Bank Manager Resume Examples and Templates

This page provides you with Bank Manager resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Bank Manager resume.

How to Write a Bank Manager Resume?

To write a professional Bank Manager resume, follow these steps:

- Select the right Bank Manager resume template.

- Write a professional summary at the top explaining your Bank Manager’s experience and achievements.

- Follow the STAR method while writing your Bank Manager resume’s work experience. Show what you were responsible for and what you achieved as {a/an} Bank Manager.

- List your top Bank Manager skills in a separate skills section.

How to Write Your Bank Manager Resume Header?

Write the perfect Bank Manager resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Bank Manager to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Bank Manager resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Bank Manager Resume Example - Header Section

Rayna 35 Marshall Drive Chardon, OH 44024 Marital Status: Married, email: cooldude2022@gmail.com

Good Bank Manager Resume Example - Header Section

Rayna Walton, Chardon, OH, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Bank Manager email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Bank Manager Resume Summary?

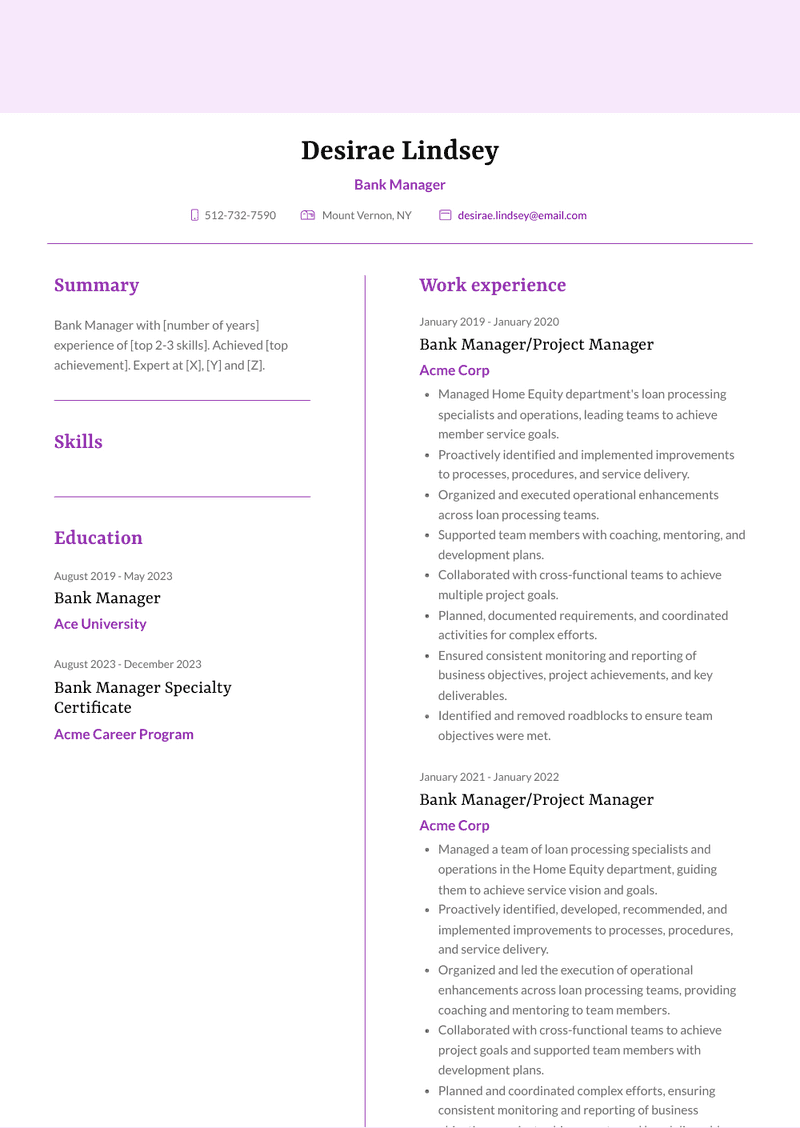

Use this template to write the best Bank Manager resume summary: Bank Manager with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Bank Manager Resume Experience Section?

Here’s how you can write a job winning Bank Manager resume experience section:

- Write your Bank Manager work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Bank Manager work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Bank Manager).

- Use action verbs in your bullet points.

Bank Manager Resume Example

Bank Manager

- Managed customer accounts, addressing issues and ensuring account satisfaction.

- Facilitated the opening of various account types, including checking, savings, and business accounts.

- Collaborated with customers individually to optimize account benefits and enhance understanding of available features.

- Conducted account services such as handling deposits and processing loans.

- Ensured high-quality service, managed customer relationships, handled queues, and maintained branch audit and compliance.

- Cross-sold banking and third-party financial products to customers.

- Demonstrated high attention to detail, accuracy, and a strong customer service orientation.

- Proactively educated clients on utilizing access channels, including ATM, online and telephone banking, while referring to other bank services.

Bank Manager Resume Example

Bank Manager

- Verified and authorized input data in the core banking system, ensuring accuracy and correctness.

- Collaborated with senior management on marketing and sales strategy, maximizing sales and acquiring new business.

- Provided market intelligence and financial analysis to key department owners.

- Maintained accurate customer system accounts.

- Addressed customer complaints promptly, ensuring swift resolution for enhanced customer loyalty.

- Managed account conflict resolutions with key clients and addressed collections balances.

Bank Manager Resume Example

Bank Manager

- Managed marketing, business analysis, and retention programs.

- Prepared annual budgets for senior executive review, ensuring compliance with cost-control initiatives.

- Oversaw commercial contracts, particularly those related to credit facilities.

- Led the risk function, ensuring complete compliance with policy and operational guidelines.

Bank Manager/Project Manager Resume Example

Bank Manager/Project Manager

- Managed a team of loan processing specialists and operations in the Home Equity department, guiding them to achieve service vision and goals.

- Proactively identified, developed, recommended, and implemented improvements to processes, procedures, and service delivery.

- Organized and led the execution of operational enhancements across loan processing teams, providing coaching and mentoring to team members.

- Collaborated with cross-functional teams to achieve project goals and supported team members with development plans.

- Planned and coordinated complex efforts, ensuring consistent monitoring and reporting of business objectives, project achievements, and key deliverables.

- Identified and resolved roadblocks, obstacles, and impediments to ensure team objectives were met.

Assistant Bank Manager Resume Example

Assistant Bank Manager

- Coached and developed new colleagues in their roles.

- Successfully led a sales team to consistently achieve KPIs.

- Provided support to colleagues transitioning from Sales to Service roles.

Bank Manager/Project Manager Resume Example

Bank Manager/Project Manager

- Managed Home Equity department's loan processing specialists and operations, leading teams to achieve member service goals.

- Proactively identified and implemented improvements to processes, procedures, and service delivery.

- Organized and executed operational enhancements across loan processing teams.

- Supported team members with coaching, mentoring, and development plans.

- Collaborated with cross-functional teams to achieve multiple project goals.

- Planned, documented requirements, and coordinated activities for complex efforts.

- Ensured consistent monitoring and reporting of business objectives, project achievements, and key deliverables.

- Identified and removed roadblocks to ensure team objectives were met.

Assistant Bank Manager Resume Example

Assistant Bank Manager

- Led the highest-performing lending branch within the national network.

- Mentored, trained, and coached Customer Service Representatives and Banking Specialists.

- Cultivated a strong customer-first performance culture.

- Established robust working relationships and market leadership within local communities.

- Achieved industry-standard branch risk and compliance outcomes.

Bank Manager Resume Example

Bank Manager

- Plans, markets, and sells deposits, loan portfolios, and non-traditional bank products.

- Cultivates and sustains interpersonal relationships with existing and prospective clients.

- Implements Branch Banking policies and procedures, executing action plans to optimize branch profitability.

- Manages the branch overall under the pillars of business growth, asset quality, housekeeping, service quality, and management efficiency.

Top Bank Manager Resume Skills for 2023

- Financial Analysis

- Budgeting

- Strategic Planning

- Financial Reporting

- Risk Management

- Regulatory Compliance

- Credit Analysis

- Loan Management

- Investment Management

- Asset Liability Management

- Financial Modeling

- Customer Relationship Management

- Team Leadership

- Performance Management

- Business Development

- Market Analysis

- Strategic Decision Making

- Financial Planning

- Treasury Management

- Compliance Management

- Cash Management

- Audit Management

- Project Management

- Data Analysis

- Financial Forecasting

- Cost Control

- Customer Service Management

- Negotiation Skills

- Digital Banking

- Credit Risk Assessment

- Financial Market Trends

- Financial Statement Analysis

- Team Building

- Training and Development

- Accounting Principles

- Fraud Prevention

- Customer Retention

- Cross-Selling

- Mergers and Acquisitions

- Corporate Finance

- Financial Regulations

- Debt Management

- Leadership Development

- Data Security

- Financial Risk Management

- IT Management in Banking

- Business Continuity Planning

- Commercial Lending

- Financial Products Knowledge

- Change Management

- Financial Decision Making

- Operational Risk Management

- Loan Portfolio Management

- AML (Anti-Money Laundering)

- Financial Market Regulations

- Investment Banking

- Financial Compliance

- Customer Onboarding

- Market Research

- Interest Rate Risk Management

- Financial Governance

- Financial Technology (Fintech)

- Credit Scoring

- Corporate Governance

- Payment Systems

- Strategic Partnerships

- Financial Controls

- Project Finance

- Financial Performance Metrics

- Investment Analysis

- Operational Excellence

- Financial Software Systems

- Financial Benchmarking

- Customer Feedback Analysis

- International Banking Regulations

- Branch Management

- Financial System Integration

- Financial Portfolio Management

- Financial Statement Auditing

- Vendor Management

- Customer Satisfaction Surveys

- Financial Control Systems

- Revenue Generation Strategies

- Market Segmentation

- Financial Product Development

- Loan Underwriting

- Financial Data Analysis

- Financial Compliance Audits

- IT Security in Banking

- Financial Services Regulation

- Credit Policy Development

- Branch Expansion Strategies

What Do Hiring Managers Look For in a Bank Manager Resume?

‣ Leadership:

- Strong leadership skills to guide and motivate the bank's staff toward common goals.

- Sound understanding of financial principles and ability to make strategic decisions.

- Focus on building and maintaining positive customer relationships.

- Ability to assess and manage risks associated with banking operations.

How Long Should my Bank Manager Resume be?

Your Bank Manager resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Bank Manager, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2024 Workstory Inc.