Claims Adjuster Resume Examples and Templates

This page provides you with Claims Adjuster resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Claims Adjuster resume.

What Do Hiring Managers Look for in a Claims Adjuster Resume

- Proficient in investigating and evaluating insurance claims to determine coverage and liability.

- Strong knowledge of insurance policies, laws, and regulations related to claim processing.

- Skilled in conducting interviews, gathering evidence, and negotiating settlements.

- Ability to review and analyze documents, medical records, and damage assessments.

- Proficiency in providing excellent customer service and resolving claim-related issues.

How to Write a Claims Adjuster Resume?

To write a professional Claims Adjuster resume, follow these steps:

- Select the right Claims Adjuster resume template.

- Write a professional summary at the top explaining your Claims Adjuster’s experience and achievements.

- Follow the STAR method while writing your Claims Adjuster resume’s work experience. Show what you were responsible for and what you achieved as a Claims Adjuster.

- List your top Claims Adjuster skills in a separate skills section.

How to Write Your Claims Adjuster Resume Header?

Write the perfect Claims Adjuster resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Claims Adjuster position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Claims Adjuster resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Claims Adjuster Resume Example - Header Section

Camren 682 Fifth St. South Plainfield, NJ 07080 Marital Status: Married, email: cooldude2022@gmail.com

Good Claims Adjuster Resume Example - Header Section

Camren Jacobs, Plainfield, NJ, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Claims Adjuster email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Claims Adjuster Resume Summary?

Use this template to write the best Claims Adjuster resume summary: Claims Adjuster with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Claims Adjuster Resume Experience Section?

Here’s how you can write a job winning Claims Adjuster resume experience section:

- Write your Claims Adjuster work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Claims Adjuster work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Claims Adjuster).

- Use action verbs in your bullet points.

Property Claims Adjuster Resume Example

Property Claims Adjuster

- Provided customer support by addressing inquiries and concerns related to deductibles and insurance coverage.

- Prepared concise and accurate summaries detailing damages, payments, and policy coverage for insurance claims.

- Analyzed claims forms and records to assess the extent of insurance coverage applicable to each case.

- Verified insurance claims and determined fair settlement amounts based on policy terms and relevant information.

- Conducted thorough interviews with witnesses and claimants to gather essential facts and evidence.

- Engaged in effective communication with witnesses and claimants to facilitate the claims investigation process.

- Demonstrated sound judgment and decision-making skills to assess and analyze over 20 claims weekly.

- Conducted detailed investigations by reviewing policy contracts and evaluating claim coverage based on the cause and facts of loss.

- Fostered and maintained positive relationships with independent adjusters and contractors to ensure efficient claims processing and resolution.

Property Claims Adjuster Resume Example

Property Claims Adjuster

- Initiate the First Notice of Loss process and promptly review the insurance policy to assess coverage and exclusions during the first contact with the insured.

- Provide clear instructions to the insured regarding the documentation required for further review or investigation of the claim.

- Conduct virtual inspections and assign field adjusters, engineers, and contracted vendors to assess and evaluate damages, as well as to prepare the scope of work.

- Facilitate the process of obtaining jewelry assessments and estimates for Personal Article Policies.

- Prepare detailed estimates based on virtual inspections, photos, and videos of the damages incurred.

- Thoroughly review, reconcile, and negotiate contractor estimates and supplements to ensure alignment with the scope of damages. This involves effective communication with field personnel, contractors, public adjusters, mortgage companies, and attorneys.

- Input relevant personal property items into Xcontents and facilitate the settlement process.

- Engage in proactive communication with the insured to review the final estimate, replacement cost benefits, any exclusions, and address any questions or concerns they may have about the claim.

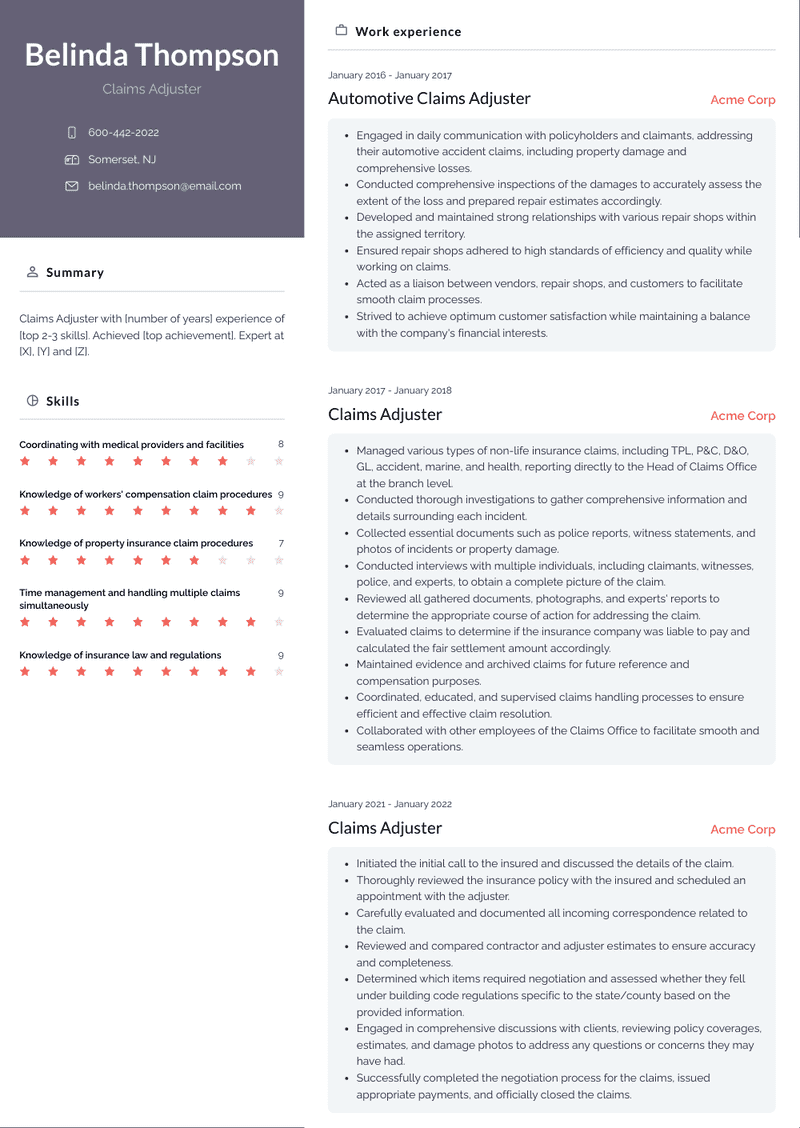

Claims Adjuster Resume Example

Claims Adjuster

- Initiated the initial call to the insured and discussed the details of the claim.

- Thoroughly reviewed the insurance policy with the insured and scheduled an appointment with the adjuster.

- Carefully evaluated and documented all incoming correspondence related to the claim.

- Reviewed and compared contractor and adjuster estimates to ensure accuracy and completeness.

- Determined which items required negotiation and assessed whether they fell under building code regulations specific to the state/county based on the provided information.

- Engaged in comprehensive discussions with clients, reviewing policy coverages, estimates, and damage photos to address any questions or concerns they may have had.

- Successfully completed the negotiation process for the claims, issued appropriate payments, and officially closed the claims.

Claims Adjuster/Estimator Resume Example

Claims Adjuster/Estimator

- Conducted thorough assessments and prepared damage estimates for vehicles, following company standards and standard operating procedures.

- Demonstrated proactive communication skills by suggesting new process ideas to enhance efficiency and productivity within the organization.

- Assumed supervisory responsibilities in the absence of management, ensuring that office productivity was maintained and addressing any customer concerns or issues.

- Organized and coordinated office events, such as birthdays, employee recognition, and charity drives, to foster a positive work environment.

- Took on additional responsibilities, including managing the file room, ordering office supplies, and maintaining inventory control.

- Acted as a trainer and mentor to fellow staff members, providing guidance and expertise in physical damage identification.

Claims Adjuster Resume Example

Claims Adjuster

- Committed to delivering exceptional customer service to insured members, claimants, and vendors, ensuring their needs are met and concerns addressed promptly.

- Proficient in conducting thorough investigations and accurately applying liability to complex auto property damage claims.

- Demonstrated ability to handle diverse customer bases and navigate through fast-paced and complex scenarios with intuitive problem-solving skills.

- Focused on resolving claims efficiently and fairly, while maintaining compliance with state regulations and industry standards.

Claims Adjuster Resume Example

Claims Adjuster

- Successfully completed 15 focus audits every quarter to ensure accuracy and compliance in claim processes.

- Conducted interviews with claimants, medical specialists, and employers to gather relevant information for injury claims.

- Performed re-inspections of claims and estimates to verify accuracy and validity of information provided.

- Checked and analyzed data to determine the authenticity of claims and made informed decisions based on findings.

- Adhered to company and insurance client guidelines throughout the claim process, including estimate writing and claim closure.

- Demonstrated expertise in handling and evaluating injury claims, leading to training and mentoring other claims staff members.

- Responsively addressed questions from insureds and attorneys, providing necessary information and assistance.

- Conducted thorough investigations of injury claims, gathering all essential data to facilitate fair and efficient claims resolution.

Claims Adjuster Resume Example

Claims Adjuster

- Managed various types of non-life insurance claims, including TPL, P&C, D&O, GL, accident, marine, and health, reporting directly to the Head of Claims Office at the branch level.

- Conducted thorough investigations to gather comprehensive information and details surrounding each incident.

- Collected essential documents such as police reports, witness statements, and photos of incidents or property damage.

- Conducted interviews with multiple individuals, including claimants, witnesses, police, and experts, to obtain a complete picture of the claim.

- Reviewed all gathered documents, photographs, and experts' reports to determine the appropriate course of action for addressing the claim.

- Evaluated claims to determine if the insurance company was liable to pay and calculated the fair settlement amount accordingly.

- Maintained evidence and archived claims for future reference and compensation purposes.

- Coordinated, educated, and supervised claims handling processes to ensure efficient and effective claim resolution.

- Collaborated with other employees of the Claims Office to facilitate smooth and seamless operations.

Automotive Claims Adjuster Resume Example

Automotive Claims Adjuster

- Engaged in daily communication with policyholders and claimants, addressing their automotive accident claims, including property damage and comprehensive losses.

- Conducted comprehensive inspections of the damages to accurately assess the extent of the loss and prepared repair estimates accordingly.

- Developed and maintained strong relationships with various repair shops within the assigned territory.

- Ensured repair shops adhered to high standards of efficiency and quality while working on claims.

- Acted as a liaison between vendors, repair shops, and customers to facilitate smooth claim processes.

- Strived to achieve optimum customer satisfaction while maintaining a balance with the company's financial interests.

Claims Adjuster Resume Example

Claims Adjuster

- Handled the resolution of injury and damage claims, ensuring timely and efficient processing.

- Reviewed incoming claims, carefully evaluating the information to approve or deny payments as appropriate.

- Demonstrated professionalism and empathy in interactions with clients, providing support and guidance throughout the claims process to help them navigate through the complexities.

Claims Adjuster Resume Example

Claims Adjuster

- Utilized various systems such as Accurint, ISO, TLO, etc., to gather relevant information for the investigations.

- Analyzed the gathered information and prepared detailed reports with findings and recommendations for upper management.

- Communicated coverage approvals and denials to stakeholders through written correspondence and verbal communication.

- Conducted interviews with insured individuals, claimants, and third parties to gather essential information for liability determination.

- Reviewed police reports, scene details, and damage assessments to assist in making liability decisions.

- Managed claims through the investigation, repair, and closure process, ensuring proper handling and customer satisfaction.

- Provided assistance to other claims adjusters as needed to support efficient claim resolution.

Top Claims Adjuster Resume Skills for 2023

- Insurance claims processing

- Policy interpretation and coverage analysis

- Investigation and evaluation of claims

- Negotiation and settlement skills

- Damage assessment and estimation

- Interviewing claimants and witnesses

- Analyzing police reports and medical records

- Identifying liability and responsibility

- Adhering to legal and regulatory guidelines

- Fraud detection and prevention in claims

- Resolving claim disputes and appeals

- Knowledge of insurance policies and procedures

- Knowledge of insurance law and regulations

- Understanding of medical terminology (for health insurance claims)

- Analyzing and interpreting claim-related data

- Coordinating with medical providers and facilities

- Resolving complex or high-value claims

- Handling property damage claims

- Knowledge of auto insurance claim procedures

- Knowledge of property insurance claim procedures

- Knowledge of workers' compensation claim procedures

- Handling bodily injury and personal injury claims

- Handling third-party liability claims

- Knowledge of insurance claim software and systems

- Effective communication with claimants and stakeholders

- Customer service and claimant support

- Time management and handling multiple claims simultaneously

- Analyzing claim documentation for completeness and accuracy

- Identifying subrogation opportunities

- Adapting to changes in claim regulations and procedures

- Handling total loss and salvage claims

- Following claim file documentation and recordkeeping

- Handling claims related to natural disasters and catastrophic events

- Understanding of insurance claim coding and billing

- Conducting claim investigations on-site or remotely

- Handling claim-related correspondence and communications

- Coordinating with legal professionals and counsel

- Knowledge of industry standards and best practices

- Continuous learning and staying updated on claim trends

- Coordinating with other insurance professionals and adjusters

- Managing claim-related expenses and costs

How Long Should my Claims Adjuster Resume be?

Your Claims Adjuster resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Claims Adjuster, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2025 Workstory Inc.