Consumer Loan Underwriter Resume Examples and Templates

This page provides you with Consumer Loan Underwriter resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Consumer Loan Underwriter resume.

What do Hiring Managers look for in a Consumer Loan Underwriter Resume

- Credit Analysis: Proficiency in assessing creditworthiness and evaluating loan applications.

- Regulatory Knowledge: Understanding of lending regulations and compliance requirements.

- Attention to Detail: Strong focus on reviewing and analyzing financial documents and credit reports accurately.

- Communication Skills: Effective communication and interpersonal abilities for interacting with applicants and colleagues.

- Risk Assessment: Capacity to identify and manage loan risks, including default probabilities and loan terms.

How to Write a Consumer Loan Underwriter Resume?

To write a professional Consumer Loan Underwriter resume, follow these steps:

- Select the right Consumer Loan Underwriter resume template.

- Write a professional summary at the top explaining your Consumer Loan Underwriter’s experience and achievements.

- Follow the STAR method while writing your Consumer Loan Underwriter resume’s work experience. Show what you were responsible for and what you achieved as a Consumer Loan Underwriter.

- List your top Consumer Loan Underwriter skills in a separate skills section.

How to Write Your Consumer Loan Underwriter Resume Header?

Write the perfect Consumer Loan Underwriter resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Consumer Loan Underwriter position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Consumer Loan Underwriter resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Consumer Loan Underwriter Resume Example - Header Section

Valentin 9 W. Wakehurst St. Mount Vernon, NY 10550 Marital Status: Married, email: cooldude2022@gmail.com

Good Consumer Loan Underwriter Resume Example - Header Section

Valentin Ross, Mount Vernon, NY, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Consumer Loan Underwriter email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Consumer Loan Underwriter Resume Summary?

Use this template to write the best Consumer Loan Underwriter resume summary: Consumer Loan Underwriter with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Consumer Loan Underwriter Resume Experience Section?

Here’s how you can write a job winning Consumer Loan Underwriter resume experience section:

- Write your Consumer Loan Underwriter work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Consumer Loan Underwriter work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Consumer Loan Underwriter).

- Use action verbs in your bullet points.

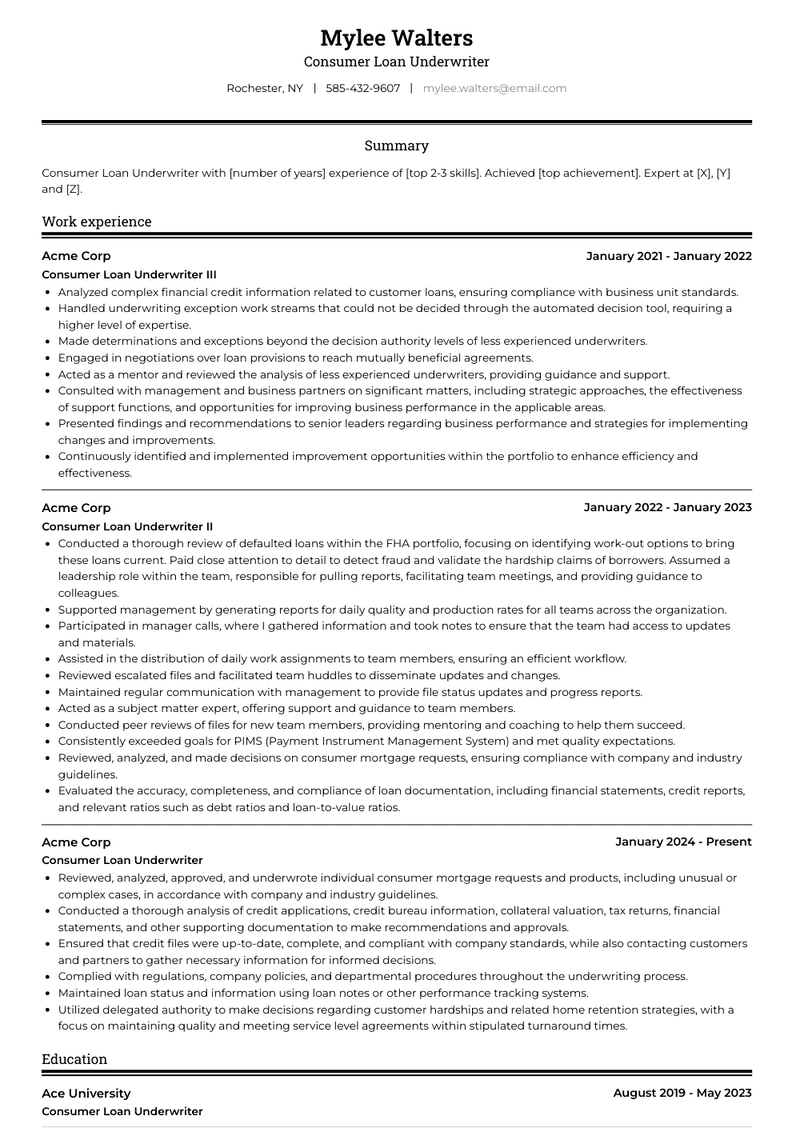

Consumer Loan Underwriter Resume Example

Consumer Loan Underwriter

- Reviewed, analyzed, approved, and underwrote individual consumer mortgage requests and products, including unusual or complex cases, in accordance with company and industry guidelines.

- Conducted a thorough analysis of credit applications, credit bureau information, collateral valuation, tax returns, financial statements, and other supporting documentation to make recommendations and approvals.

- Ensured that credit files were up-to-date, complete, and compliant with company standards, while also contacting customers and partners to gather necessary information for informed decisions.

- Complied with regulations, company policies, and departmental procedures throughout the underwriting process.

- Maintained loan status and information using loan notes or other performance tracking systems.

- Utilized delegated authority to make decisions regarding customer hardships and related home retention strategies, with a focus on maintaining quality and meeting service level agreements within stipulated turnaround times.

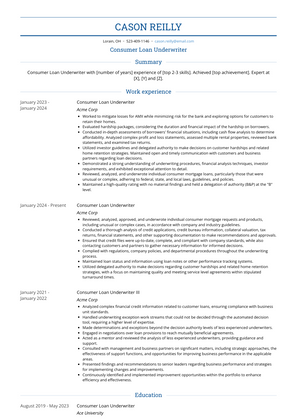

Consumer Loan Underwriter Resume Example

Consumer Loan Underwriter

- Worked to mitigate losses for AMX while minimizing risk for the bank and exploring options for customers to retain their homes.

- Evaluated hardship packages, considering the duration and financial impact of the hardship on borrowers.

- Conducted in-depth assessments of borrowers' financial situations, including cash flow analysis to determine affordability. Analyzed complex profit and loss statements, assessed multiple rental properties, reviewed bank statements, and examined tax returns.

- Utilized investor guidelines and delegated authority to make decisions on customer hardships and related home retention strategies. Maintained open and timely communication with customers and business partners regarding loan decisions.

- Demonstrated a strong understanding of underwriting procedures, financial analysis techniques, investor requirements, and exhibited exceptional attention to detail.

- Reviewed, analyzed, and underwrote individual consumer mortgage loans, particularly those that were unusual or complex, adhering to federal, state, and local laws, guidelines, and policies.

- Maintained a high-quality rating with no material findings and held a delegation of authority (B&P) at the "B" level.

Consumer Loan Underwriter II Resume Example

Consumer Loan Underwriter II

- Conducted a thorough review of defaulted loans within the FHA portfolio, focusing on identifying work-out options to bring these loans current. Paid close attention to detail to detect fraud and validate the hardship claims of borrowers. Assumed a leadership role within the team, responsible for pulling reports, facilitating team meetings, and providing guidance to colleagues.

- Supported management by generating reports for daily quality and production rates for all teams across the organization.

- Participated in manager calls, where I gathered information and took notes to ensure that the team had access to updates and materials.

- Assisted in the distribution of daily work assignments to team members, ensuring an efficient workflow.

- Reviewed escalated files and facilitated team huddles to disseminate updates and changes.

- Maintained regular communication with management to provide file status updates and progress reports.

- Acted as a subject matter expert, offering support and guidance to team members.

- Conducted peer reviews of files for new team members, providing mentoring and coaching to help them succeed.

- Consistently exceeded goals for PIMS (Payment Instrument Management System) and met quality expectations.

- Reviewed, analyzed, and made decisions on consumer mortgage requests, ensuring compliance with company and industry guidelines.

- Evaluated the accuracy, completeness, and compliance of loan documentation, including financial statements, credit reports, and relevant ratios such as debt ratios and loan-to-value ratios.

Consumer Loan Underwriter III Resume Example

Consumer Loan Underwriter III

- Analyzed complex financial credit information related to customer loans, ensuring compliance with business unit standards.

- Handled underwriting exception work streams that could not be decided through the automated decision tool, requiring a higher level of expertise.

- Made determinations and exceptions beyond the decision authority levels of less experienced underwriters.

- Engaged in negotiations over loan provisions to reach mutually beneficial agreements.

- Acted as a mentor and reviewed the analysis of less experienced underwriters, providing guidance and support.

- Consulted with management and business partners on significant matters, including strategic approaches, the effectiveness of support functions, and opportunities for improving business performance in the applicable areas.

- Presented findings and recommendations to senior leaders regarding business performance and strategies for implementing changes and improvements.

- Continuously identified and implemented improvement opportunities within the portfolio to enhance efficiency and effectiveness.

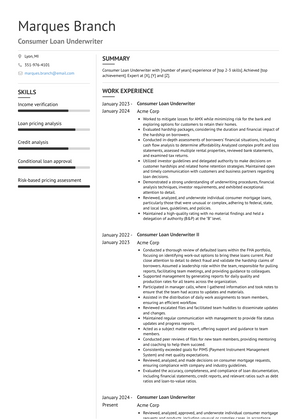

Top Consumer Loan Underwriter Resume Skills for 2023

- Loan underwriting

- Credit analysis

- Loan origination

- Risk assessment

- Creditworthiness evaluation

- Income verification

- Debt-to-income (DTI) ratio analysis

- Credit score analysis

- Loan approval or denial

- Loan documentation review

- Loan policy adherence

- Loan pricing analysis

- Loan program eligibility determination

- Collateral evaluation

- Asset verification

- Loan-to-value (LTV) ratio analysis

- Loan underwriting software usage

- Automated underwriting systems (AUS)

- Loan application review

- Regulatory compliance (e.g., TRID, Dodd-Frank)

- Fair lending practices

- Anti-money laundering (AML) checks

- Know Your Customer (KYC) checks

- Risk-based pricing assessment

- Loan program knowledge (e.g., FHA, VA, USDA)

- Home equity lines of credit (HELOC) evaluation

- Mortgage insurance analysis

- Private mortgage insurance (PMI) requirements

- Loan file documentation

- Fraud detection

- Loan closing coordination

- Loan funding approval

- Conditional loan approval

- Mortgage loan underwriting

- Consumer loan underwriting

- Small business loan underwriting

- Commercial loan underwriting

- Loan decision-making

- Loan policy development

- Loan portfolio risk assessment

- Credit report analysis

- Loan restructuring analysis

- Loan workout options assessment

- Loan loss reserve analysis

- Loan servicing standards

- Loan performance monitoring

- Regulatory reporting

- Loan audit preparation

- Financial statement analysis

How Long Should my Consumer Loan Underwriter Resume be?

Your Consumer Loan Underwriter resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Consumer Loan Underwriter, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2025 Workstory Inc.