3+ Claims Analyst Resume Examples and Templates

This page provides you with Claims Analyst resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Claims Analyst resume.

What do Hiring Managers look for in a Claims Analyst Resume

- Analytical Skills: Strong analytical abilities to evaluate insurance claims, assess data, and make informed decisions.

- Attention to Detail: Meticulousness in reviewing claims documents and ensuring accuracy in processing.

- Communication Skills: Effective communication, both written and verbal, to interact with claimants, policyholders, and colleagues.

- Problem-Solving: The capability to investigate and resolve complex claims issues and disputes.

- Regulatory Knowledge: Understanding of insurance laws and regulations to ensure claims compliance with legal requirements.

How to Write a Claims Analyst Resume?

To write a professional Claims Analyst resume, follow these steps:

- Select the right Claims Analyst resume template.

- Write a professional summary at the top explaining your Claims Analyst’s experience and achievements.

- Follow the STAR method while writing your Claims Analyst resume’s work experience. Show what you were responsible for and what you achieved as a Claims Analyst.

- List your top Claims Analyst skills in a separate skills section.

How to Write Your Claims Analyst Resume Header?

Write the perfect Claims Analyst resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Claims Analyst job title to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Claims Analyst resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Claims Analyst Resume Example - Header Section

Jonathon 9 W. Wakehurst St. Mount Vernon, NY 10550 Marital Status: Married, email: cooldude2022@gmail.com

Good Claims Analyst Resume Example - Header Section

Jonathon Franklin, Mount Vernon, NY, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Claims Analyst email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Claims Analyst Resume Summary?

Use this template to write the best Claims Analyst resume summary: Claims Analyst with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Claims Analyst Resume Experience Section?

Here’s how you can write a job winning Claims Analyst resume experience section:

- Write your Claims Analyst work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Claims Analyst work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Claims Analyst).

- Use action verbs in your bullet points.

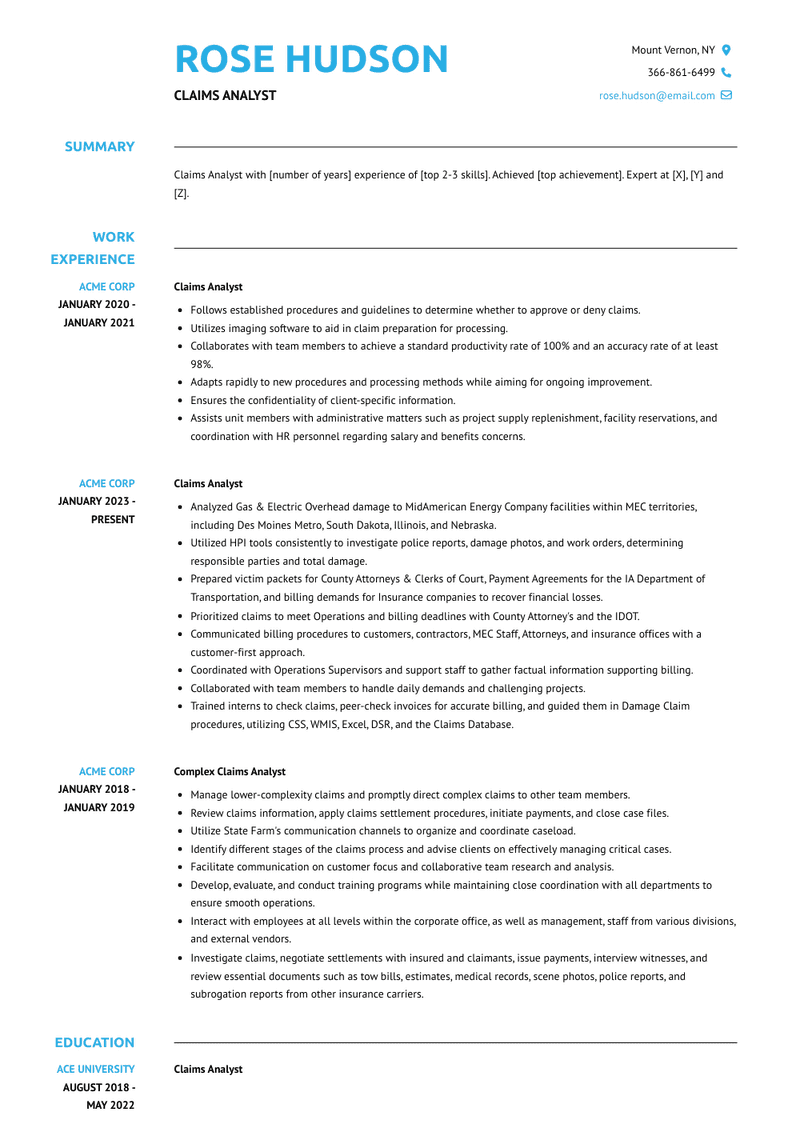

Claims Analyst Resume Example

Claims Analyst

- Analyzed Gas & Electric Overhead damage to MidAmerican Energy Company facilities within MEC territories, including Des Moines Metro, South Dakota, Illinois, and Nebraska.

- Utilized HPI tools consistently to investigate police reports, damage photos, and work orders, determining responsible parties and total damage.

- Prepared victim packets for County Attorneys & Clerks of Court, Payment Agreements for the IA Department of Transportation, and billing demands for Insurance companies to recover financial losses.

- Prioritized claims to meet Operations and billing deadlines with County Attorney's and the IDOT.

- Communicated billing procedures to customers, contractors, MEC Staff, Attorneys, and insurance offices with a customer-first approach.

- Coordinated with Operations Supervisors and support staff to gather factual information supporting billing.

- Collaborated with team members to handle daily demands and challenging projects.

- Trained interns to check claims, peer-check invoices for accurate billing, and guided them in Damage Claim procedures, utilizing CSS, WMIS, Excel, DSR, and the Claims Database.

Claims Analyst Resume Example

Claims Analyst

- Gathered and analyzed data.

- Proficient in the adjudication process.

- In-depth knowledge of Medicare and Medicaid health plans.

- Expertise in handling claims.

- Assisted management and other teams in defining business goals and requirements.

- Efficiently managed a significant claims caseload, ensuring timely processing and resolution.

- Conducted investigations and processed claims promptly.

- Maintained electronic and hardcopy claims records, safeguarding information through HIPAA/ARRA security measures.

- Successfully managed various special projects, including mental health claims, dental, prosthetics, orthotics, and x-rays, among others.

Senior Claims Analyst Resume Example

Senior Claims Analyst

- Supervises a team of processors and acts as backup to the Team Lead for client database maintenance and intake triage according to contractual requirements.

- Assumes the role of Quality Lead to maintain accuracy and productivity standards.

- Identifies and escalates data transaction issues with potential contractual impacts on service level agreements.

- Participates in client-specific training and refresher courses when necessary.

- Offers guidance and mentoring to new and less experienced team members.

- Provides feedback on the performance of team members, trainees, and new hires.

- Assists in preparing the team's time and expense reports for payroll administration.

- Functions as a reports analyst.

Claims Analyst Resume Example

Claims Analyst

- Follows established procedures and guidelines to determine whether to approve or deny claims.

- Utilizes imaging software to aid in claim preparation for processing.

- Collaborates with team members to achieve a standard productivity rate of 100% and an accuracy rate of at least 98%.

- Adapts rapidly to new procedures and processing methods while aiming for ongoing improvement.

- Ensures the confidentiality of client-specific information.

- Assists unit members with administrative matters such as project supply replenishment, facility reservations, and coordination with HR personnel regarding salary and benefits concerns.

Claims Analyst Resume Example

Claims Analyst

- Compiled and analyzed data to provide information to leadership and claimants.

- Detected and rectified data entry errors to avoid duplication across systems.

- Accurately processed confidential tax form information.

Complex Claims Analyst Resume Example

Complex Claims Analyst

- Manage lower-complexity claims and promptly direct complex claims to other team members.

- Review claims information, apply claims settlement procedures, initiate payments, and close case files.

- Utilize State Farm's communication channels to organize and coordinate caseload.

- Identify different stages of the claims process and advise clients on effectively managing critical cases.

- Facilitate communication on customer focus and collaborative team research and analysis.

- Develop, evaluate, and conduct training programs while maintaining close coordination with all departments to ensure smooth operations.

- Interact with employees at all levels within the corporate office, as well as management, staff from various divisions, and external vendors.

- Investigate claims, negotiate settlements with insured and claimants, issue payments, interview witnesses, and review essential documents such as tow bills, estimates, medical records, scene photos, police reports, and subrogation reports from other insurance carriers.

Senior Claims Analyst Resume Example

Senior Claims Analyst

- Responsible for daily resolution of complex problem claims, involving thorough analysis.

- Takes appropriate action when transaction characteristics and account changes indicate complex scenarios across all claim types.

- Acts as a subject matter expert in all claim types, making complex decisions based on analytical research, established policies, procedures, and judgment.

- Proactively processes claims with a strong sense of urgency to minimize loss for the banking institution.

- Handles 95-125 complex and high-profile time-sensitive/aging claims weekly.

- Addresses escalated customer situations that initial claims analysts were unable to resolve.

- Provides coaching and training to other associates, ensuring compliance with Federal and Bank Regulations.

Claims Analyst II, Back Office Resume Example

Claims Analyst II, Back Office

- Resolved customer problems and concerns related to ATM, debit card, ACH claims, and other consumer products.

- Handled incoming calls from customers requesting new claims, updates on existing claims, or appeals for denied claims, adhering to bank policies and procedures.

- Communicated directly with customers and clients to make informed and timely decisions regarding their claims.

- Adjusted accounting as necessary while claims were pending resolution.

- Collaborated with management to assist in coaching new hires and priority gate associates on the reconsideration process.

- Conducted research and data analysis daily to determine resolutions for debit card claims, utilizing multiple banking systems.

- Progressed to specialized areas, including ATM Fraud, New Account Fraud, High Priority Claims, and Reconsiderations Team.

Claims Analyst Resume Example

Claims Analyst

- Collected, recorded, verified, and processed financial and medical transactions and documents essential for accounts receivable processing.

- Assisted the Claims Department with tasks related to the billing process, including payment authorizations.

- Managed client folders, matched source documents with invoices, prepared and processed client account adjustments, and organized client data.

- Generated daily activity reports, participated in in-service sessions, and maintained third-party reimbursement data.

- Undertook additional duties as assigned by the department supervisor.

Claims Analyst Resume Example

Claims Analyst

- Conducted data entry, processed, and analyzed various claim types, including electronically submitted claims.

- Entered and processed enrollments and terminations for insurance groups.

- Managed claim reversals.

- Generated and dispatched various types of letters, including pre-existing, HIPAA, return letters, Accident Info Request, and other insurance-related requests.

- Processed and printed a range of reports and claims.

- Served as a backup for clerks and the mailroom.

Claims Analyst Resume Example

Claims Analyst

- Analyzes and categorizes claims with multiple diagnoses, escalating them to the Medical Resource Team for additional evaluation.

- Processes claims based on criticality and claim type, giving priority to claims with short turnaround times.

- Addresses team inquiries regarding any issues or concerns arising from claim transactions.

- Exhibits dedication to customers by ensuring compliance with applicable statutory and regulatory requirements.

- Maintains expertise in benefits claim processing, claims principles, medical terminology, and procedures.

Top Claims Analyst Resume Skills for 2023

- Claims Processing

- Insurance Policy Knowledge

- Claims Investigation

- Policy Interpretation

- Risk Assessment

- Data Analysis

- Document Verification

- Claim Documentation

- Claim Coding

- Claim Auditing

- Claims Software (e.g., Claims Management Systems)

- Fraud Detection

- Claims Adjudication

- Loss Assessment

- Claim Settlement

- Customer Service

- Claim Payment Processing

- Claims Resolution

- Subrogation

- Claim Denial Handling

- Medical Billing and Coding

- Liability Assessment

- Coverage Determination

- Regulatory Compliance

- Claims Reporting

- Claims Metrics Analysis

- Claim Dispute Resolution

- Claim Recovery

- Medical Terminology

- Insurance Law and Regulations

- Claims Review

- Claims Adjuster Communication

- Claims Database Management

- Claim Fraud Prevention

- Third-party Claims

- Claims Escalation

- Auto Insurance Claims

- Property Insurance Claims

- Workers' Compensation Claims

- Health Insurance Claims

- Claims Appeals Process

- Claims Negotiation

- Settlement Negotiation

- Claims Quality Assurance

- Claims Process Improvement

- Claims Recordkeeping

- Claims Audit Procedures

- Claims Handling Best Practices

- Claims Investigation Tools

- Claims Data Privacy and Security

How Long Should my Claims Analyst Resume be?

Your Claims Analyst resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Claims Analyst, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Frequently Asked Questions (FAQs) for Claims Analyst Resume

-

What does a Claims Analyst do?

- A Claims Analyst evaluates insurance claims submitted by policyholders to determine coverage eligibility, assess damages or losses, and process claims payments. They investigate claims, gather relevant information, and ensure compliance with insurance policies and regulations.

-

What qualifications are important for a Claims Analyst position?

- Qualifications typically include a bachelor's degree in business, finance, insurance, or a related field. Relevant experience in claims processing, insurance underwriting, or risk assessment, knowledge of insurance principles and regulations, and strong analytical skills are essential.

-

What kind of experience should a Claims Analyst highlight on their resume?

- Experience in claims analysis, including reviewing claim documents, conducting investigations, and evaluating coverage, is crucial for a Claims Analyst. Highlighting proficiency in data analysis, decision-making, and customer service is important.

-

How important is it for a Claims Analyst to demonstrate attention to detail on their resume?

- Attention to detail is critical for a Claims Analyst as they are responsible for accurately assessing claims, verifying policy coverage, and processing payments. Highlighting experience in reviewing documentation, identifying discrepancies, and maintaining accurate records is essential.

-

Should a Claims Analyst include their experience with customer service on their resume?

- Yes, mentioning experience with customer service, including communicating with policyholders, agents, and other stakeholders to provide assistance and address inquiries related to claims, can demonstrate the Analyst's commitment to customer satisfaction.

-

What soft skills are important for a Claims Analyst to highlight on their resume?

- Soft skills such as communication, problem-solving, negotiation, empathy, and conflict resolution are crucial for a Claims Analyst. These skills contribute to effectively handling claim disputes, resolving issues, and maintaining positive relationships with stakeholders.

-

Is it necessary for a Claims Analyst to mention their experience with insurance regulations on their resume?

- Yes, mentioning experience with insurance regulations, including knowledge of state insurance laws, policy provisions, and claims processing guidelines, can demonstrate the Analyst's understanding of regulatory compliance and adherence to industry standards.

-

How should a Claims Analyst tailor their resume for different types of insurance claims?

- A Claims Analyst should highlight experience and skills relevant to the specific types of insurance claims they have handled, whether it's property and casualty, health, auto, liability, or workers' compensation claims. Emphasizing familiarity with industry-specific terminology, procedures, and regulations can be beneficial.

-

Should a Claims Analyst include their educational background on their resume?

- Yes, including educational background such as degrees, certifications, or relevant coursework in insurance, business, or finance is important. This provides credibility and demonstrates the foundational knowledge necessary for the role.

-

How can a Claims Analyst make their resume visually appealing and easy to read?

- Utilizing clear headings, bullet points to highlight key skills and experiences, and a professional layout are important aspects of resume formatting. Additionally, including specific examples of successful claims resolutions or process improvements, along with quantifiable achievements, can enhance the overall presentation of the resume.

Copyright ©2024 Workstory Inc.