analyst Resume Example

Senior Credit Risk Analyst

- Responsible for conducting the credit process, which includes gathering, analyzing, and interpreting various types of credit information for existing and potential customers and portfolios. Prepare credit/rating reports and present key findings to the Head of the Risk Department and HQ for high-risk exposure groups.

- Design, establish, and implement the credit strategy for the managed portfolio.

- Evaluate credit risk, structure credit products (such as Syndicated loans, LBOs, MBOs, etc.), as well as working capital solutions, and conduct financial modeling and assessments using internal models for both existing clients and new transactions.

- Analyze, coordinate, and negotiate with various stakeholders (Relationship Managers, Compliance, Product Managers, etc.) in structured and complex operations.

- Continuously monitor the portfolio to proactively identify potential issues, thereby maximizing credit quality and minimizing the company's credit risk and potential losses.

- Prepare quarterly portfolio reports to track trends, including ratings, limits, utilization of committed and uncommitted facilities, trading lines, and guarantees.

- Oversee the review of adherence to the Group's principles, risk appetite, and policies.

- Provide support to Relationship Managers in regular meetings with senior management/founders to update data and analyze potential needs.

Credit Risk Analyst Small Caps Resume Example

Credit Risk Analyst Small Caps

- Credit risk analyst specializing in Small Caps.

- Defined key performance indicators (KPIs) to analyze credit risk production.

- Provided financial training and supported policy/strategy development for the business area.

Credit Risk Analyst Resume Example

Credit Risk Analyst

- Designed a Risk Rating Model to assess the strength of Promoters, Projects, and Proposals.

- Proposed appropriate mitigants for potential risks.

- Monitored Project Progress and performance, including construction, sales, and collections, to ensure disbursement milestones were met.

- Conducted quarterly reviews of assets to monitor quality and forecast performance.

- Analyzed micro markets to understand supply, absorption, and overhang trends, providing insights into saleability.

- Developed financial models to create cash flows for project funding requirements and loan repayment.

- Coordinated with Branch Credit and Relationship Teams, external stakeholders, Valuation agencies, and empaneled Advocates for legal and technical due diligence.

- Prepared facility proposals for management approval against funding.

Credit Risk Analyst Resume Example

Credit Risk Analyst

- Conducted credit underwriting, decisioning, and collection for MSME Unsecured Business Loan Products.

- Managed the entire process, including hygiene checks, KYC verification, policy compliance, eligibility assessment, customer interactions, and business premise verification.

- Assisted the Senior Manager in underwriting and decisioning for Unsecured Large Ticket Size loans.

- Maintained portfolio quality through regular customer interactions and post-disbursement follow-ups.

- Collaborated in developing Credit Rating Score Cards for lending products and engaged with vendors of Machine Learning-based Score Card Models.

- Participated in a market study of the lending business during the lockdown to provide real-time management updates.

- Contributed to the Credit TAT Review Committee to optimize the credit process and provide insights for technology automation in the loan processing system.

Credit Risk Analyst Resume Example

Credit Risk Analyst

- Evaluated the creditworthiness of both large corporates and SMEs clients.

- Submitted Credit Risk Recommendations to the relevant Credit Committees and provided advice on the best course of action.

- Reviewed, validated, and occasionally overrode the final rating generated by Moody's Risk Analyst, aligning with the bank's Risk Rating policy.

Lead Credit risk analyst Resume Example

Lead Credit risk analyst

- Oversaw a team of ten analysts tasked with analyzing and quantifying data and reports.

- Checked the creditworthiness and financial conditions of loan applicants and conducted underwriting analysis.

- Handled various collection and credit functions, including NPA analysis.

- Developed and automated a system to expedite the application process, resulting in increased efficiency.

Merchant Credit Risk Analyst Resume Example

Merchant Credit Risk Analyst

- Conducted comprehensive risk analyses, focusing on identifying and mitigating potential risk exposure for high-revenue client accounts, crowd-funding platforms, and charity/NGO accounts.

- Negotiated loss mitigation terms in both French and English.

- Provided merchant credit-risk training and mentoring to new hires.

- Obtained risk exposure sign-off for amounts up to 100K USD.

- Collaborated with account managers and sales teams to successfully onboard large merchants.

- Referred potential commercial leads through explosive growth analysis to the sales department.

- Ensured merchant compliance with EMEA regulatory policies.

- Effectively resolved high-profile social media escalations.

- Consistently exceeded individual KPI targets.

- Presented the team's role to senior management as required.

- Initiated a program to recognize 'Above and Beyond Efforts.'

- Identified outdated or incorrect content in client-facing correspondence and led a team to overhaul the content.

Top Credit Risk Analyst Resume Skills for 2023

- Credit Risk Analysis

- Financial Analysis

- Credit Scoring Models

- Credit Reports and Scores

- Risk Assessment

- Loan Underwriting

- Credit Policies and Procedures

- Credit Decision Making

- Data Analysis

- Financial Statement Analysis

- Credit Portfolio Management

- Loan Origination

- Credit Risk Mitigation

- Credit Risk Modeling

- Creditworthiness Evaluation

- Credit Monitoring

- Default Risk Analysis

- Credit Review

- Industry and Market Analysis

- Risk Reporting

- Regulatory Compliance

- Risk Management Software

- Loan Documentation

- Credit Limit Determination

- Financial Ratios Analysis

- Statistical Analysis

- Risk Scoring

- Loan Approval

- Credit Risk Policies

- Credit Risk Reporting Tools

- Risk Assessment Documentation

- Credit Risk Strategy

- Credit Risk Metrics Tracking

- Credit Risk Assessment Frameworks

- Risk Identification

- Problem Solving

- Communication Skills

- Time Management

- Team Collaboration

- Credit Risk Dashboards

- Portfolio Stress Testing

- Credit Risk Policy Review

- Basel III Compliance

- Credit Risk Management Tools

- Credit Loss Forecasting

- Loan Portfolio Analysis

- Credit Risk Governance

- Data Modeling

- Credit Risk Documentation

- Credit Risk Training

How Long Should my Credit Risk Analyst Resume be?

Your Credit Risk Analyst resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Credit Risk Analyst, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2024 Workstory Inc.