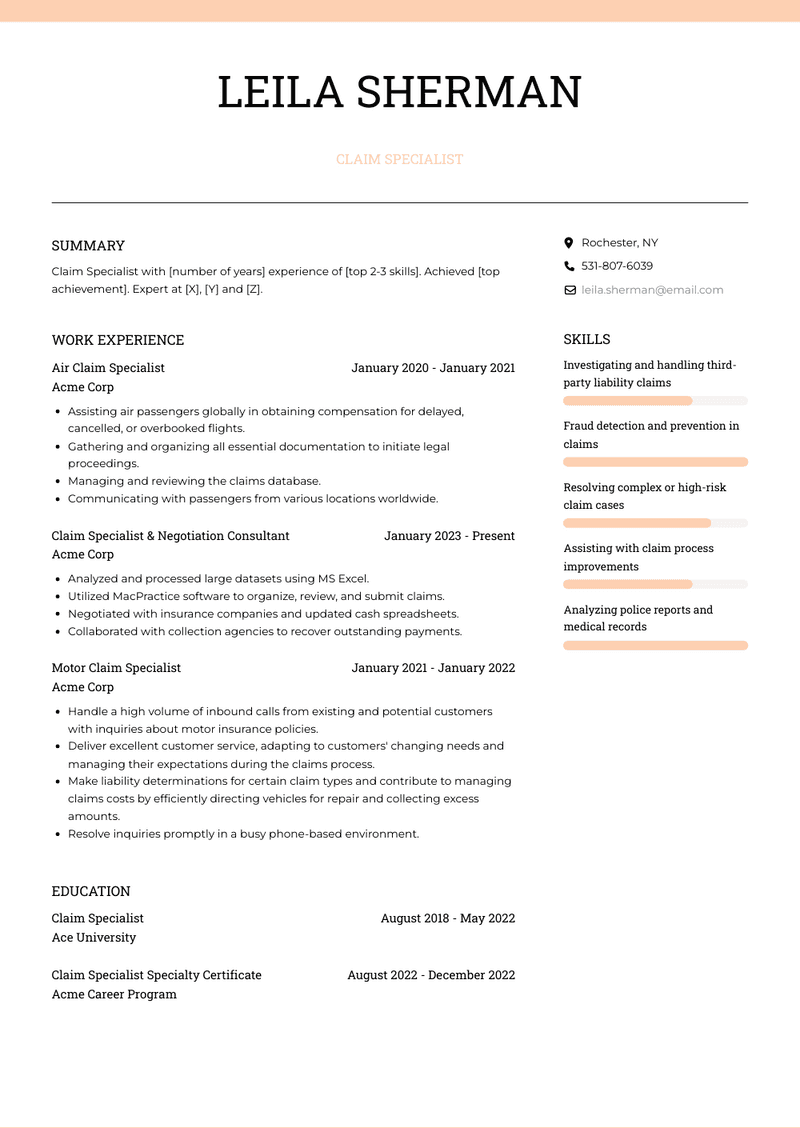

Claim Specialist Resume Examples and Templates

This page provides you with Claim Specialist resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Claim Specialist resume.

What Do Hiring Managers Look for in a Claim Specialist Resume

- Proficient in processing and managing insurance claims for individuals or businesses.

- Strong knowledge of insurance policies, coverage, and claim settlement procedures.

- Skilled in reviewing and analyzing claim documents, investigating claims, and verifying coverage.

- Ability to negotiate and settle claims in a fair and timely manner.

- Proficiency in providing excellent customer service and maintaining accurate claim records.

How to Write a Claim Specialist Resume?

To write a professional Claim Specialist resume, follow these steps:

- Select the right Claim Specialist resume template.

- Write a professional summary at the top explaining your Claim Specialist’s experience and achievements.

- Follow the STAR method while writing your Claim Specialist resume’s work experience. Show what you were responsible for and what you achieved as a Claim Specialist.

- List your top Claim Specialist skills in a separate skills section.

How to Write Your Claim Specialist Resume Header?

Write the perfect Claim Specialist resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Claim Specialist position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Claim Specialist resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Claim Specialist Resume Example - Header Section

Keith 7704 Clay St. Huntley, IL 60142 Marital Status: Married, email: cooldude2022@gmail.com

Good Claim Specialist Resume Example - Header Section

Keith Hale, Huntley, IL, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Claim Specialist email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Claim Specialist Resume Summary?

Use this template to write the best Claim Specialist resume summary: Claim Specialist with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Claim Specialist Resume Experience Section?

Here’s how you can write a job winning Claim Specialist resume experience section:

- Write your Claim Specialist work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Claim Specialist work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Claim Specialist).

- Use action verbs in your bullet points.

Claim Specialist & Negotiation Consultant Resume Example

Claim Specialist & Negotiation Consultant

- Analyzed and processed large datasets using MS Excel.

- Utilized MacPractice software to organize, review, and submit claims.

- Negotiated with insurance companies and updated cash spreadsheets.

- Collaborated with collection agencies to recover outstanding payments.

Delay Claim Specialist Resume Example

Delay Claim Specialist

- Analyzed main contract excusable delays, disruptions, accelerations, concurrent delays, and subcontractor delays.

- Assessed subcontractors' claims and their impact on the project.

Motor Claim Specialist Resume Example

Motor Claim Specialist

- Handle a high volume of inbound calls from existing and potential customers with inquiries about motor insurance policies.

- Deliver excellent customer service, adapting to customers' changing needs and managing their expectations during the claims process.

- Make liability determinations for certain claim types and contribute to managing claims costs by efficiently directing vehicles for repair and collecting excess amounts.

- Resolve inquiries promptly in a busy phone-based environment.

Air Claim Specialist Resume Example

Air Claim Specialist

- Assisting air passengers globally in obtaining compensation for delayed, cancelled, or overbooked flights.

- Gathering and organizing all essential documentation to initiate legal proceedings.

- Managing and reviewing the claims database.

- Communicating with passengers from various locations worldwide.

Top Claim Specialist Resume Skills for 2023

- Insurance claims processing

- Knowledge of insurance policies and coverage

- Claims investigation and analysis

- Accurate data entry and documentation

- Effective communication with policyholders and clients

- Customer service and support

- Claims adjudication and decision-making

- Negotiation and settlement skills

- Understanding of claim processing systems and software

- Policy interpretation and application

- Handling claims inquiries and inquiries

- Fraud detection and prevention in claims

- Legal and regulatory compliance in claims handling

- Medical terminology (for health insurance claims)

- Auto and property damage assessment

- Damage estimation and appraisal

- Understanding of accident and incident reports

- Investigation of liability and responsibility

- Interviewing claimants and witnesses

- Analyzing police reports and medical records

- Identifying subrogation opportunities

- Coordinating with external adjusters and investigators

- Calculating claim payouts and settlements

- Handling complex and high-value claims

- Managing claim disputes and appeals

- Reviewing and analyzing claim-related documents

- Evaluating claim documentation for completeness and accuracy

- Coordinating with other departments (e.g., legal, underwriting)

- Providing clear and detailed claim status updates to stakeholders

- Knowledge of insurance claim regulations and statutes of limitations

- Investigating fraudulent or suspicious claims

- Handling claim escalations and complaints

- Negotiating with claimants and attorneys

- Collaborating with law enforcement and legal professionals

- Assisting with claim process improvements

- Handling total loss and salvage claims

- Resolving complex or high-risk claim cases

- Ensuring adherence to claims handling guidelines and procedures

- Prioritizing claims based on urgency and severity

- Keeping up-to-date with industry trends and best practices

- Investigating and handling third-party liability claims

- Analyzing and reporting claim data and trends

- Conducting on-site inspections and assessments

- Utilizing claim management software and tools

- Investigating property damage and repair costs

- Handling claim-related correspondence and communications

- Coordinating with medical providers and facilities (for health insurance claims)

How Long Should my Claim Specialist Resume be?

Your Claim Specialist resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Claim Specialist, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

How can I highlight my experience as a Claim Specialist on my resume?

Focus on your expertise in reviewing, processing, and resolving insurance claims. Highlight your role in investigating claims, ensuring accurate documentation, and communicating with clients and insurance adjusters to resolve disputes and approve claims.

What are the key skills to feature on a Claim Specialist's resume?

Emphasize skills in claims processing, customer service, investigation, and documentation. Highlight your proficiency with claims management systems, attention to detail, and your ability to handle a high volume of claims efficiently.

How do I demonstrate my ability to manage claims on my resume?

Provide examples of how you’ve handled claims efficiently, reduced processing times, or improved accuracy. Highlight your role in resolving disputes, working with insurance adjusters, and ensuring timely and accurate claims payments.

Should I include metrics on my Claim Specialist resume? If so, what kind?

Yes, include metrics such as the number of claims processed daily, reduction in claim resolution time, or the percentage of claims resolved successfully. These metrics help quantify your efficiency and contributions to improving claims handling.

How can I showcase my experience with claims investigation on my resume?

Detail your role in investigating claims, verifying policy details, and gathering evidence to support or deny claims. Highlight your ability to assess the validity of claims and your experience in working with claimants and adjusters to ensure fair settlements.

What kind of achievements should I highlight as a Claim Specialist?

Highlight achievements such as improving claims accuracy, reducing claim processing times, or being recognized for exceptional customer service. Mention any recognition for your ability to resolve complex claims or handle high volumes of claims efficiently.

How do I address a lack of experience in a specific area of claims management on my resume?

Emphasize your core skills in investigation, documentation, and communication. Highlight any relevant training, certifications, or projects that demonstrate your ability to adapt and learn quickly in different areas of claims management.

How important is customer service for a Claim Specialist role?

Customer service is essential for resolving claim disputes and maintaining client relationships. Highlight your experience in working with claimants, providing clear explanations of claim decisions, and handling escalated disputes professionally.

How do I demonstrate my ability to manage complex claims on my resume?

Mention specific examples where you’ve handled complex or high-value claims, detailing your role in investigating, coordinating with other departments, and ensuring timely resolution. Highlight your ability to work with multiple stakeholders to resolve claims fairly.

Should I include certifications on my Claim Specialist resume?

Yes, include relevant certifications such as Associate in Claims (AIC), Certified Claims Professional (CCP), or other insurance-related certifications. These demonstrate your expertise in claims handling and commitment to maintaining high professional standards.

-

What Do Hiring Managers Look for in a Claim Specialist Resume

-

How to Write a Professional Claim Specialist Resume Summary?

-

How can I highlight my experience as a Claim Specialist on my resume?

-

What are the key skills to feature on a Claim Specialist's resume?

-

How do I demonstrate my ability to manage claims on my resume?

-

Should I include metrics on my Claim Specialist resume? If so, what kind?

-

How can I showcase my experience with claims investigation on my resume?

-

What kind of achievements should I highlight as a Claim Specialist?

-

How do I address a lack of experience in a specific area of claims management on my resume?

-

How important is customer service for a Claim Specialist role?

-

How do I demonstrate my ability to manage complex claims on my resume?

-

Should I include certifications on my Claim Specialist resume?

Copyright ©2024 Workstory Inc.