3+ Business Banker Resume Examples and Templates

This page provides you with Business Banker resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Business Banker resume.

What do Hiring Managers look for in a Business Banker Resume

- Financial Expertise: Strong knowledge of financial products, services, and banking regulations.

- Relationship Building: Capability to build and maintain relationships with business clients, understanding their financial needs.

- Sales Skills: Effective sales and negotiation abilities to promote banking products and services to business clients.

- Risk Assessment: Proficiency in assessing the creditworthiness and risk associated with business loan applications.

- Communication Skills: Effective communication with business clients and colleagues to provide financial advice and solutions.

How to Write a Business Banker Resume?

To write a professional Business Banker resume, follow these steps:

- Select the right Business Banker resume template.

- Write a professional summary at the top explaining your Business Banker’s experience and achievements.

- Follow the STAR method while writing your Business Banker resume’s work experience. Show what you were responsible for and what you achieved as a Business Banker.

- List your top Business Banker skills in a separate skills section.

How to Write Your Business Banker Resume Header?

Write the perfect Business Banker resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Business Banking position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Business Banker resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Business Banker Resume Example - Header Section

Cason 7600 W. Bay Meadows Avenue Rochester, NY 14606 Marital Status: Married, email: cooldude2022@gmail.com

Good Business Banker Resume Example - Header Section

Cason Reilly, Rochester, NY, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Business Banker email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Business Banker Resume Summary?

Use this template to write the best Business Banker resume summary: Business Banker with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Business Banker Resume Experience Section?

Here’s how you can write a job winning Business Banker resume experience section:

- Write your Business Banker work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Business Banker work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Business Banker).

- Use action verbs in your bullet points.

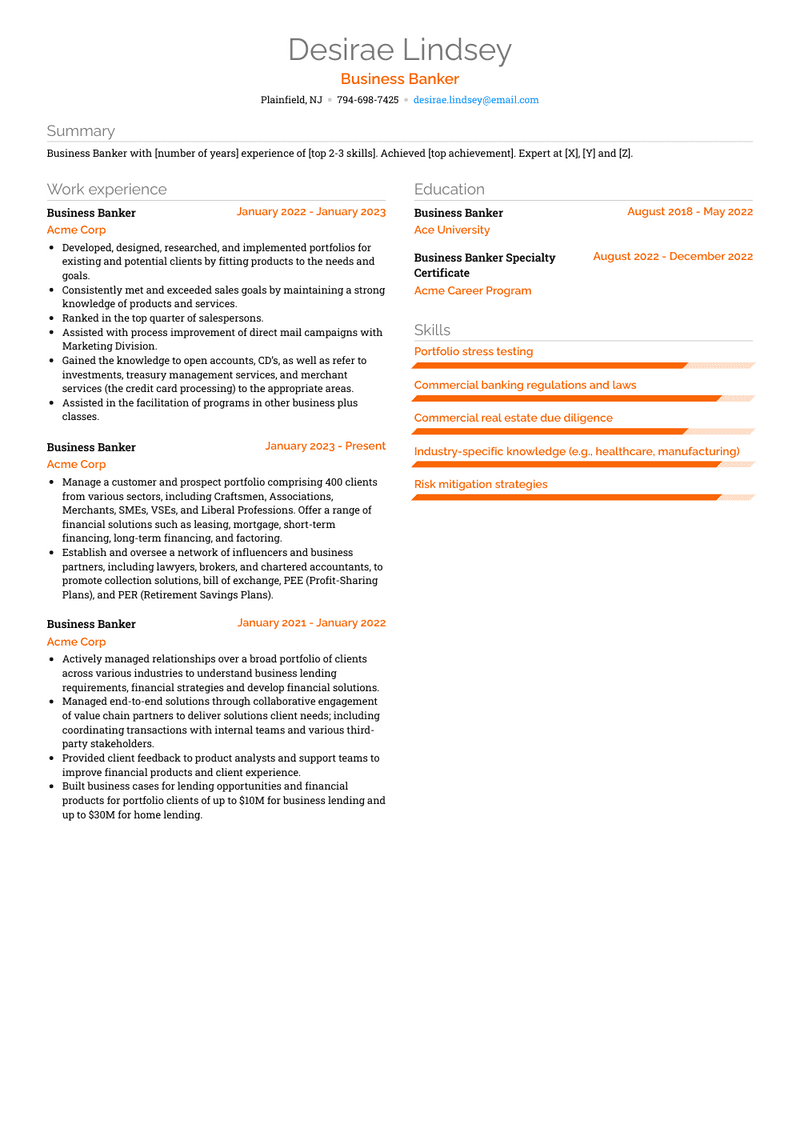

Business Banker Resume Example

Business Banker

- Manage a customer and prospect portfolio comprising 400 clients from various sectors, including Craftsmen, Associations, Merchants, SMEs, VSEs, and Liberal Professions. Offer a range of financial solutions such as leasing, mortgage, short-term financing, long-term financing, and factoring.

- Establish and oversee a network of influencers and business partners, including lawyers, brokers, and chartered accountants, to promote collection solutions, bill of exchange, PEE (Profit-Sharing Plans), and PER (Retirement Savings Plans).

Business Banker Resume Example

Business Banker

- Developed, designed, researched, and implemented portfolios for existing and potential clients by fitting products to the needs and goals.

- Consistently met and exceeded sales goals by maintaining a strong knowledge of products and services.

- Ranked in the top quarter of salespersons.

- Assisted with process improvement of direct mail campaigns with Marketing Division.

- Gained the knowledge to open accounts, CD’s, as well as refer to investments, treasury management services, and merchant services (the credit card processing) to the appropriate areas.

- Assisted in the facilitation of programs in other business plus classes.

Business Banker Resume Example

Business Banker

- Actively managed relationships over a broad portfolio of clients across various industries to understand business lending requirements, financial strategies and develop financial solutions.

- Managed end-to-end solutions through collaborative engagement of value chain partners to deliver solutions client needs; including coordinating transactions with internal teams and various third-party stakeholders.

- Provided client feedback to product analysts and support teams to improve financial products and client experience.

- Built business cases for lending opportunities and financial products for portfolio clients of up to $10M for business lending and up to $30M for home lending.

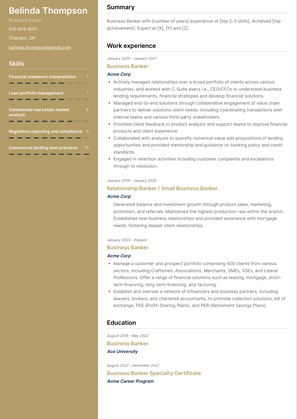

Business Banker Resume Example

Business Banker

- Actively managed relationships over a broad portfolio of clients across various industries, and worked with C-Suite execs i.e., CEO/CFOs to understand business lending requirements, financial strategies and develop financial solutions.

- Managed end-to-end solutions through collaborative engagement of value chain partners to deliver solutions client needs; including coordinating transactions with internal teams and various third-party stakeholders.

- Provided client feedback to product analysts and support teams to improve financial products and client experience.

- Collaborated with analysts to quantify numerical value add propositions of lending opportunities and provided mentorship and guidance on banking policy and credit standards.

- Engaged in retention activities including customer complaints and escalations through to resolution.

Relationship Banker / Small Business Banker Resume Example

Relationship Banker / Small Business Banker

‣ Generated balance and investment growth through product sales, marketing, promotion, and referrals. Maintained the highest production rate within the branch. Established new business relationships and provided assistance with mortgage needs, fostering deeper client relationships.

Top Business Banker Resume Skills for 2023

- Financial analysis and risk assessment

- Commercial lending principles

- Credit analysis and underwriting

- Business finance and accounting

- Loan origination and documentation

- Small business banking products knowledge

- Commercial real estate financing

- Cash flow analysis

- Financial statement interpretation

- Business valuation techniques

- Loan portfolio management

- Regulatory compliance in banking

- Relationship management

- Business development and prospecting

- Business credit scoring models

- Debt restructuring and workout strategies

- Collateral assessment

- Commercial loan structuring

- Financial modeling and forecasting

- Business legal and tax considerations

- Industry-specific knowledge (e.g., healthcare, manufacturing)

- Commercial insurance assessment

- Treasury management services

- Commercial real estate market analysis

- Commercial credit risk management

- Loan pricing and profitability analysis

- Risk mitigation strategies

- Financial market trends analysis

- Commercial loan portfolio analysis

- Business succession planning

- Economic and market research

- Commercial banking software proficiency

- Cross-selling banking services

- Customer relationship management (CRM) tools

- Commercial banking regulations and laws

- Loan servicing and monitoring

- Asset-based lending

- International business finance (if applicable)

- Commercial lease analysis

- Industry benchmarking analysis

- Portfolio stress testing

- Financial covenants monitoring

- Financial statement spreading tools

- Small business consulting

- SBA loan programs knowledge

- Commercial lending best practices

- Financial risk assessment tools

- Regulatory reporting and compliance

- Commercial real estate due diligence

- Banking industry certifications (e.g., CBA, CRC)

How Long Should my Business Banker Resume be?

Your Business Banker resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Business Banker, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Frequently Asked Questions (FAQs) for Business Banker Resume

-

What does a Business Banker do?

- A Business Banker specializes in providing financial services and solutions to small and medium-sized businesses. They help business clients manage their finances, including loans, credit lines, deposit accounts, cash management services, and other banking products.

-

What qualifications are important for a Business Banker position?

- Qualifications typically include a bachelor's degree in finance, business administration, economics, or a related field. Relevant experience in banking, sales, or financial services, knowledge of business finance principles, and strong customer relationship management skills are essential.

-

What kind of experience should a Business Banker highlight on their resume?

- Experience in commercial banking, business development, relationship management, or financial advisory roles is crucial for a Business Banker. Highlighting proficiency in assessing credit risk, structuring financing solutions, and meeting sales targets is important.

-

How important is it for a Business Banker to demonstrate customer relationship management skills on their resume?

- Customer relationship management skills are vital for a Business Banker as they are responsible for building and maintaining relationships with business clients. Highlighting experience in understanding clients' financial needs, providing personalized solutions, and fostering trust and loyalty is essential.

-

Should a Business Banker include their experience with credit analysis on their resume?

- Yes, mentioning experience with credit analysis, including evaluating business creditworthiness, assessing financial statements, and mitigating credit risk, can demonstrate the Banker's ability to make informed lending decisions and protect the bank's assets.

-

What soft skills are important for a Business Banker to highlight on their resume?

- Soft skills such as communication, negotiation, problem-solving, attention to detail, and teamwork are crucial for a Business Banker. These skills contribute to effectively understanding clients' needs, addressing concerns, and collaborating with internal teams to deliver solutions.

-

Is it necessary for a Business Banker to mention their experience with business development on their resume?

- Yes, mentioning experience with business development activities, including prospecting for new clients, expanding existing relationships, and cross-selling banking products and services, can demonstrate the Banker's ability to drive revenue growth and expand the bank's customer base.

-

How should a Business Banker tailor their resume for different industries or client segments?

- A Business Banker should highlight experience and skills relevant to the specific industries or client segments they are targeting, whether it's healthcare, real estate, manufacturing, or professional services. Emphasizing familiarity with industry-specific financial needs and challenges can be beneficial.

-

Should a Business Banker include their educational background on their resume?

- Yes, including educational background such as degrees, certifications, or relevant coursework in finance, business administration, or banking is important. This provides credibility and demonstrates the foundational knowledge necessary for the role.

-

How can a Business Banker make their resume visually appealing and easy to read?

- Utilizing clear headings, bullet points to highlight key skills and experiences, and a professional layout are important aspects of resume formatting. Additionally, including specific examples of successful client relationships or business development initiatives, along with quantifiable achievements, can enhance the overall presentation of the resume.

Copyright ©2024 Workstory Inc.