Credit Manager Resume Examples and Templates

This page provides you with Credit Manager resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Credit Manager resume.

What do Hiring Managers look for in a Credit Manager Resume

- Credit Analysis Skills: Strong credit analysis abilities to assess creditworthiness and make informed lending decisions.

- Risk Management: Proficiency in managing credit risk by setting credit limits, monitoring accounts, and implementing risk mitigation strategies.

- Financial Knowledge: A deep understanding of financial principles, accounting, and lending practices.

- Communication Skills: Effective communication, both written and verbal, to interact with clients, credit teams, and stakeholders.

- Leadership Abilities: The capability to lead and manage credit teams and set credit policies and procedures.

How to Write a Credit Manager Resume?

To write a professional Credit Manager resume, follow these steps:

- Select the right Credit Manager resume template.

- Write a professional summary at the top explaining your Credit Manager’s experience and achievements.

- Follow the STAR method while writing your Credit Manager resume’s work experience. Show what you were responsible for and what you achieved as a Credit Manager.

- List your top Credit Manager skills in a separate skills section.

How to Write Your Credit Manager Resume Header?

Write the perfect Credit Manager resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Credit Management to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Credit Manager resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Credit Manager Resume Example - Header Section

Arturo Miller 19 Adams Street Lorain, OH 44052 Marital Status: Married, email: cooldude2022@gmail.com

Good Credit Manager Resume Example - Header Section

Arturo Miller Miller, Lorain, OH, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Credit Manager email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Credit Manager Resume Summary?

Use this template to write the best Credit Manager resume summary: Credit Manager with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Credit Manager Resume Experience Section?

Here’s how you can write a job winning Credit Manager resume experience section:

- Write your Credit Manager work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Credit Manager work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Credit Manager).

- Use action verbs in your bullet points.

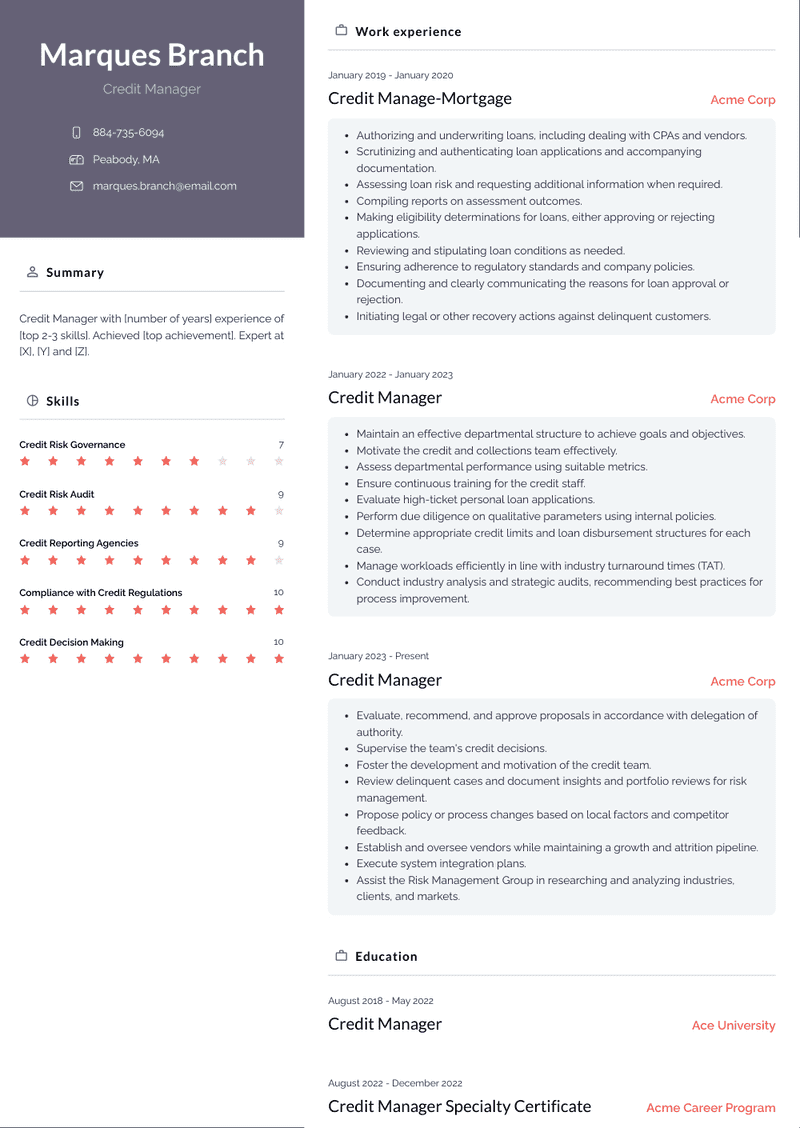

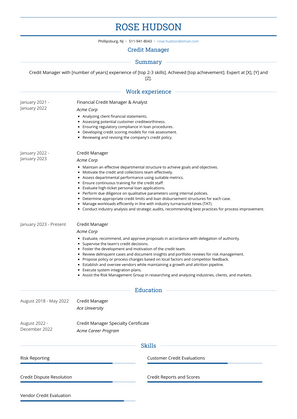

Credit Manager Resume Example

Credit Manager

- Evaluate, recommend, and approve proposals in accordance with delegation of authority.

- Supervise the team's credit decisions.

- Foster the development and motivation of the credit team.

- Review delinquent cases and document insights and portfolio reviews for risk management.

- Propose policy or process changes based on local factors and competitor feedback.

- Establish and oversee vendors while maintaining a growth and attrition pipeline.

- Execute system integration plans.

- Assist the Risk Management Group in researching and analyzing industries, clients, and markets.

Credit Manager Resume Example

Credit Manager

- Maintain an effective departmental structure to achieve goals and objectives.

- Motivate the credit and collections team effectively.

- Assess departmental performance using suitable metrics.

- Ensure continuous training for the credit staff.

- Evaluate high-ticket personal loan applications.

- Perform due diligence on qualitative parameters using internal policies.

- Determine appropriate credit limits and loan disbursement structures for each case.

- Manage workloads efficiently in line with industry turnaround times (TAT).

- Conduct industry analysis and strategic audits, recommending best practices for process improvement.

Financial Credit Manager & Analyst Resume Example

Financial Credit Manager & Analyst

- Analyzing client financial statements.

- Assessing potential customer creditworthiness.

- Ensuring regulatory compliance in loan procedures.

- Developing credit scoring models for risk assessment.

- Reviewing and revising the company's credit policy.

Credit Manager, Business Control Resume Example

Credit Manager, Business Control

- Leading the debt collection team across three regions.

- Streamlining the support tool and making changes to align with business needs.

- Supervising the credit control framework, encompassing risk profiles, treatment, and escalation processes.

- Collaborating closely with sales and sales support teams to ensure efficient funds collection.

Credit Manager-Mortgage Resume Example

Credit Manage-Mortgage

- Authorizing and underwriting loans, including dealing with CPAs and vendors.

- Scrutinizing and authenticating loan applications and accompanying documentation.

- Assessing loan risk and requesting additional information when required.

- Compiling reports on assessment outcomes.

- Making eligibility determinations for loans, either approving or rejecting applications.

- Reviewing and stipulating loan conditions as needed.

- Ensuring adherence to regulatory standards and company policies.

- Documenting and clearly communicating the reasons for loan approval or rejection.

- Initiating legal or other recovery actions against delinquent customers.

Top Credit Manager Resume Skills for 2023

- Credit Management

- Credit Analysis

- Credit Risk Assessment

- Credit Policies and Procedures

- Credit Scoring Models

- Financial Analysis

- Risk Mitigation

- Credit Decision Making

- Debt Collection

- Credit Underwriting

- Credit Reports and Scores

- Loan Portfolio Management

- Credit Limit Determination

- Credit Monitoring

- Compliance with Credit Regulations

- Credit Reporting Agencies

- Customer Credit Evaluations

- Creditworthiness Assessment

- Credit Documentation

- Credit Policies Review

- Credit Risk Identification

- Credit Risk Reporting

- Credit Monitoring Systems

- Debt Recovery Strategies

- Credit Risk Models

- Risk Reporting

- Credit Risk Metrics Tracking

- Vendor Credit Evaluation

- Legal Knowledge (pertaining to credit)

- Communication Skills

- Leadership Skills

- Problem Solving

- Time Management

- Attention to Detail

- Team Collaboration

- Negotiation Skills

- Credit Risk Management Tools

- Credit Risk Governance

- Customer Relationship Management

- Credit Risk Documentation

- Credit Risk Training

- Credit Risk Policy Development

- Credit Risk Policy Enforcement

- Debt Restructuring

- Credit Score Improvement Strategies

- Credit Dispute Resolution

- Credit Risk Audit

- Credit Portfolio Analysis

- Credit Loss Forecasting

- Credit Risk Strategy Development

How Long Should my Credit Manager Resume be?

Your Credit Manager resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Credit Manager, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

How can I highlight my experience in credit management on a Credit Manager resume?

To highlight your credit management experience, focus on your ability to assess creditworthiness, manage risk, and oversee the collection of outstanding debts. Include examples of how you’ve worked with credit policies, monitored credit limits, and analyzed financial data to make credit decisions. Mention any experience in reducing delinquency rates, managing a team, or improving credit approval processes.

What are the key skills to feature on a Credit Manager resume?

Key skills to feature include credit analysis, risk management, financial reporting, and customer relationship management. Additionally, highlight your experience with credit scoring models, your ability to negotiate payment terms, and proficiency with accounting or credit management software like SAP or QuickBooks. Emphasize your attention to detail, problem-solving abilities, and knowledge of credit policies and regulations.

How do I demonstrate my ability to manage credit risk on a resume?

Demonstrate your ability to manage credit risk by providing examples of how you’ve assessed the creditworthiness of clients, set credit limits, and implemented risk mitigation strategies. Mention any success in reducing the risk of bad debt or improving the company’s cash flow through effective credit management. Highlight your role in ensuring compliance with internal credit policies and industry regulations.

Should I include metrics on my Credit Manager resume? If so, what kind?

Yes, including metrics is important to quantify your impact. For example, you could mention the reduction in delinquency rates, the percentage of accounts you managed that stayed within credit limits, or the amount of revenue you helped protect through effective credit management. Metrics such as improvements in collections or reduced write-offs provide tangible evidence of your effectiveness as a Credit Manager.

How can I showcase my experience with credit policies on my resume?

You can showcase your experience with credit policies by detailing how you’ve developed, implemented, or enforced credit policies within an organization. Mention any involvement in creating or revising policies to mitigate risk, improve cash flow, or streamline credit approvals. Highlight your ability to align credit policies with business objectives and ensure compliance with legal and regulatory requirements.

What kind of achievements should I highlight as a Credit Manager?

Highlight achievements such as reducing delinquency rates, improving the efficiency of the credit approval process, or increasing collections. You could also mention any recognition you received for reducing bad debt, improving customer payment behaviors, or implementing new credit risk assessment tools. Achievements that demonstrate your ability to protect company assets, optimize cash flow, and manage credit risk are particularly valuable.

How do I address a lack of formal credit management experience on a Credit Manager resume?

If you lack formal credit management experience, focus on transferable skills such as financial analysis, risk assessment, and customer relationship management. Mention any relevant experience you have in accounting, collections, or finance roles where you handled credit-related tasks. Highlight your attention to detail, your analytical abilities, and your eagerness to develop credit management skills.

How important is experience with credit scoring models for a Credit Manager role?

Experience with credit scoring models is highly important for a Credit Manager, as it helps you assess credit risk more accurately. Highlight your familiarity with common scoring models like FICO or VantageScore and mention any experience using these models to make informed credit decisions. If applicable, discuss any role you’ve had in implementing or customizing credit scoring tools to meet your organization’s needs.

How do I demonstrate my ability to work with cross-functional teams on my resume?

Demonstrate your ability to work with cross-functional teams by describing how you’ve collaborated with sales, finance, or collections departments to align credit decisions with business goals. Mention any examples of how you’ve communicated credit policies, resolved credit disputes, or ensured smooth operations between departments. Highlight your communication skills, ability to work under pressure, and your role in ensuring that credit decisions support broader business objectives.

Should I include certifications on my Credit Manager resume?

Yes, including certifications can enhance your resume by demonstrating your qualifications and commitment to professional development. Certifications such as Certified Credit Executive (CCE), Certified Credit Professional (CCP), or Certified Risk Manager (CRM) can add significant value to your resume and make you stand out to potential employers.

-

How can I highlight my experience in credit management on a Credit Manager resume?

-

What are the key skills to feature on a Credit Manager resume?

-

How do I demonstrate my ability to manage credit risk on a resume?

-

Should I include metrics on my Credit Manager resume? If so, what kind?

-

How can I showcase my experience with credit policies on my resume?

-

What kind of achievements should I highlight as a Credit Manager?

-

How do I address a lack of formal credit management experience on a Credit Manager resume?

-

How important is experience with credit scoring models for a Credit Manager role?

-

How do I demonstrate my ability to work with cross-functional teams on my resume?

-

Should I include certifications on my Credit Manager resume?

Copyright ©2025 Workstory Inc.