Commercial Credit Analyst Resume Examples and Templates

This page provides you with Commercial Credit Analyst resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Commercial Credit Analyst resume.

What do Hiring Managers look for in a Commercial Credit Analyst Resume

- Financial Analysis: Proficiency in financial statement analysis, credit risk assessment, and lending principles for evaluating commercial credit applications.

- Risk Assessment: Ability to assess creditworthiness of commercial borrowers, including analyzing financial data, industry trends, and market conditions.

- Analytical Skills: Strong analytical and problem-solving abilities to identify potential credit risks and recommend risk mitigation strategies.

- Communication Skills: Effective written and verbal communication to prepare credit reports, present findings, and collaborate with lending teams.

- Regulatory Compliance: Knowledge of banking regulations and compliance requirements to ensure loans adhere to legal and industry standards.

How to Write a Commercial Credit Analyst Resume?

To write a professional Commercial Credit Analyst resume, follow these steps:

- Select the right Commercial Credit Analyst resume template.

- Write a professional summary at the top explaining your Commercial Credit Analyst’s experience and achievements.

- Follow the STAR method while writing your Commercial Credit Analyst resume’s work experience. Show what you were responsible for and what you achieved as a Commercial Credit Analyst.

- List your top Commercial Credit Analyst skills in a separate skills section.

How to Write Your Commercial Credit Analyst Resume Header?

Write the perfect Commercial Credit Analyst resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Commercial Credit Analyst position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Commercial Credit Analyst resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Commercial Credit Analyst Resume Example - Header Section

Alyson 682 Fifth St. South Plainfield, NJ 07080 Marital Status: Married, email: cooldude2022@gmail.com

Good Commercial Credit Analyst Resume Example - Header Section

Alyson Schmidt, Plainfield, NJ, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Commercial Credit Analyst email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Commercial Credit Analyst Resume Summary?

Use this template to write the best Commercial Credit Analyst resume summary: Commercial Credit Analyst with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Commercial Credit Analyst Resume Experience Section?

Here’s how you can write a job winning Commercial Credit Analyst resume experience section:

- Write your Commercial Credit Analyst work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Commercial Credit Analyst work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Commercial Credit Analyst).

- Use action verbs in your bullet points.

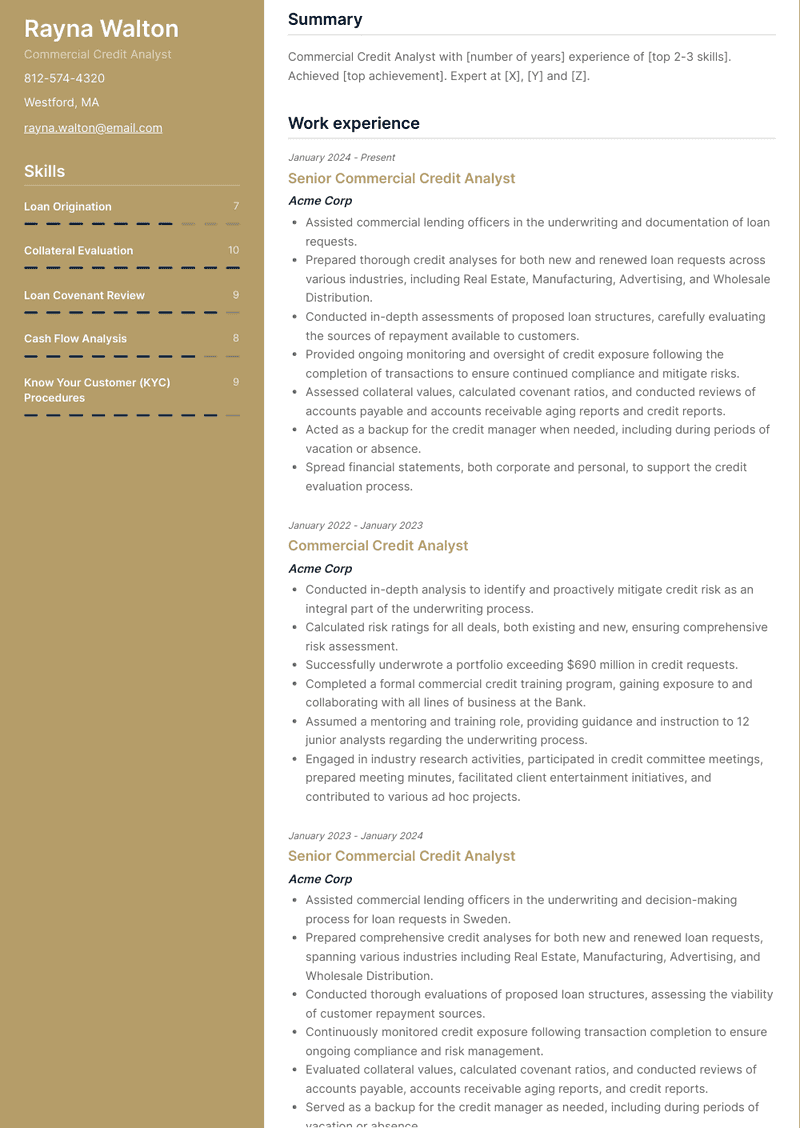

Senior Commercial Credit Analyst Resume Example

Senior Commercial Credit Analyst

- Assisted commercial lending officers in the underwriting and documentation of loan requests.

- Prepared thorough credit analyses for both new and renewed loan requests across various industries, including Real Estate, Manufacturing, Advertising, and Wholesale Distribution.

- Conducted in-depth assessments of proposed loan structures, carefully evaluating the sources of repayment available to customers.

- Provided ongoing monitoring and oversight of credit exposure following the completion of transactions to ensure continued compliance and mitigate risks.

- Assessed collateral values, calculated covenant ratios, and conducted reviews of accounts payable and accounts receivable aging reports and credit reports.

- Acted as a backup for the credit manager when needed, including during periods of vacation or absence.

- Spread financial statements, both corporate and personal, to support the credit evaluation process.

Senior Commercial Credit Analyst Resume Example

Senior Commercial Credit Analyst

- Assisted commercial lending officers in the underwriting and decision-making process for loan requests in Sweden.

- Prepared comprehensive credit analyses for both new and renewed loan requests, spanning various industries including Real Estate, Manufacturing, Advertising, and Wholesale Distribution.

- Conducted thorough evaluations of proposed loan structures, assessing the viability of customer repayment sources.

- Continuously monitored credit exposure following transaction completion to ensure ongoing compliance and risk management.

- Evaluated collateral values, calculated covenant ratios, and conducted reviews of accounts payable, accounts receivable aging reports, and credit reports.

- Served as a backup for the credit manager as needed, including during periods of vacation or absence.

- Compiled and analyzed corporate and personal financial statements in support of the credit evaluation process.

Commercial Credit Analyst Resume Example

Commercial Credit Analyst

- Conducted in-depth analysis to identify and proactively mitigate credit risk as an integral part of the underwriting process.

- Calculated risk ratings for all deals, both existing and new, ensuring comprehensive risk assessment.

- Successfully underwrote a portfolio exceeding $690 million in credit requests.

- Completed a formal commercial credit training program, gaining exposure to and collaborating with all lines of business at the Bank.

- Assumed a mentoring and training role, providing guidance and instruction to 12 junior analysts regarding the underwriting process.

- Engaged in industry research activities, participated in credit committee meetings, prepared meeting minutes, facilitated client entertainment initiatives, and contributed to various ad hoc projects.

Top Commercial Credit Analyst Resume Skills for 2023

- Credit Analysis

- Financial Statement Analysis

- Risk Assessment

- Credit Scoring Models

- Creditworthiness Evaluation

- Industry and Market Research

- Loan Portfolio Analysis

- Credit Risk Management

- Credit Policy Development

- Loan Origination

- Credit Underwriting

- Collateral Evaluation

- Credit Decision Making

- Credit Documentation

- Loan Structuring

- Cash Flow Analysis

- Debt Service Coverage Ratio (DSCR) Calculation

- Loan Covenant Review

- Financial Statement Spreading

- Credit Reporting Agencies (e.g., Experian)

- Credit Risk Assessment Software

- Credit Review and Approval Process

- Credit Risk Mitigation Strategies

- Commercial Loan Due Diligence

- Regulatory Compliance

- Commercial Real Estate Analysis

- Loan Documentation Software (e.g., LaserPro)

- Commercial Credit Reports

- Credit Policy Adherence

- Credit Portfolio Monitoring

- Credit Risk Reporting

- Credit Policy Review and Updates

- Credit Loss Provisioning

- Debt Restructuring Analysis

- Loan Default Analysis

- Stress Testing

- Credit Risk Policy Analysis

- Credit Risk Reporting Tools

- Legal Aspects of Credit Analysis

- Credit Risk Models Validation

- Anti-Money Laundering (AML) Compliance

- Know Your Customer (KYC) Procedures

- Bankruptcy Analysis

- Credit Documentation Auditing

- Regulatory Reporting

- Credit Risk Management Software

- Credit Decision Support Systems

- Loan Pricing Analysis

How Long Should my Commercial Credit Analyst Resume be?

Your Commercial Credit Analyst resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Commercial Credit Analyst, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2024 Workstory Inc.