Mortgage Broker Resume Examples and Templates

This page provides you with Mortgage Broker resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Mortgage Broker resume.

What do Hiring Managers look for in a Mortgage Broker Resume

- Financial Acumen: Proficiency in understanding financial products, including mortgages, rates, and terms.

- Communication: Excellent interpersonal and communication skills for liaising with clients, lenders, and real estate professionals.

- Negotiation Skills: Ability to negotiate favorable terms and conditions for clients' mortgage deals.

- Attention to Detail: Meticulous in reviewing mortgage documents and ensuring accuracy and compliance.

- Market Knowledge: In-depth understanding of the mortgage market, trends, and regulations.

How to Write a Mortgage Broker Resume?

To write a professional Mortgage Broker resume, follow these steps:

- Select the right Mortgage Broker resume template.

- Write a professional summary at the top explaining your Mortgage Broker’s experience and achievements.

- Follow the STAR method while writing your Mortgage Broker resume’s work experience. Show what you were responsible for and what you achieved as a Mortgage Broker.

- List your top Mortgage Broker skills in a separate skills section.

How to Write Your Mortgage Broker Resume Header?

Write the perfect Mortgage Broker resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Mortgage Broker position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Mortgage Broker resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Mortgage Broker Resume Example - Header Section

Tommy 167 Hamilton Drive Phillipsburg, NJ 08865 Marital Status: Married, email: cooldude2022@gmail.com

Good Mortgage Broker Resume Example - Header Section

Tommy Mack, Phillipsburg, NJ, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Mortgage Broker email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Mortgage Broker Resume Summary?

Use this template to write the best Mortgage Broker resume summary: Mortgage Broker with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Mortgage Broker Resume Experience Section?

Here’s how you can write a job winning Mortgage Broker resume experience section:

- Write your Mortgage Broker work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Mortgage Broker work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Mortgage Broker).

- Use action verbs in your bullet points.

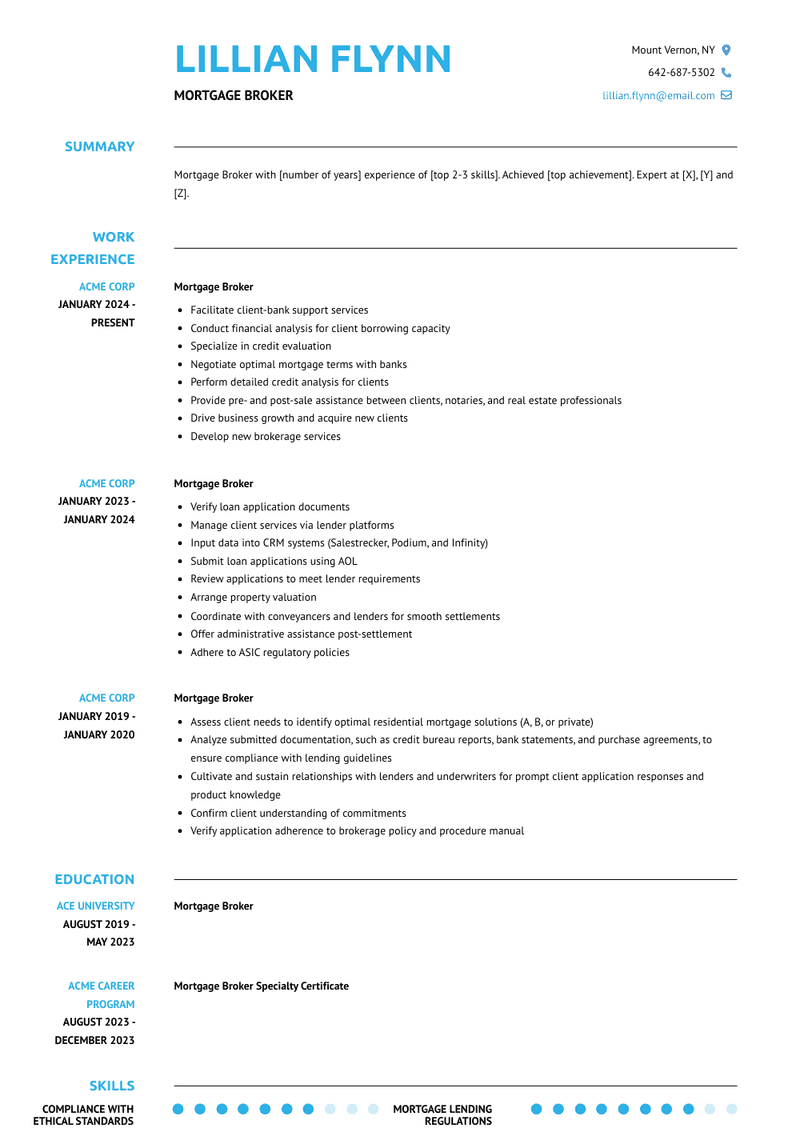

Mortgage Broker Resume Example

Mortgage Broker

- Conduct financial analysis of clients to determine their borrowing capacity.

- Perform detailed analysis of customer credit profiles.

- Estimate a volume of $70 million for the year 2023.

- Maintain a closing rate of over 73% on valid files.

- Ensure all files and documents are completed and stored in Salesforce.

- Recruit and train new brokers at AMX to expand the team.

Mortgage Broker Resume Example

Mortgage Broker

‣ Facilitate client-bank support services

- Conduct financial analysis for client borrowing capacity

- Specialize in credit evaluation

- Negotiate optimal mortgage terms with banks

- Perform detailed credit analysis for clients

- Provide pre- and post-sale assistance between clients, notaries, and real estate professionals

- Drive business growth and acquire new clients

- Develop new brokerage services

Mortgage Broker Resume Example

Mortgage Broker

‣ Verify loan application documents

- Manage client services via lender platforms

- Input data into CRM systems (Salestrecker, Podium, and Infinity)

- Submit loan applications using AOL

- Review applications to meet lender requirements

- Arrange property valuation

- Coordinate with conveyancers and lenders for smooth settlements

- Offer administrative assistance post-settlement

- Adhere to ASIC regulatory policies

Mortgage Broker Resume Example

Mortgage Broker

‣ Track customer information

- Identify optimal mortgage options for clients

- Negotiate competitive mortgage rates through bank partnerships

- Utilize internal software to provide tailored solutions

Mortgage Broker Resume Example

Mortgage Broker

‣ Gathered client financial data and assessed their requirements using payslips, business reports, tax assessments, and group certificates

- Calculated loan-to-value ratio (LVR), serviceability, and monthly payments, recommending appropriate products

- Aid clients in loan application submission and offer ongoing support

- Acted as intermediary between solicitors, conveyancers, agents, and lenders

- Achievements:

- Implemented marketing strategies for various home loan products, surpassing quarterly mortgage sales targets by at least 78%

Mortgage Broker Resume Example

Mortgage Broker

‣ Aided the accounts officer in analyzing Accounts Payable/Receivable reports and spreadsheets

- Conducted bank reconciliations, processed tuition adjustments, and posted to the general ledger using Xero

- Managed student invoices, pursued overdue payments, and updated the student database

- Oversaw budget tasks including forecasting income from new semester enrollments and preparing annual budgets

Mortgage Broker Resume Example

Mortgage Broker

‣ Assess client needs to identify optimal residential mortgage solutions (A, B, or private)

- Analyze submitted documentation, such as credit bureau reports, bank statements, and purchase agreements, to ensure compliance with lending guidelines

- Cultivate and sustain relationships with lenders and underwriters for prompt client application responses and product knowledge

- Confirm client understanding of commitments

- Verify application adherence to brokerage policy and procedure manual

Top Mortgage Broker Resume Skills for 2023

- Mortgage products knowledge (e.g., fixed-rate, adjustable-rate, FHA, VA)

- Mortgage lending regulations knowledge (e.g., RESPA, TILA, Dodd-Frank)

- Understanding of local and national housing market trends

- Mortgage application process management

- Pre-qualification and pre-approval procedures

- Mortgage underwriting guidelines knowledge

- Credit analysis and risk assessment

- Debt-to-income ratio calculation

- Loan-to-value ratio calculation

- Mortgage rate negotiation skills

- Mortgage closing process management

- Loan origination software proficiency

- Mortgage document preparation and review

- Compliance with fair lending practices

- Mortgage insurance options knowledge

- Private mortgage insurance (PMI) requirements and options

- Mortgage escrow account management

- Title insurance requirements and procedures

- Home appraisal process understanding

- Home inspection process understanding

- Property tax assessment and implications

- Flood zone determination and requirements

- Understanding of mortgage fraud prevention measures

- Knowledge of government-backed mortgage programs (e.g., FHA, VA, USDA)

- Ability to analyze financial statements and tax returns

- Familiarity with alternative lending options (e.g., non-conforming loans)

- Mortgage refinancing procedures and options

- Reverse mortgage products knowledge

- Understanding of home equity products (e.g., HELOCs)

- Knowledge of credit repair and improvement strategies

- Understanding of foreclosure and short sale processes

- Ability to work with borrowers facing financial difficulties

- Negotiation skills for debt restructuring and loan modification

- Familiarity with real estate investment financing

- Understanding of lease-to-own and rent-to-own financing options

- Continuous learning in mortgage industry regulations and best practices

- Relationship management skills with borrowers, lenders, and real estate professionals

- Customer service skills for assisting clients throughout the mortgage process

- Communication skills for explaining complex mortgage concepts to clients

- Networking skills for building relationships with referral partners

- Time management skills for handling multiple loan applications simultaneously

- Problem-solving skills for addressing issues that arise during the mortgage process

- Attention to detail for accurately completing mortgage paperwork

- Technology proficiency for utilizing mortgage software and online tools

- Marketing skills for promoting mortgage services and attracting clients

- Compliance with ethical standards and regulations governing mortgage brokers

- Financial planning skills for helping clients choose the right mortgage options

- Market research skills for identifying mortgage trends and opportunities

- Knowledge of tax implications related to mortgage interest deductions

- Collaboration skills for working with real estate agents, attorneys, and other professionals involved in the home buying process

How Long Should my Mortgage Broker Resume be?

Your Mortgage Broker resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Mortgage Broker, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2024 Workstory Inc.